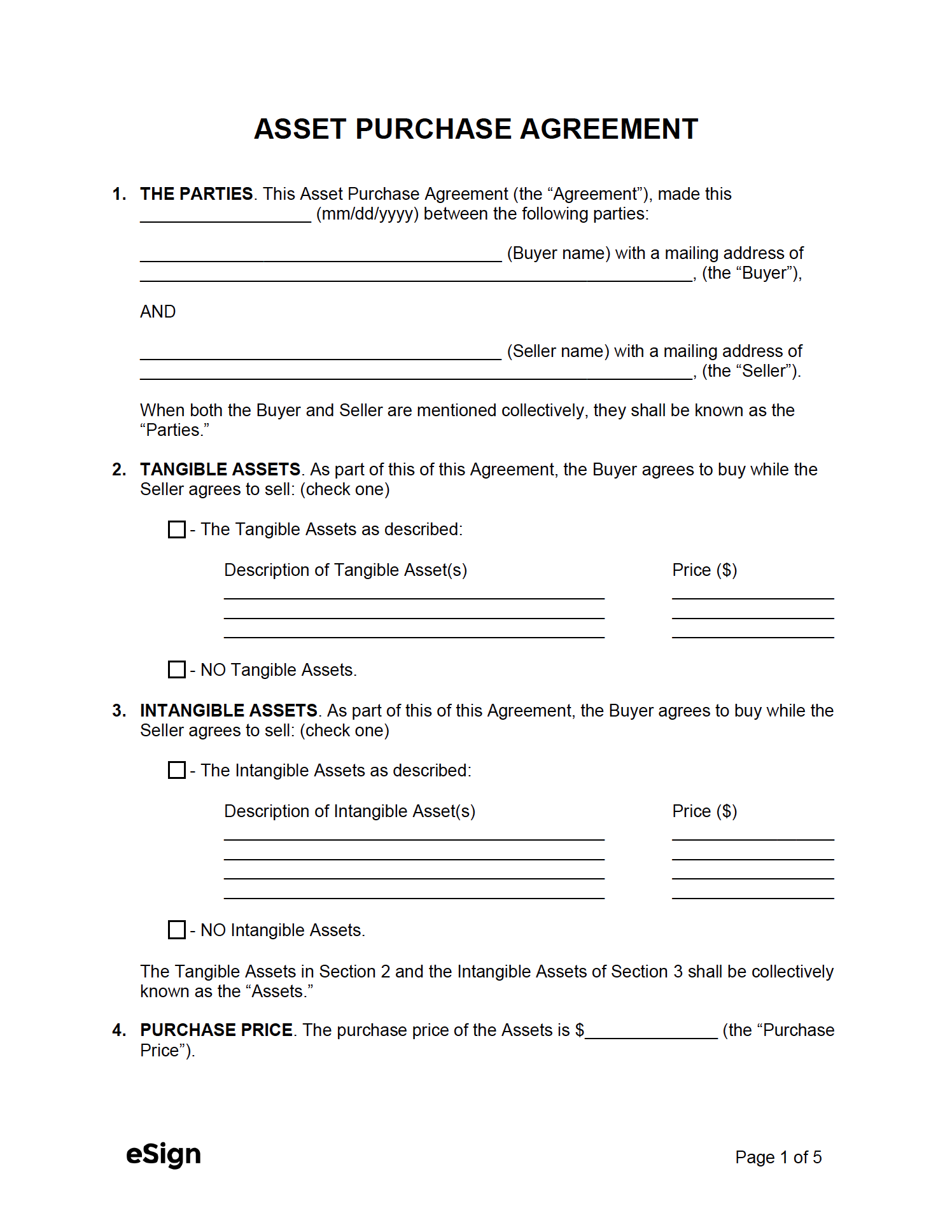

The purchase contract confirms the major aspects of the deal, including information on the buyer and seller, the tangible and intangible assets being sold, the amount ($) they’re being sold for, how payment will be made, and a series of conditions and covenants both parties agree to adhere to. In order for the contract to remain effective, it must be signed by both the seller and buyer.

What is an Asset Purchase?

An asset purchase is a way of acquiring a business in which the assets are bought and transferred to the new owner. The business’ liabilities (loans, unpaid taxes, leases, etc.) are not transferred to the buyer after the sale, but remain with the seller. The following is a list of asset types that are often purchased:

- Equipment / machinery

- Software

- Licenses

- Know-how/trade secrets

- Real Estate

Compared to a Stock Purchase

A stock purchase is a simpler type of business acquisition in which all of the shares of a company are purchased. The buyer assumes all of the company’s liabilities, existing contracts, employees, and so on. While the contract has the advantage of being more straightforward, it loses out on the tax benefits that an asset purchase provides, and can result in the buyer taking ownership of unwanted (and potentially risky) liabilities.

Pros & Cons

| PROS | CONS |

| The buyer can choose which assets they wish to acquire. | Asset purchases are (generally) more complicated than stock purchases. |

| Avoids the potential issue of minority shareholders being unwilling to part with their shares. | The buyer will need to re-title any assets they purchase, which can be complicated and time-consuming. |

| The buyer doesn’t assume the risk of the company’s liabilities (unless they choose to). | Due to an increased tax burden on the seller, a higher purchase price may be necessitated. |

| The buyer can “step up” the basis of purchased assets, reducing tax liability. | Contracts with both customers and/or essential employees may need to be renegotiated. |