Recording Requirements

- The grantor must acknowledge their signature before a notary public, county clerk, or register of deeds.[1]

- The paper must be no larger than 8.5″ x 11″.[2]

Some counties have specific formatting requirements regarding margins and font sizes. Users should check with their local office to ensure they meet local standards.

The local Register of Deeds records deeds in Kansas.[3] At the time of this writing, the fee is $21 for a single page and $17 for each subsequent page.[4]

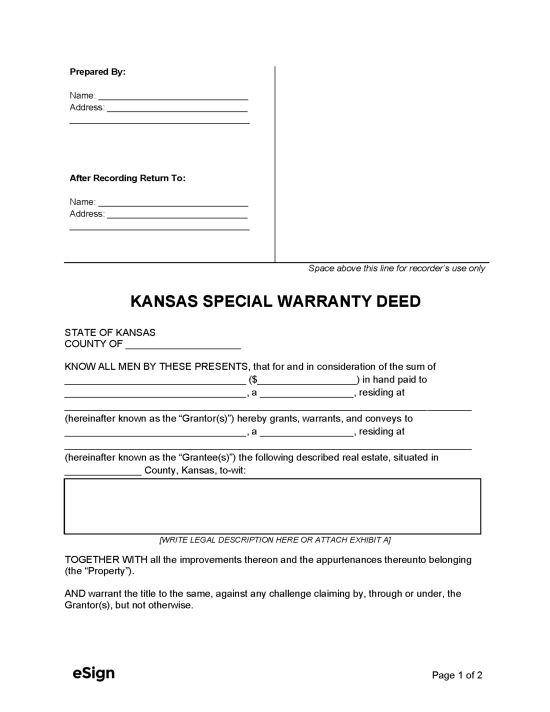

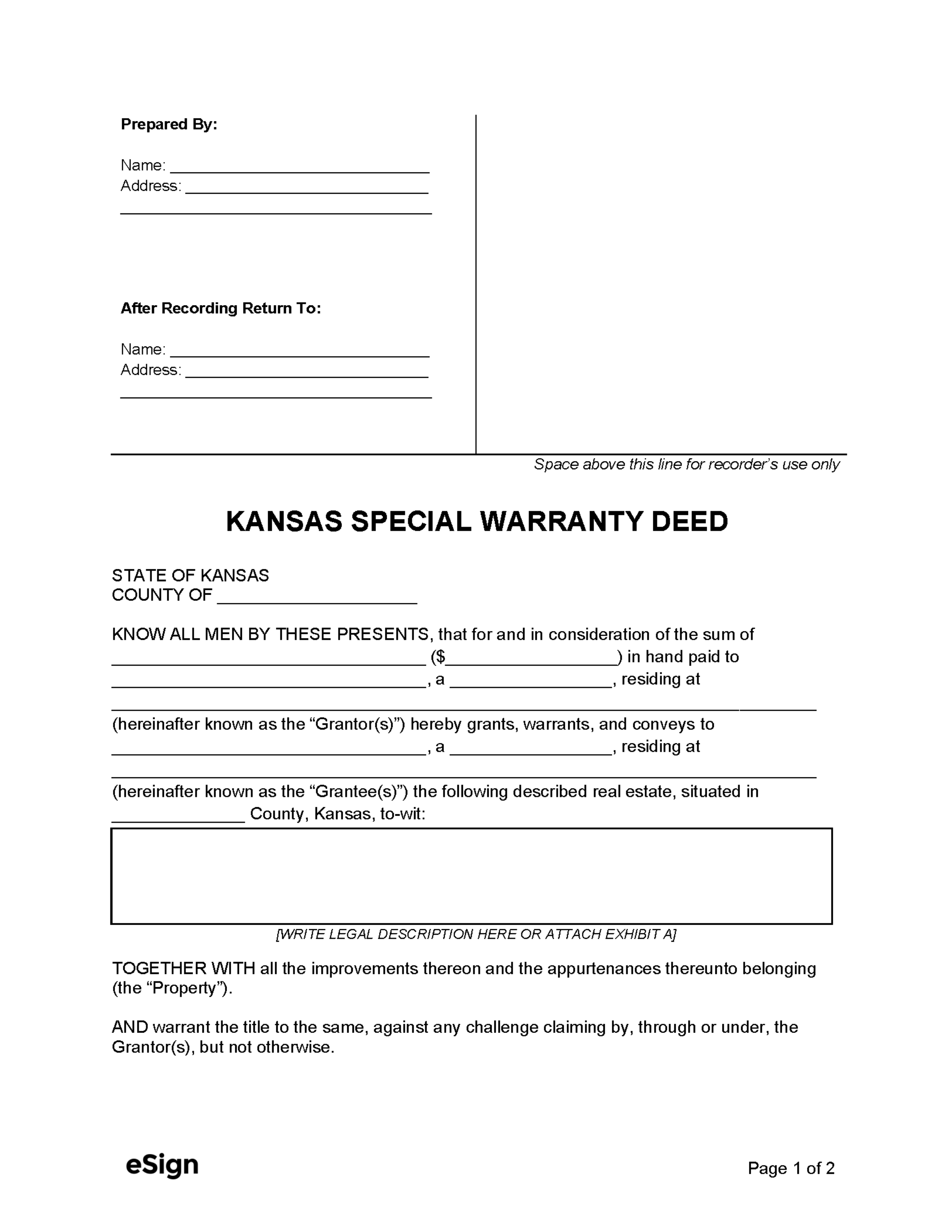

Special Warranty Deed (Preview)

Additional Forms

Sales Validation Questionnaire (SVQ) – This form reports the sale price and details of a property transfer and helps determine fair market value for property tax assessments. It is required when filing a deed (unless exempt).[5]