Recording Details

- Signing Requirements – The person executing a quitclaim deed must acknowledge their signature before a notary public or other qualified individual.[1]

- Where to Record – Registry of Deeds[2]

- Recording fees – $22 for the first page, $2 for each additional page (as of this writing)[3]

Formatting Requirements

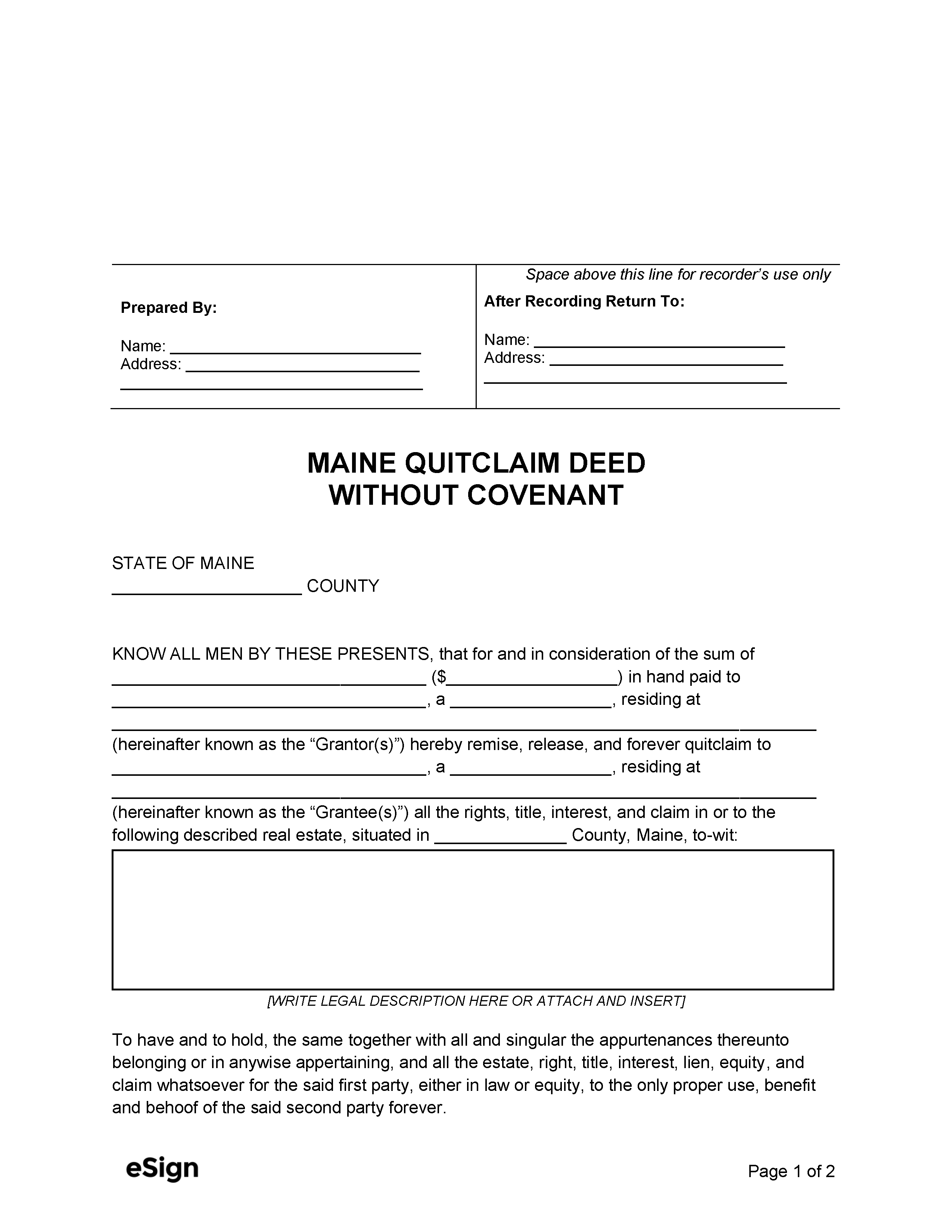

The Maine Registers of Deeds Association requires deeds to comply with the following formatting requirements in order to be recorded[4]:

- Paper: Min. 8.5″ x 11″, max. 8.5″ x 14″

- Font: Min. 10pt

- Margins: 1.75″ top margin of the first page, 1″ top margin all other pages, 0.75″ on sides of all pages, 1.5″ margin bottom of the last page

Real Estate Transfer Tax Declaration (Form RETTD) (Online|PDF) – Unless the property is exempt from transfer tax, a deed must be accompanied by Form RETTD when being recorded.[5]

Quitclaim Deed (Preview)

Sources

-

- § 203

- § 201

- § 751(1), Fee Schedule

- MRDOA Recording Requirements (download only)

- § 4641-D