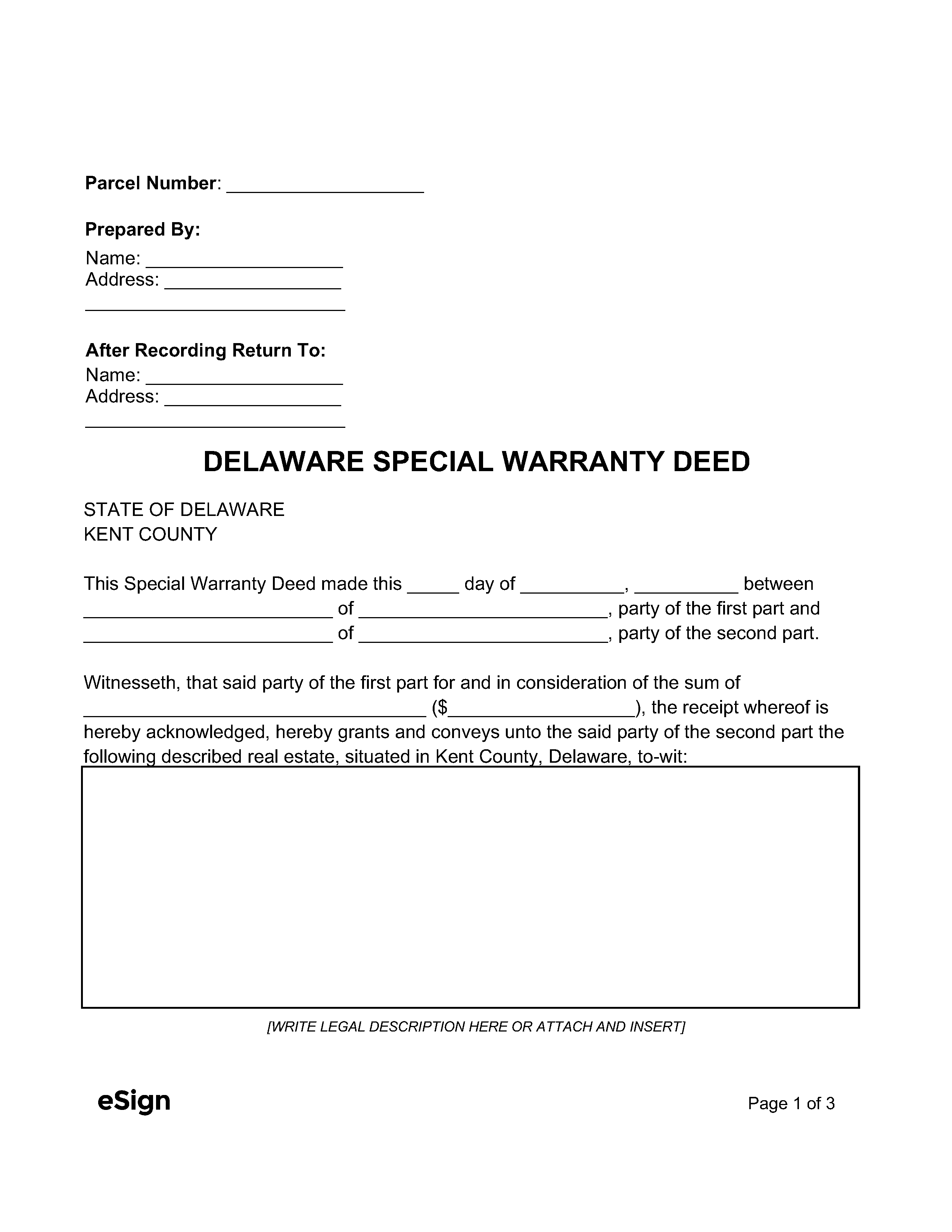

Forms by County

Recording Requirements

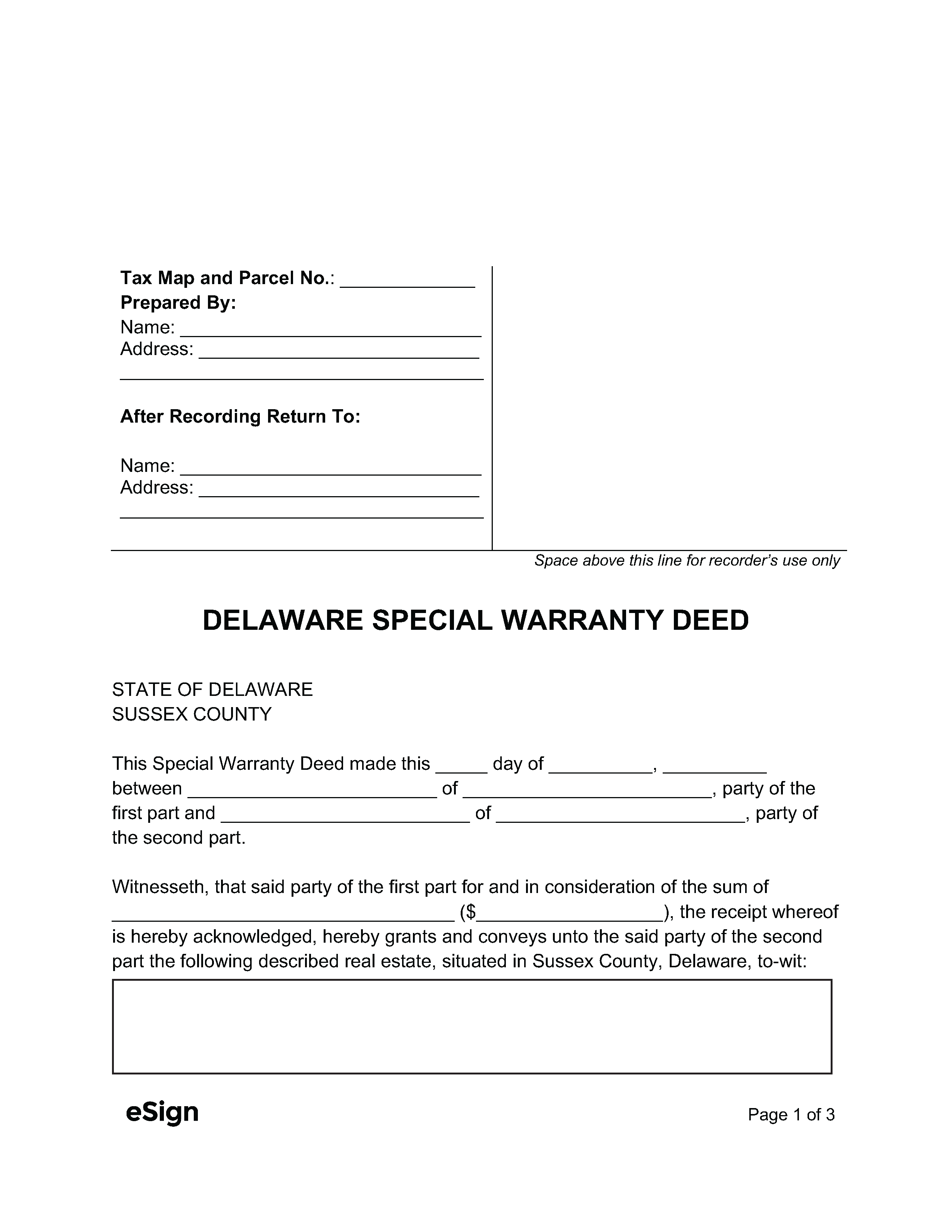

The grantor must have their signature notarized.[1]

View Recording Requirements by County |

| Kent County |

|

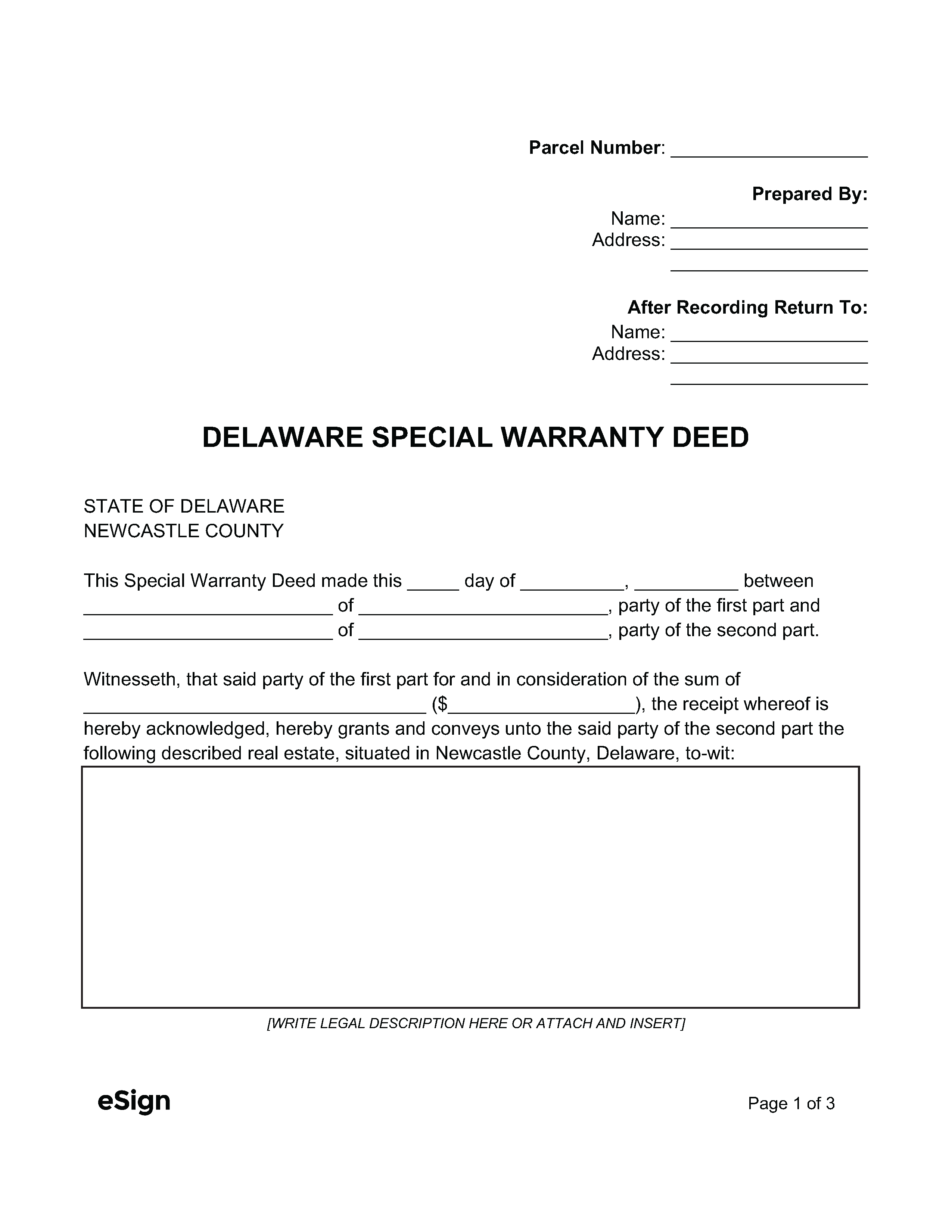

| Newcastle County |

|

| Sussex County |

|

Deeds will be recorded at the County Recorder’s Office in Kent County, Newcastle County, or Sussex County.[5] As of this writing, the fees are:

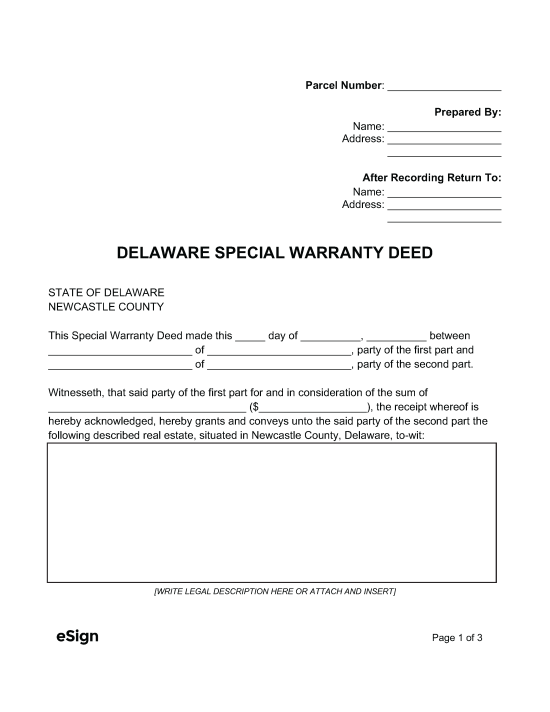

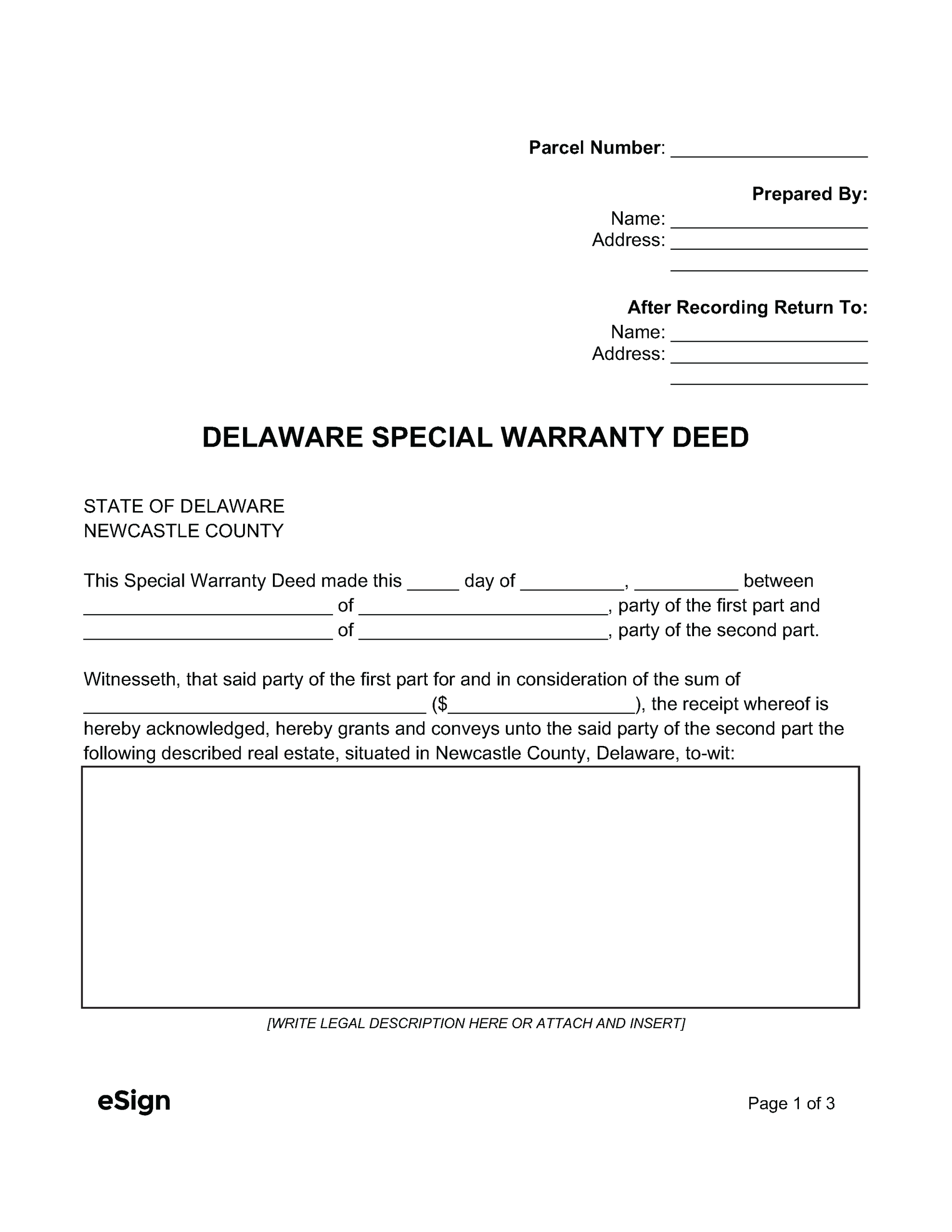

Special Warranty Deed (Newcastle County Preview)

Additional Forms

Realty Transfer Tax Return and Affidavit of Gain and Value (Form RTT-TAX) – This form relays the transfer tax owed and needs to be recorded with the deed.

Form RTT-SCH – First-time homebuyers may submit this form with the deed to claim credit towards their realty transfer tax.

Form REW-EST – This form assesses applicable income tax due on a conveyance. It must be filed with the deed.

Kent County First Time Homebuyer Certification Form – This form is used by Kent County residents purchasing their first home to get credit from their realty transfer tax.

Kent County New Property Owner Information Form – This form must be included in all deeds recorded in Kent County to provide the new owner’s information.

General Information Sheet – This document provides details regarding the property. It must accompany all deed filings in Sussex County.

Sussex County FHB Affidavit – First time home buyers must include this document with the deed.

Sussex County Transfer Tax Affidavit – This form is to be filed with every deed to calculates the applicable county-level tax in Sussex County.