Recording Details

- Signing Requirements – Notary acknowledgment is required.[1]

- Where to Record – County Recorder’s Office[2]

- Recording fees – According to state law, $31 is the minimum recording fee for deeds; however, most county recorders charge upwards of $70.[3]

Formatting Requirements

Deeds must comply with the following requirements to be accepted as a standard document for recording[4]:

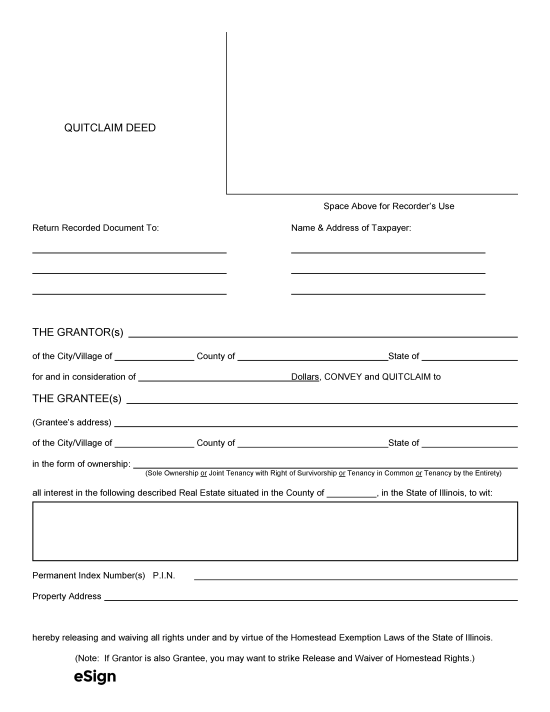

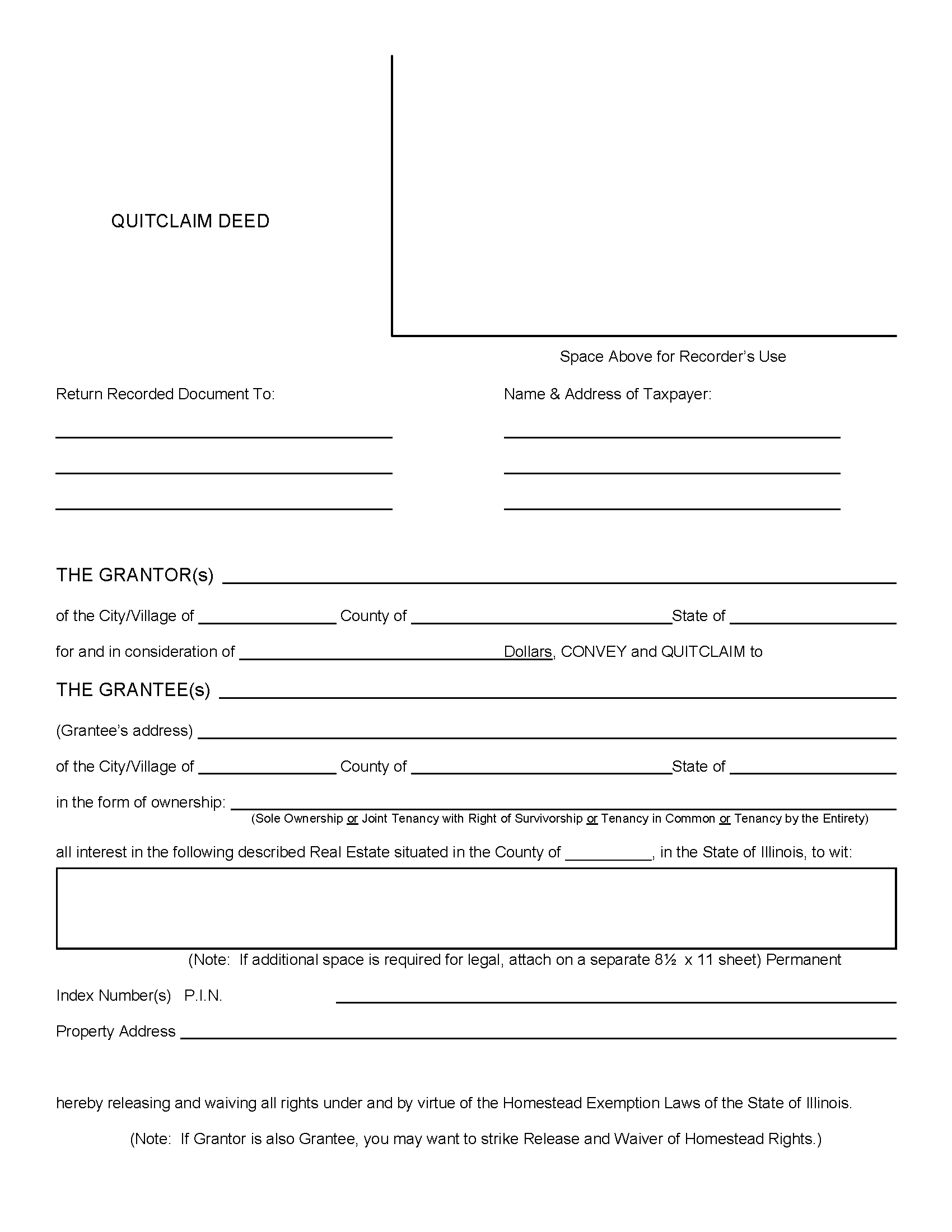

- Margins: 0.5″ margin on all sides, 3″ x 5″ blank space in the top right corner of the first page

- Font: Not specified in state statutes, but most counties require at least 10pt font

- Paper: Minimum 20-pound weight white paper measuring 8.5″ x 11″ with no stapled or affixed attachments

- Ink: Black

Quitclaim Deed (Preview)

PTAX-203 – Unless exempt, this Real Estate Transfer Declaration Form must be filed with the deed.[5]

PTAX-203-A – When certain types of property (typically commercial) valued over $1 million are being transferred, this supplemental form must be filed with the deed.

PTAX-203-NR – If a deed is not being recorded but transfer tax is being paid, this Transfer Tax Payment Document must be filed.