Sample

Download: PDF, Word (.docx), OpenDocument

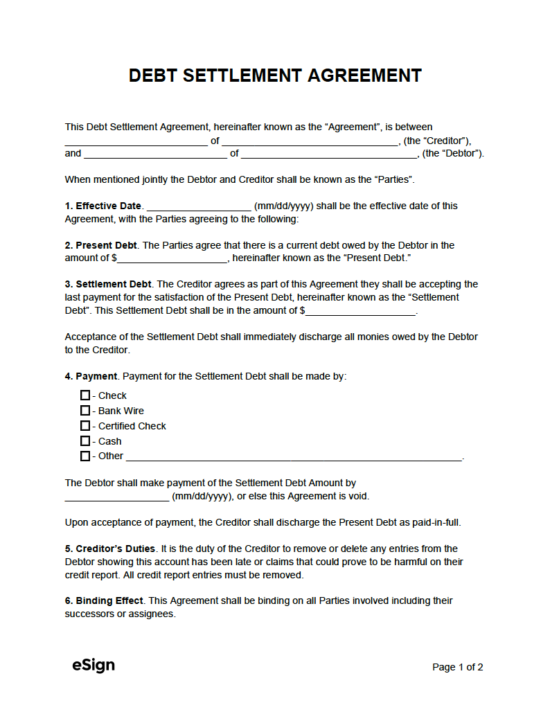

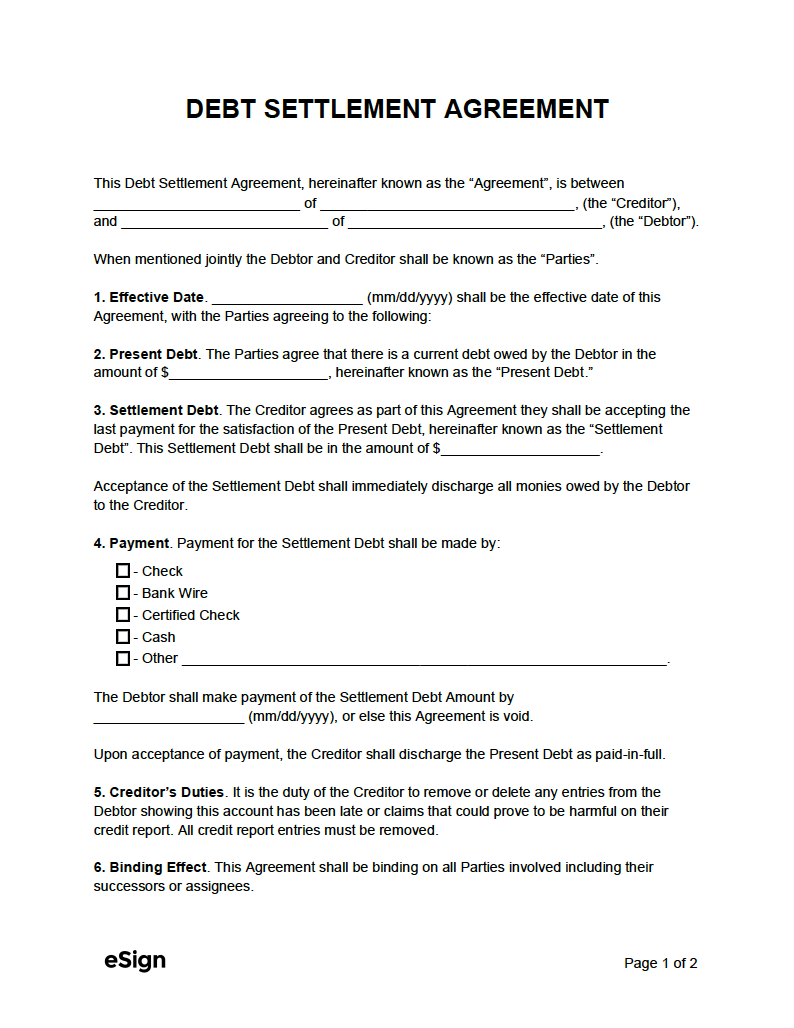

DEBT SETTLEMENT AGREEMENT

This Debt Settlement Agreement, hereinafter known as the “Agreement”, is between [CREDITOR NAME] of [CREDITOR ADDRESS], (the “Creditor”), and [DEBTOR NAME] of [DEBTOR ADDRESS], (the “Debtor”).

When mentioned jointly, the Debtor and Creditor shall be known as the “Parties”.

1. EFFECTIVE DATE. This Agreement shall go into effect on [MM/DD/YYYY], with the Parties agreeing to the following:

2. PRESENT DEBT. The Parties agree that there is a current debt owed by the Debtor in the amount of $[AMOUNT OWED], hereinafter known as the “Present Debt.”

3. SETTLEMENT DEBT. The Creditor agrees as part of this Agreement, they shall be accepting the last payment for the satisfaction of the Present Debt, hereinafter known as the “Settlement Debt”. This Settlement Debt shall be in the amount of $[ SETTLEMENT DEBT].

Acceptance of the Settlement Debt shall immediately discharge all monies owed by the Debtor to the Creditor.

4. PAYMENT. Payment for the Settlement Debt shall be made by:

☐ – Check

☐ – Bank Wire

☐ – Certified Check

☐ – Cash

☐ – Other [OTHER (IF APPLICABLE)].

The Debtor shall make payment of the Settlement Debt Amount by [MM/DD/YYYY], or else this Agreement is void.

Upon acceptance of the payment, the Creditor shall discharge the Present Debt as paid-in-full.

5. CREDITOR’S DUTIES. The Creditor must remove or delete any entries from the Debtor showing this account has been late or claims that could prove harmful to their credit report. All credit report entries must be removed.

6. BINDING EFFECT. This Agreement shall be binding on all Parties involved, including their successors or assignees.

7. HOLD HARMLESS. Except to dispute the terms of this Agreement, the Parties agree not to bring any claim against the other party concerning any matter related to the Present Debt. Creditor and Debtor understand that the authorization of this Agreement bars them from making any claim.

8. CONFIDENTIALITY. All Parties understand that all parts of this Agreement are to be kept confidential. If any portion of this Agreement were to be made public, the releasing party would be held responsible for any damages that were inflicted. Furthermore, the releasing party would be liable for all attorney’s fees of the violated party in responding to such release.

9. MODIFICATION. No modification to any provisions contained in this Agreement shall be binding upon any party unless made in writing and signed by both Parties.

10. SEVERABILITY. If any provision, part, or expression is held to be unenforceable for any reason, the remaining provisions, parts, or expressions of this Agreement shall remain in full force and effect.

11. THIRD (3rd) PARTIES. The Parties agree that they have not assigned any portion of the Debt to another individual or entity. Furthermore, the Creditor and Debtor each claim to have the authority to enter into this Agreement.

12. GOVERNING LAW. This Agreement shall be governed under the laws in the State of [STATE NAME].

13. SIGNATURES.

Debtor’s Signature: ____________________ Date: [MM/DD/YYYY]

Printed Name: [DEBTOR NAME]

Creditor’s Signature: ____________________ Date: [MM/DD/YYYY]

Printed Name: [CREDITOR NAME]