Life Estate vs. Transfer-on-Death Deed

Both life estate and transfer-on-death (TOD) deeds are estate planning tools that allow a property to be inherited without probate and reduce the beneficiary’s tax burden. However, there are important differences between the two.

Unlike a TOD deed, a life estate deed isn’t revocable; however, it does offer protection from Medicaid claims that a TOD deed doesn’t provide. Furthermore, the grantor in a TOD deed retains total ownership of their real estate, while the life estate grantor forfeits the future interest in their estate to the grantee.

Life Estate Law – § 35-6-03-05-101(2), (3)

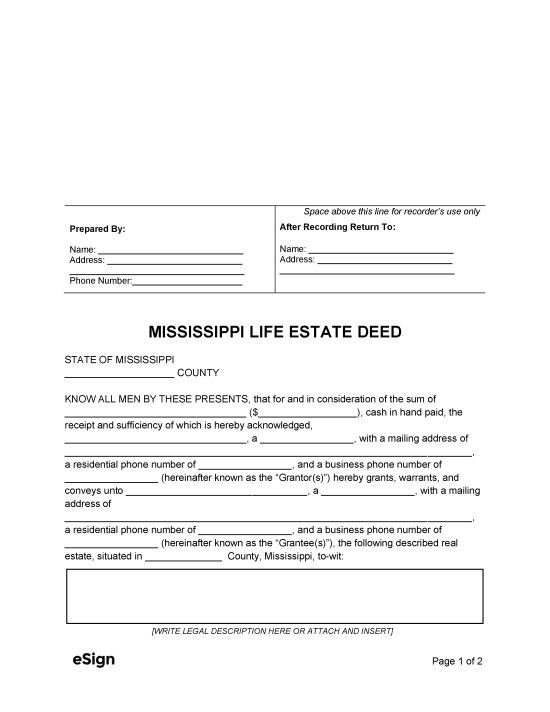

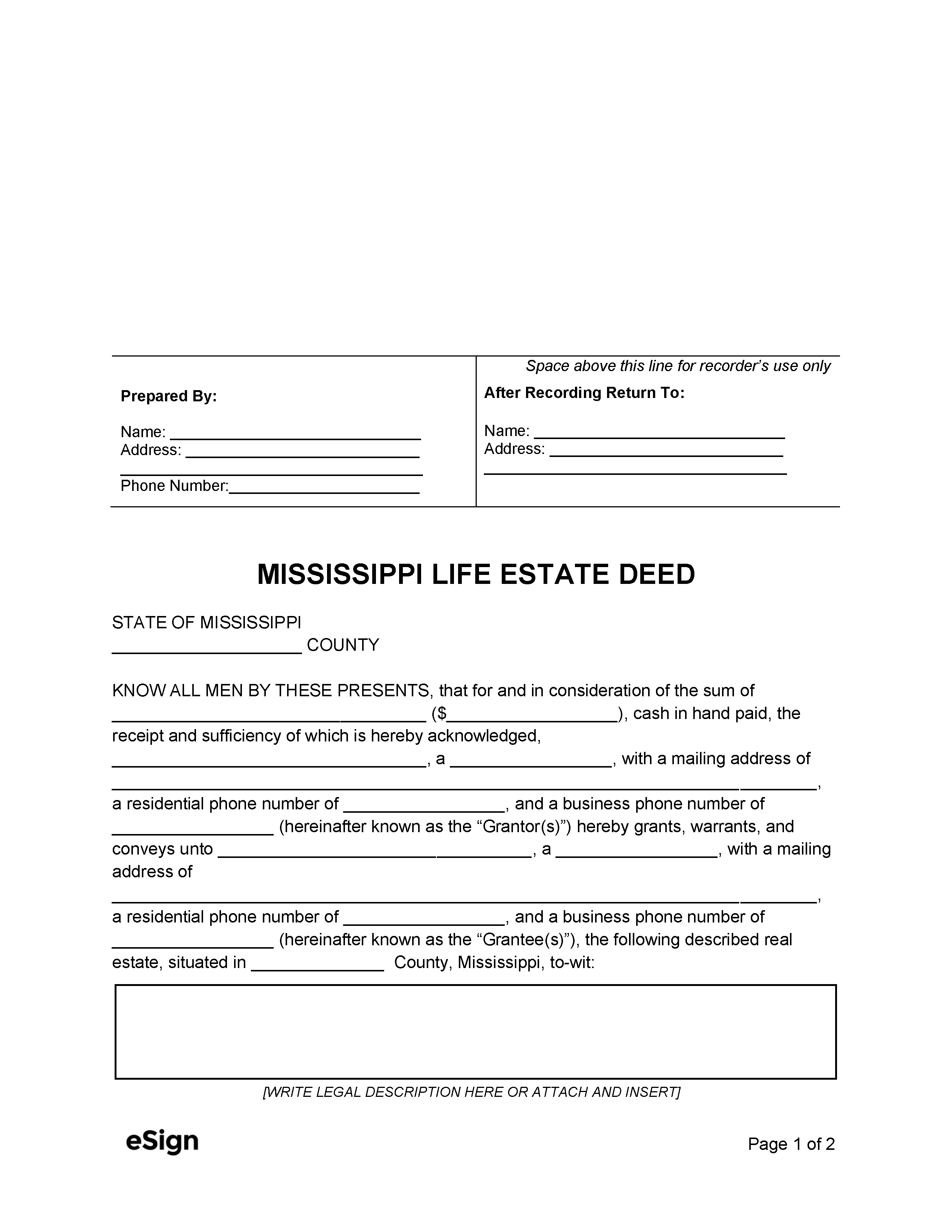

Recording Deeds

Deeds must be recorded with the Chancery Clerk’s Office in the property’s county to be considered valid. Before recording, the deed must be signed by the grantor and notarized.[1]

As of this writing, recording fees are $25 for the first 5 pages and $1 for each additional page.[2]

Formatting Requirements

- Single-sided, unbound, and unstapled

- Minimum 10-point font size

- Minimum 20 lb weight white paper

- 3” top margin on first page, ¾” margin all other sides and pages