Formatting Requirements

Deeds of trust require the signatures of the grantor and a notary public.[1] The document must be filed with the Chancery Clerk’s Office for the county where the property is located.

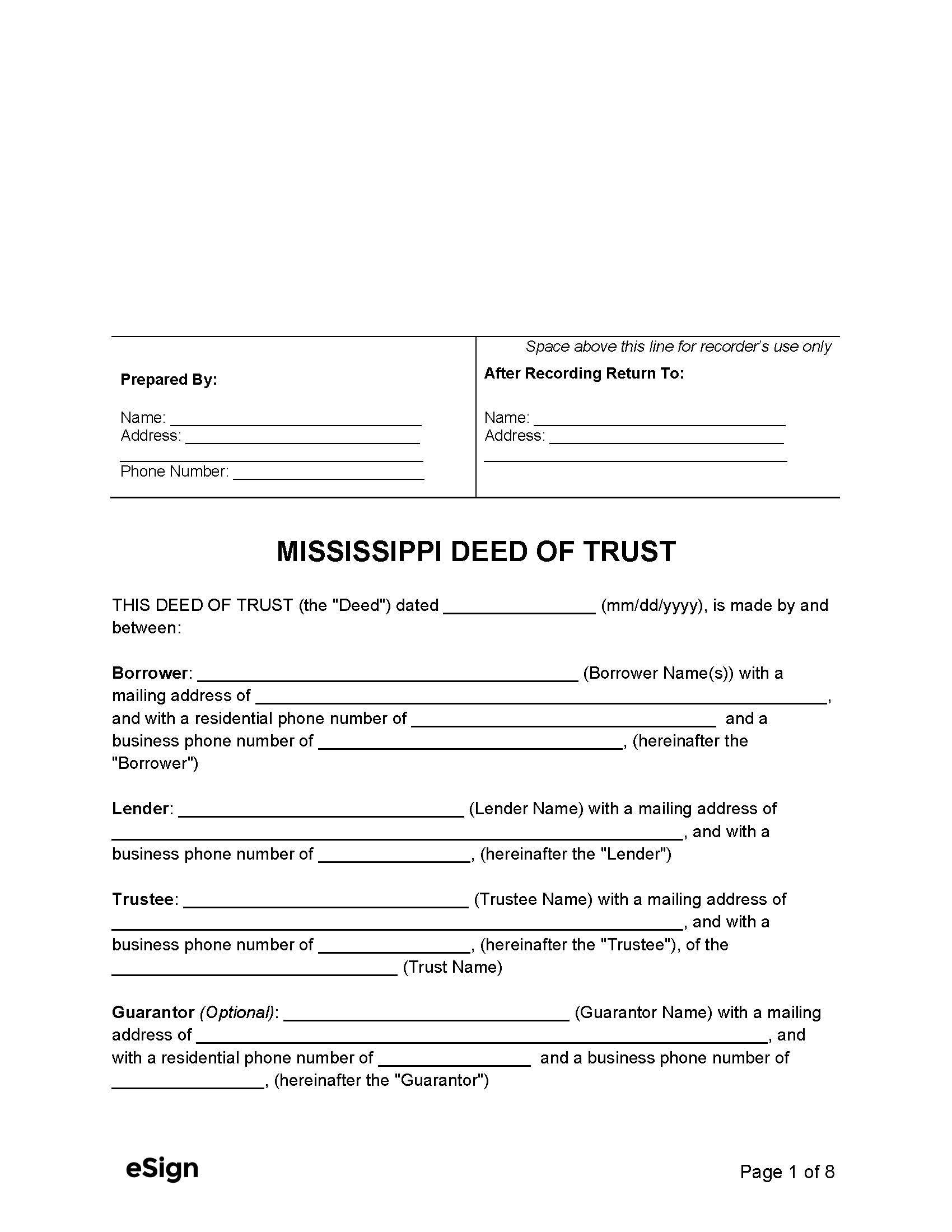

Documents must be formatted as follows before being presented for recording[2]:

- White paper

- Text must be at least 10pt in size

- Margins must be 0.75″, except for a 3″ top margin on the first page