Also known as a:

- Share purchase agreement

- SPA

Contents |

What is a Stock Purchase Agreement?

A stock purchase agreement is a legal form used for transferring a specific number of shares from one party to another. On the surface, the company remains effectively the same after the deal, although the new owner will commonly appoint new officers while retaining any key personnel.

The agreement specifies the number (#) and type of shares being sold, the amount ($) per share, the total purchase price, the date the transaction will be finalized, and a series of terms and conditions used for protecting both parties’ interests.

The agreement can be used for any type of entity, including single-member LLCs, partnerships, corporations, trusts, and more.

Compared to an Asset Purchase Agreement

The alternative to a stock purchase is an asset purchase – a type of deal in which the buyer only purchases assets they wish to acquire. It lets the buyer avoid any unattractive or risky liabilities the company has and makes it easier to merge the acquired assets into a different company.

However, a stock purchase has the benefit of being more straightforward to execute and doesn’t require the re-titling of assets.

The Stock Purchase Process

Once the owner of the company comes to the decision they would like to sell their ownership in the company, the following steps will often take place:

- The seller will look for potential buyers;

- Once a buyer is found, they’ll either negotiate with the potential buyer over the purchase price OR the buyer will submit an offer upfront;

- The buyer will be given a “due diligence” period so they can confirm all of the details of the company. If the buyer finds an issue, they can negotiate a new purchase price or back out of the deal; and

- Following the due diligence period, the parties will need to complete and then sign the stock purchase agreement.

Key Provisions

While the provisions found in a share purchase agreement will often vary in some form or another due to the unique circumstances of the sale, a few are especially important in order to have a resilient contract.

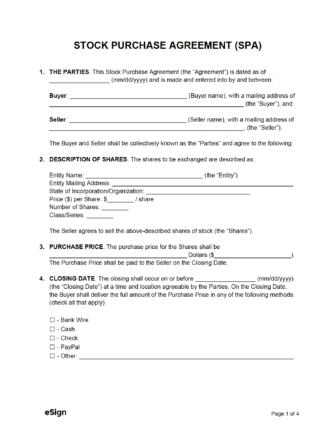

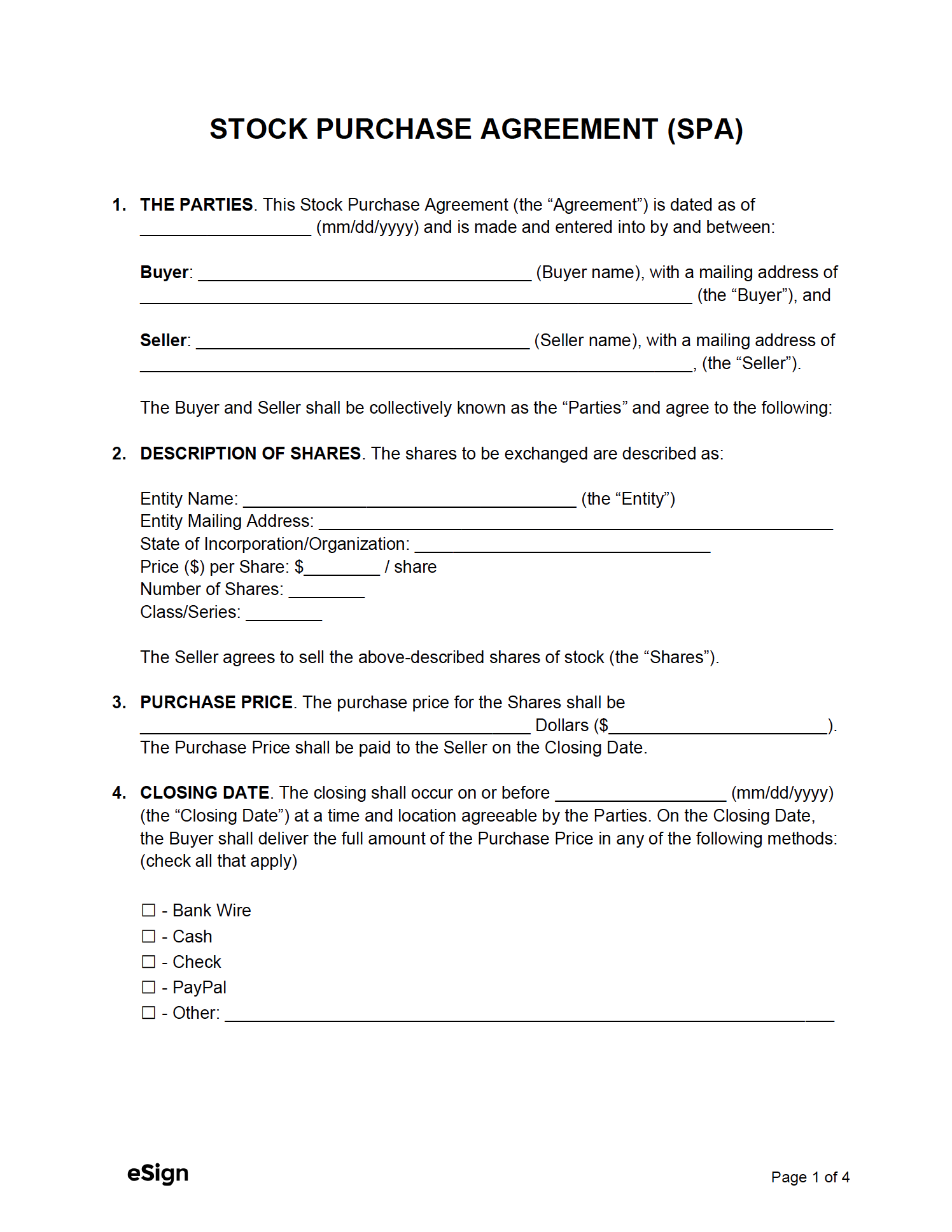

Parties – Establishes the names and addresses of both the seller and buyer.

Shares – One of the most important sections, lists the essential details regarding the shares being sold.

-

- Covers what company (name + address) the shares are from.

- The state in which the company is incorporated.

- The amount ($) of money the buyer is paying for each share.

- The total number (#) of shares that are being sold.

- The type (class/series) of shares.

Purchase Price – The TOTAL amount ($) the buyer is paying for the shares (price per share X total number of shares).

Closing Date – Establishes the date that the transaction will take place (can occur before this date as well, but not after). Also lists the payment methods the buyer is allowed to use.

Due Diligence – An important provision that states the date and time by which the buyer can examine the company’s finances and operations. If the buyer finds something they don’t like prior to the end of the due diligence period, they can back out of the agreement without repercussion (or try and negotiate a lower price).

Signatures – To make the contract official, it will require the signatures of the buyer and seller. While optional, the parties can have their signature witnessed by up to two (2) witnesses (who must also sign the form).