By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Corporate Bylaws Defined

What’s Included

While the contents of the bylaws form will vary from corporation to corporation, the following sections are generally found in every document:

Meetings

Board of Directors

The board of directors is responsible for corporate oversight. The section establishes the number of directors that will serve on the board, how directors are nominated, how long each can serve, how they’re compensated, and other information related to their roles and responsibilities.

Also included can be information on committees, which are smaller groups of directors that focus on specific tasks or topics. Some agreements include a standalone “committees” section.

Officers

The officers of a company are the top-level employees responsible for managing the day-to-day operations and ensuring their respective teams remain focused and meet deadlines. Typical officer roles include the following positions:

- President

- Chairperson

- Treasurer

- Secretary

The “officers” clause will establish how they are elected, the initial roles that will be created, and the roles and responsibilities of each officer.

Stock Certificates

Indemnification

Amendments

Dissolution

Corporate Bylaws Requirements: By State

| STATE | STATUTE | REQUIRED? |

| Alabama | § 10A-2A-2.05 | Yes |

| Alaska | § 10.06.223 | Yes |

| Arizona | § 10-206 | Yes |

| Arkansas | § 4-27-206 | Yes |

| California | CORP §§ 200 – 213 | No |

| Colorado | § 7-102-106 | No |

| Connecticut | § 33-640 | Yes |

| Delaware | Tit. 8 §§ 108, 109 | Yes |

| Florida | § 607.0206 | Yes |

| Georgia | § 14-2-206 | Yes |

| Hawaii | § 414-36 | Yes |

| Idaho | § 30-29-206 | Yes |

| Illinois | § 805 ILCS 5/2.20 | Yes |

| Indiana | IC § 23-1-21-6 | Yes |

| Iowa | § 490.206 | Yes |

| Kansas | § 17-6009 | No |

| Kentucky | § 271B.2-060 | Yes |

| Louisiana | § 1-206 | No |

| Maine | 13-C § 206 | Yes |

| Maryland | § 2-109 | Yes |

| Massachusetts | § 2.06 | Yes |

| Michigan | § 450.1223 | No |

| Minnesota | § 302A.181 | No |

| Mississippi | § 79-4-2.06 | Yes |

| Missouri | § 351.290 | No |

| Montana | § 35-14-206 | Yes |

| Nebraska | § 21-224 | Yes |

| Nevada | § 78.120 | No |

| New Hampshire | § 293-A:2.06 | Yes |

| New Jersey | § 14A:2-9 | Yes |

| New Mexico | § 53-11-27 | Yes |

| New York | § 601 | Yes |

| North Carolina | § 55-2-06 | Yes |

| North Dakota | § 10-19.1-31 | No |

| Ohio | § 1701.11 | No |

| Oklahoma | 18 OK Stat § 1013 | No |

| Oregon | § 60.061 | Yes |

| Pennsylvania | §§ 1504, 1505 | No |

| Rhode Island | § 7-1.2-203 | No |

| South Carolina | § 33-2-106 | Yes |

| South Dakota | § 47-1A-206 | Yes |

| Tennessee | § 48-12-106 | Yes |

| Texas | § 21.057 | Yes |

| Utah | § 16-10a-206 | No |

| Vermont | 11V.S.A § 2.06 | Yes |

| Virginia | § 13.1-624 | Yes |

| Washington | § 23B.02.060 | Yes |

| West Virginia | § 31D-2-205 | Yes |

| Wisconsin | § 180.0206 | No |

| Wyoming | § 17-16-206 | Yes |

Sample

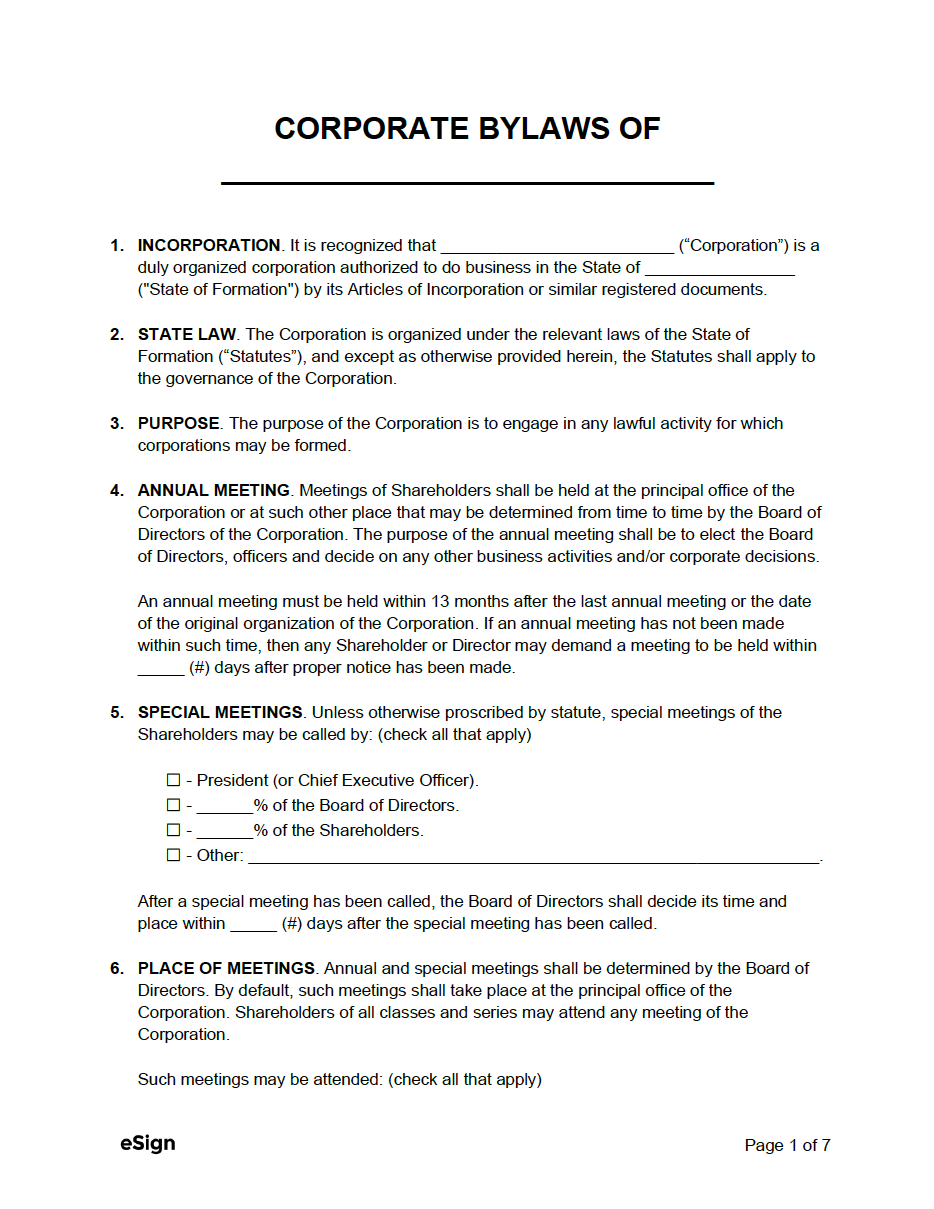

[STATE] BYLAWS OF

[CORPORATION NAME]

1. INCORPORATION. It is recognized that [CORPORATION NAME] (“Corporation”) is a duly organized corporation authorized to do business in the State of [STATE] by its Articles of Incorporation.

2. PURPOSE. The purpose of the Corporation is to engage in any lawful activity for which corporations may be formed.

3. ANNUAL MEETING. Meetings of shareholders shall be held at the principal office or any other place determined by the board. The purpose of the annual meeting shall be to elect directors and conduct business. An annual meeting must be held within [#] months after the last annual meeting or incorporation date. If not held, any shareholder or director may demand a meeting within [#] days after notice.

4. SPECIAL MEETINGS. Special meetings of shareholders may be called by [CONVENING PARTY]. The board shall set the time and place within [#] days after the meeting is called.

5. PLACE OF MEETINGS. Meetings shall take place at the principal office or another place decided by the board. Shareholders may attend by [METHOD OF ATTENDANCE].

6. DISSOLUTION. The Corporation may only be dissolved by [% OF AUTHORIZED PARTIES].

7. NOTICE OF MEETINGS. Written notice shall state time, place, and purpose, delivered at least [#] days and no more than [#] days before the meeting. Notice may be given by [METHOD OF DELIVERY].

8. QUORUM. A quorum is met by [% OF DIRECTORS/SHAREHOLDERS PRESENT]. Upon meeting the requirements of the quorum, the attending individuals of the meeting shall be able to act and make decisions for the Corporation.

9. ACTIONS OF THE CORPORATION. Actions must be taken ☐ only at a meeting ☐ without a meeting by written consent of sufficient shareholders.

10. CORPORATE SEAL. The Corporation shall ☐ have ☐ not have a corporate seal.

11. EXECUTION OF DOCUMENTS. Documents may be signed by [LIST ALL AUTHORIZED SIGNERS].

12. INDEMNIFICATION. The Corporation shall ☐ indemnify ☐ not indemnify directors and officers to the fullest extent permitted by law, except for acts of bad faith, fraud, dishonesty, or gross negligence.

13. AMENDMENTS. These bylaws may be amended by [% OF AUTHORIZED PARTIES].

14. STOCK CERTIFICATES. The Corporation may provide shares of stock ☐ with ☐ without certificates.

15. DIRECTORS. The Corporation shall be managed by [#] directors, elected at the annual meeting, each serving [#] years. A majority constitutes a quorum. Regular meetings may occur without notice per board resolution. Special meetings may be called by any officer or director with at least [#] days’ notice. Remote participation is allowed and counts as presence. Any director may resign with written notice. Vacancies may be filled by the board. Directors may be removed with or without cause by majority shareholder vote. Committees may be formed by resolution. Actions may be taken without a meeting by unanimous written consent.

16. CONFLICT OF INTEREST. A director has a conflict if personal, financial, or other interests impair independent judgment. Disputes about conflicts are decided by board majority.

17. OFFICERS. Officers include chairperson, president, secretary, treasurer, and others as appointed. Officers are elected by the board and serve until successors are chosen or removed. chairperson oversees the Corporation and presides over meetings. President manages day-to-day operations. Treasurer manages funds and records. Secretary keeps minutes and records.

18. LIST OF SHAREHOLDERS. At least [#] days before a meeting, a list of shareholders entitled to vote shall be prepared and made available for inspection.

19. CERTIFICATION. The original or copy of these bylaws shall be kept at the principal office and available for inspection by shareholders.

By signing below, these bylaws are certified as adopted on [MM/DD/YYYY].

Signature (Director or Officer): ________________________ Date: [MM/DD/YYYY]

Print Name: [PRINTED NAME]

Title: [TITLE]