Sample

- Download (Blank): PDF, Word (.docx), OpenDocument

- Download (Sample Data): PDF, Word (.docx), OpenDocument

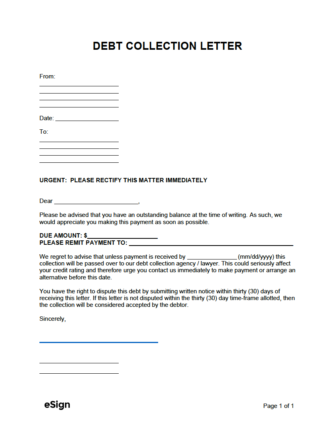

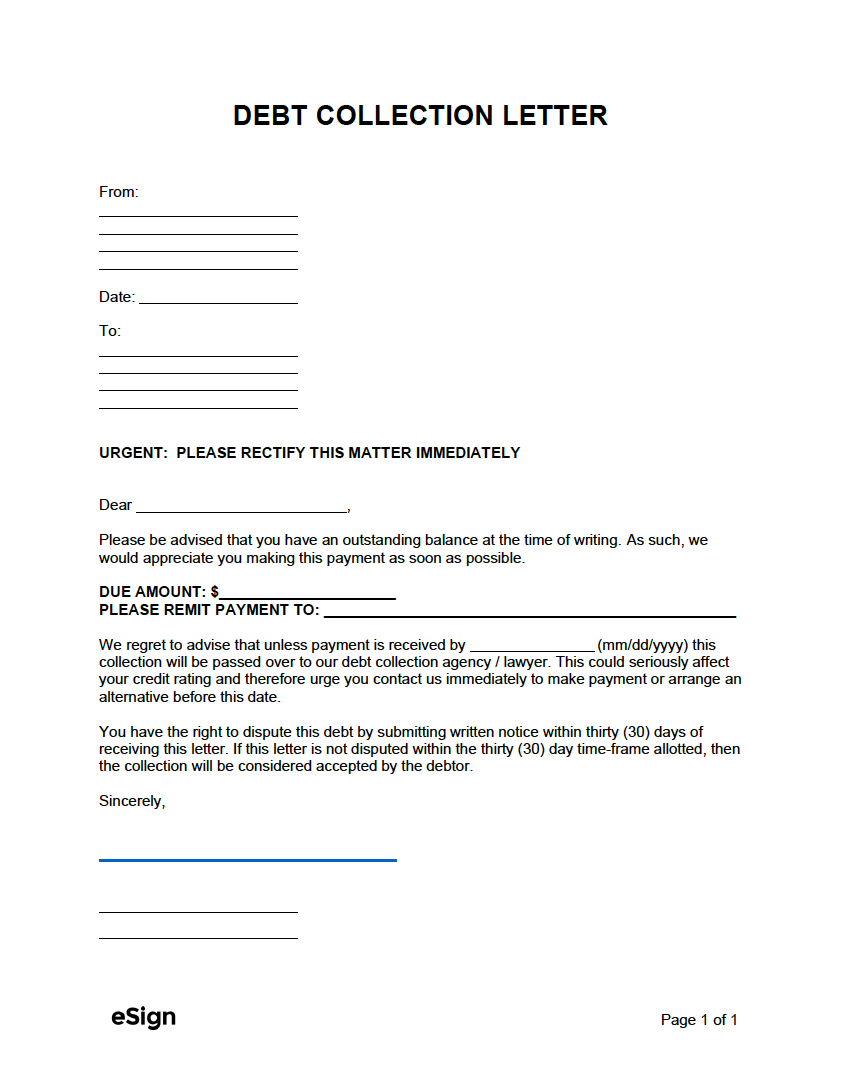

DEBT COLLECTION LETTER

From:

[SENDER (CREDITOR) NAME]

[SENDER COMPANY]

[SENDER ADDRESS LINE 1]

[SENDER ADDRESS LINE 2]

Date: [MM/DD/YYYY]

To:

[RECIPIENT (DEBTOR) NAME]

[RECIPIENT COMPANY (IF ANY)]

[RECIPIENT ADDRESS LINE 1]

[RECIPIENT ADDRESS LINE 2]

URGENT: PLEASE RECTIFY THIS MATTER IMMEDIATELY

Dear [RECIPIENT NAME],

Please be advised that you have an outstanding balance at the time of writing. As such, we would appreciate you making this payment as soon as possible.

DUE AMOUNT: $[AMOUNT DUE]

PLEASE REMIT PAYMENT TO: [PAYMENT ADDRESS]

We regret to advise that unless payment is received by [MM/DD/YYYY], this collection will be passed over to our debt collection agency/lawyer. This could seriously affect your credit rating, and therefore, we urge you to contact us immediately to pay the amount due or arrange an alternative before this date.

You have the right to dispute this debt by submitting written notice within thirty (30) days of receiving this letter. If this letter is not disputed within the thirty (30) day time frame allotted, then the collection will be considered accepted by the debtor.

Sincerely,

____________________________

Signature

[SENDER NAME]

[SENDER TITLE]

Instructions (How to Write)

Step 1 – Sender (“From”) Information

In the top four (4) lines of the letter, enter the following information:

- The full name of the creditor (sender).

- The company the sender owns (or is employed by, if any).

- The street address of the creditor.

- The city, state, and ZIP code of the creditor.

Step 2 – Date

Beneath the creditor’s mailing information, enter the date (mm/dd/yyyy) the letter is being sent to the debtor.

Step 3 – Recipient (“To”) Information

The recipient’s mailing information should be written in the same format as the sender (the creditor).

- Full name of the recipient (the debtor).

- The recipient’s company name (if any).

- The recipient’s street address (including unit number, if any).

- The recipient’s city, state, and ZIP code.

Step 4 – Letter Contents

After “Dear,” enter the full name of the recipient. Alternatively, their first name can be used.

Then, after “Due Amount,” enter the total amount ($) the debtor owes the creditor. The next field should be used to provide the mailing information where the debtor can send the payment for the debt.

Step 5 – Payment Due Date

Enter the date (mm/dd/yyyy) that the recipient must pay the “Due Amount” to prevent the creditor (sender) from sending the debt to collections.

Step 6 – Signing

While optional, it’s recommended that the sender sign their name onto the letter. This adds to the letter’s credibility, increasing the likelihood that the recipient takes its message seriously. Beneath their signature, they should include their full printed name, followed by their position at the company (if applicable).