Corporate bylaws establish the rules and guidelines on how a business will be run and list each shareholder (owner). It is written by the founder(s) or the board of directors shortly after incorporation. If there are any changes to the entity, they must be reflected in the bylaws or by amendment and agreed to by its shareholders.

By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

What are Corporate Bylaws?

Bylaws act as the rulebook for how an organization should be operated. The agreement is geared towards ensuring management makes decisions within a set of pre-established guidelines, improving the efficiency and consistency of operations on a day-to-day basis. Many states require that companies draft corporate bylaws, although none require it to be filed with the Secretary of State (SOS). In other words, the form will always remain private to the company that created it, unless they purposely share it with others.

When are Bylaws Required?

The following thirty-one (31) states require corporations to create bylaws:

Alabama, Arizona, Arkansas, Connecticut, Florida, Georgia, Hawaii, Idaho, Indiana, Kentucky, Maine, Maryland, Massachusetts, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Texas, Vermont, Virginia, Washington, West Virginia, and Wyoming.

What do Corporate Bylaws Include?

- Annual Meetings

- Board of Directors

- Officers

- Indemnification

- Conflict of Interest

- Amendments

- Dissolution

While the contents of bylaws will often vary from corporation to corporation, the following clauses should be included, at a minimum:

Annual Meetings

Also called an Annual General Meeting (AGM), this is a yearly meeting where directors of the company present important information to shareholders. The company will summarize financial performance, outline major events over the past year, elect the board of directors, and allow shareholders to ask questions directly to the executives. All 50 states require an annual meeting to be held for all registered corporations.

The “annual meetings” clause establishes the purpose of the meeting, when the meeting can be called, the location of the meeting, and when shareholders/directors can force a meeting if one has not been held within the required timeframe (once per year).

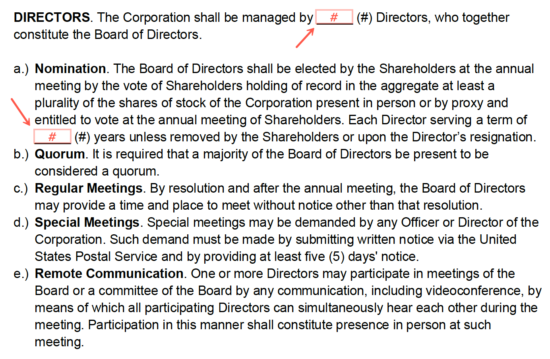

Board of Directors

The board of directors is responsible for providing the corporation with oversight. They have a wide perspective, which allows them to determine if the company is headed in the right direction. The “directors” clause establishes the number of directors that will serve on the board, how the directors are nominated, how long each director can serve (their “term”), how they’re compensated, and other information related to director meetings and communication. Also included in this section can be information on committees, which are smaller groups of directors that focus on specific tasks or topics. Some agreements include a standalone “committees” section as well.

Officers

The officers of a company are the top-level employees that are responsible for managing the day-to-day operations and ensuring their respective teams remain focused and meet deadlines. They’re appointed by the board of directors at the onset of the corporation, and any time thereafter. Typical officer roles include the following positions:

- President

- Chief Executive Officer (CEO)

- Chief Operations Officer (COO)

- Chief Technology Officer (CTO)

- Chief Financial Officer (CFO)

- Chief Marketing Officer (CMO)

- Chief Compliance Officer (CCO)

- Treasurer

- Secretary

The “officers” clause will establish when and how they’re appointed, the initial roles that will be created, and the responsibilities of each officer.

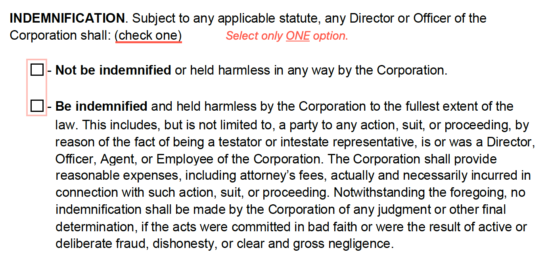

Indemnification

An indemnification clause refers to whether or not directors and officers would be protected from any liability that may arise due to their association with the corporation. If the bylaws indemnify the directors/officers, the corporation would pay for any expenses necessary in order to resolve any issues. The most common expense is attorneys’ fees.

Conflict of Interest

This is an important clause that establishes when a director or officer has a conflict of interest. A conflict of interest is an occurrence where a person’s personal life interferes with the operations and objectives of the company, whether it is due to family members, friends, a side project, or ownership interest in another company (to name a few).

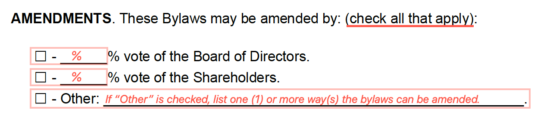

Amendments

As time goes on, the bylaws document is bound to change. In order for changes to be made in an organized manner, the bylaws need to establish the requirements that must be met in order to amend the contract. One of the main requirements would be a vote by the board of directors or shareholders. An amendment clause will set the minimum percentage of votes that must be reached for any change in the bylaws (e.g. 65%).

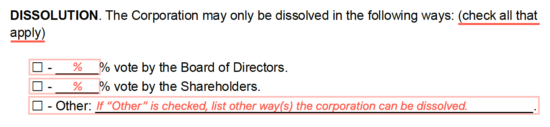

Dissolution

The bylaws should include a section that substantiates the events that must occur in order for the corporation to be dissolved (terminated). Like the “amendments” clause, this will often be determined by a vote by the shareholders or the directors, where a specific percentage must be met (such as 50%) in order for the dissolution to go forward.

Corporate Bylaws Requirements: By State

| STATE | STATUTE | REQUIRED? |

| Alabama | § 10A-2A-2.05 | Yes |

| Alaska | § 10.06.228, § 10.06.230, § 10.06.233 | No |

| Arizona | § 10-206 | Yes |

| Arkansas | § 4-27-206 | Yes |

| California | §§ 200 – 213 | No |

| Colorado | § 7-102-106 | No |

| Connecticut | § 33-640 | Yes |

| Delaware | § 109 | No |

| Florida | § 607.0206 | Yes |

| Georgia | § 14-2-206 | Yes |

| Hawaii | § 414-36 | Yes |

| Idaho | § 30-29-206 | Yes |

| Illinois | § 805 ILCS 5/2.25 | No |

| Indiana | § 23-1-21-6 | Yes |

| Iowa | § 490.206 | No |

| Kansas | § 17-6009 | No |

| Kentucky | § 271B.2-060 | Yes |

| Louisiana | § 1-206 | No |

| Maine | § 206 | Yes |

| Maryland | § 2-109 | Yes |

| Massachusetts | § 2.06 | Yes |

| Michigan | § 450.1223 | No |

| Minnesota | § 302A.181 | No |

| Mississippi | § 79-4-2.06 | No |

| Missouri | § 351.290 | No |

| Montana | § 35-14-206 | Yes |

| Nebraska | § 21-224 | Yes |

| Nevada | § 78.120 | No |

| New Hampshire | § 293-A:2.06 | Yes |

| New Jersey | § 14A:2-9 | Yes |

| New Mexico | § 53-11-27 | Yes |

| New York | § 601 | Yes |

| North Carolina | § 55-2-06 | Yes |

| North Dakota | § 10-19.1-31 | No |

| Ohio | § 1729.14 | No |

| Oklahoma | § 18-381.26 | Yes |

| Oregon | § 60.061 | Yes |

| Pennsylvania | § 1504 & § 1505 | No |

| Rhode Island | § 7-1.2-203 | No |

| South Carolina | § 33-2-106 | Yes |

| South Dakota | § 47-1A-206 | Yes |

| Tennessee | § 48-12-106 | Yes |

| Texas | § 21.057 | Yes |

| Utah | § 16-10a-206 | No |

| Vermont | § 2.06 | Yes |

| Virginia | § 13.1-624 | Yes |

| Washington | § 23B.02.060 | Yes |

| West Virginia | § 31D-2-205 | Yes |

| Wisconsin | § 180.0206 | No |

| Wyoming | § 17-16-206 | Yes |

Sample

Download Sample: PDF

How to Write

Download: PDF, Word (.docx), OpenDocument

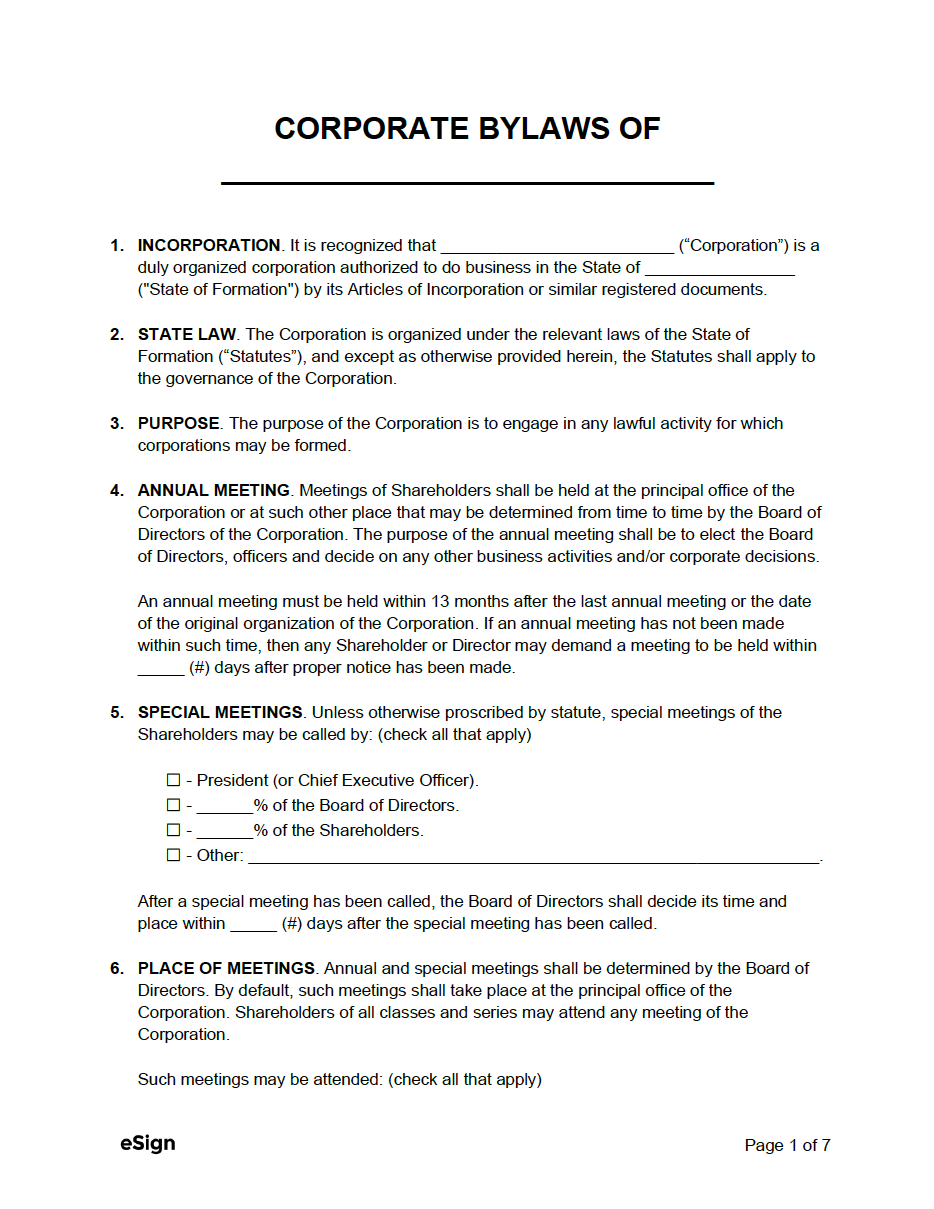

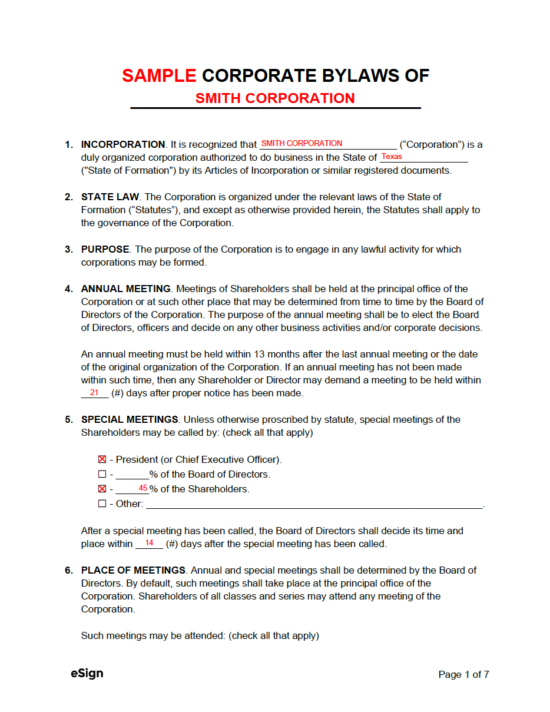

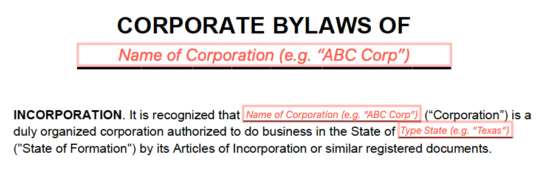

Step 1 – Corporation Name + Formation State

In the first three (3) fields of the document, the following information will need to be provided:

- The full legal name of the corporation (as written on the company’s Articles of Incorporation);

- The name of the corporation again on the second line as shown in the image below; and

- The state in which the corporation is registered to do business.

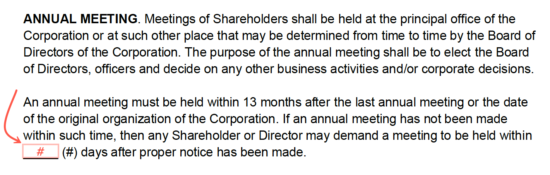

Step 2 – Annual Meeting

Enter the number (#) of days’ a meeting can occur after the appropriate notice has been provided to all shareholders. A common span of time is 30 days/one month.

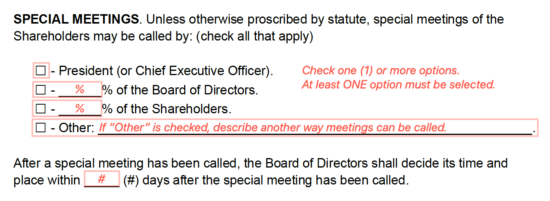

Step 3 – Special Meetings

Check the box next to the person or party that can call a special meeting. If “Board of Directors” or “Shareholders” is selected, type the percentage of directors/shareholders that must agree to the special meeting.

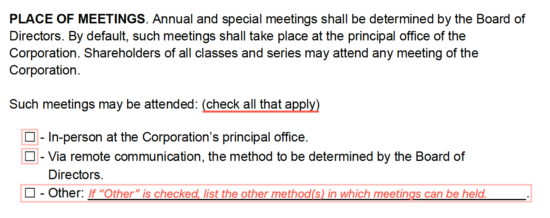

Step 4 – Place of Meetings

This section is for establishing where meetings can take place. Any number of options can be selected, although at least one (1) option must be checked before heading to the next section.

Step 5 – Dissolution

Dissolution refers to terminating the corporation. Select all the options that can result in the company’s dissolution. If either “Board of Directors” or “Shareholders” is checked, type the percentage of vote required by each. A common requirement is at least 50% of the vote.

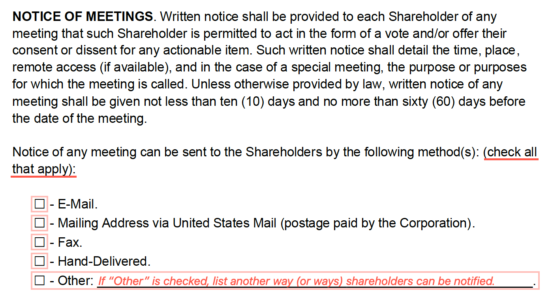

Step 6 – Notice of Meetings

Select the checkboxes that correspond to the method of notification that must be used to inform shareholders of upcoming meetings. At least one (1) option must be selected.

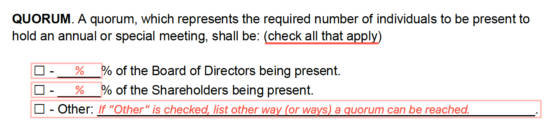

Step 7 – Quorum

A quorum is the minimum percentage of people that must be present in order to hold an annual or special meeting. If the minimum percentage is not met, the meeting cannot go forward. Select all checkboxes that apply, then enter the percentage next to each selected option. A common value is a two-thirds vote, which correlates to roughly 66%.

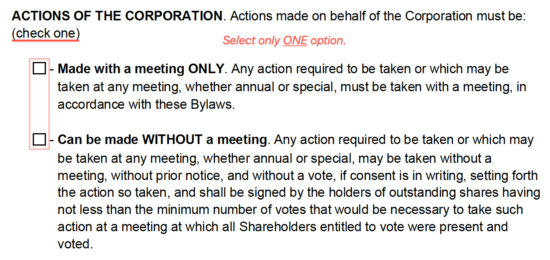

Step 8 – Actions of the Corporation

Select one of the checkboxes to indicate whether or not actions on behalf of the corporation can be made without a meeting being held. Only ONE (1) option can be selected.

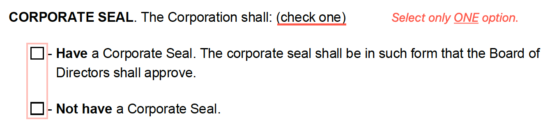

Step 9 – Corporate Seal

A corporate seal is a company’s official signature. By stamping it onto a document, the corporation effectively verifies the contents of the document. Technically corporate seals are no longer required, although some companies still choose to use them. Select one (1) of the checkboxes to indicate whether or not the corporation will have an official seal.

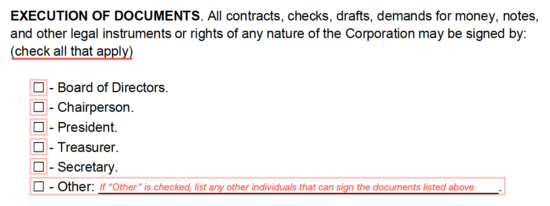

Step 10 – Execution of Documents

Select one (1) or more of the checkboxes as shown below to indicate which individuals can sign important documents on behalf of the corporation.

Step 11 – Indemnification

Indemnification refers to compensating the directors or officers for any legal issues relating to the company (except for those that result from fraud or negligence). Select the appropriate checkbox to indicate whether or not directors and officers will be indemnified by the corporation.

Step 12 – Amendments

An amendment is a change to the bylaws, whether large or small. Check the box corresponding to the situation that can result in the bylaws being modified, followed by the percentage of the vote required (e.g., 66%).

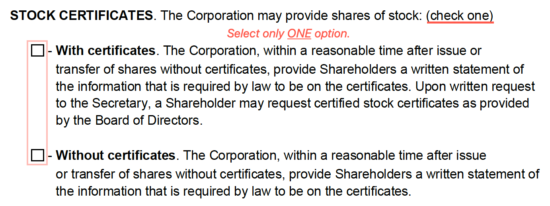

Step 13 – Stock Certificates

A stock certificate is a document that proves one’s ownership of shares in the corporation. Stock certificates are not a requirement by federal or state law, and ownership of the corporation can be proved without holding physical stock certificates. Choose one (1) of the options to indicate whether certificates will be provided to shareholders.

Step 14 – Directors

There are two (2) fields that need to be completed in the “Directors” section. The first is the number (#) of directors that will serve on the board (e.g., 6). The second is the length of term for a board member (e.g., 3 years).

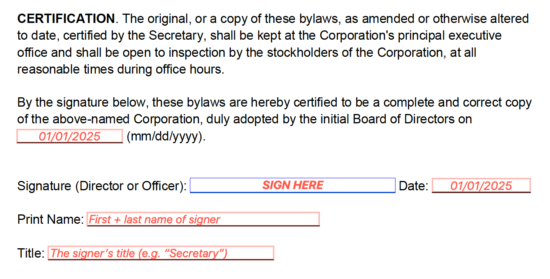

Step 15 – Certification

Although optional, certifying the document with a signature adds a significant amount of authenticity to the bylaws. The following fields must be completed in order to certify the form:

- The date the board of directors is officially adopting the bylaws.

- The signature of the person certifying the form (the secretary or a member of the board).

- The date (mm/dd/yyyy) the document was signed (most likely the same as the date entered above).

- The full printed name of the person certifying the form.

- The signer’s title (e.g., “Secretary” or “CEO”).