Recording and Resources

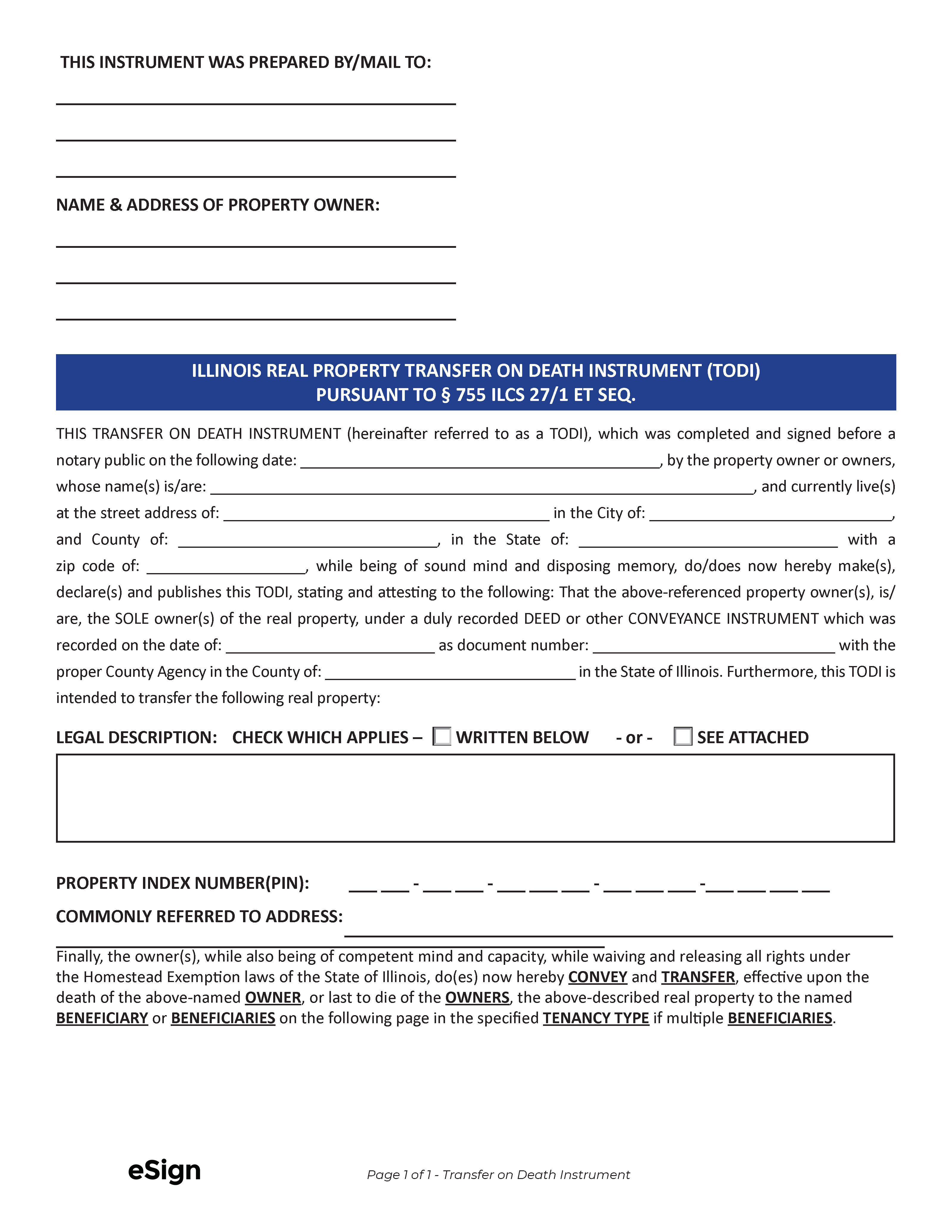

Formatting

- Paper: 8.5″ x 11″

- Margins: 3″ x 5″ top right corner of first page, 0.5″ everywhere else

- Ink: Black[1]

Signing and Recording

- Signing Requirements: Notary public and two witnesses[2]

- Where to Record: County Recorder’s Office[3]

- Recording fees: Varies by county

Resources