Formatting Requirements

A grantor must have their signature notarized.[1] A completed deed of trust is filed with the Register of Deeds.[2]

The following recording requirements must be met for a deed to be accepted for filing[3]:

- The deed must be on white paper, 8.5″ x 11″ to 8.5″ x 14″ in size

- The first page’s top margin must be 3″ and other margins 1″

- The text must be in black ink and at least 8pt in size

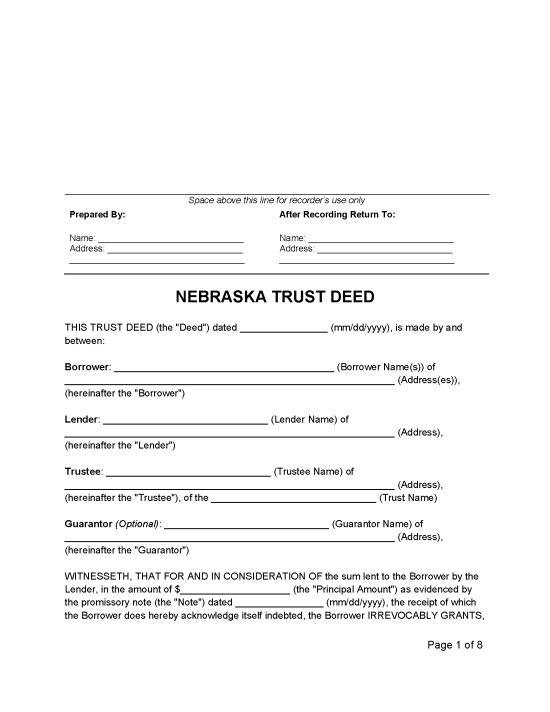

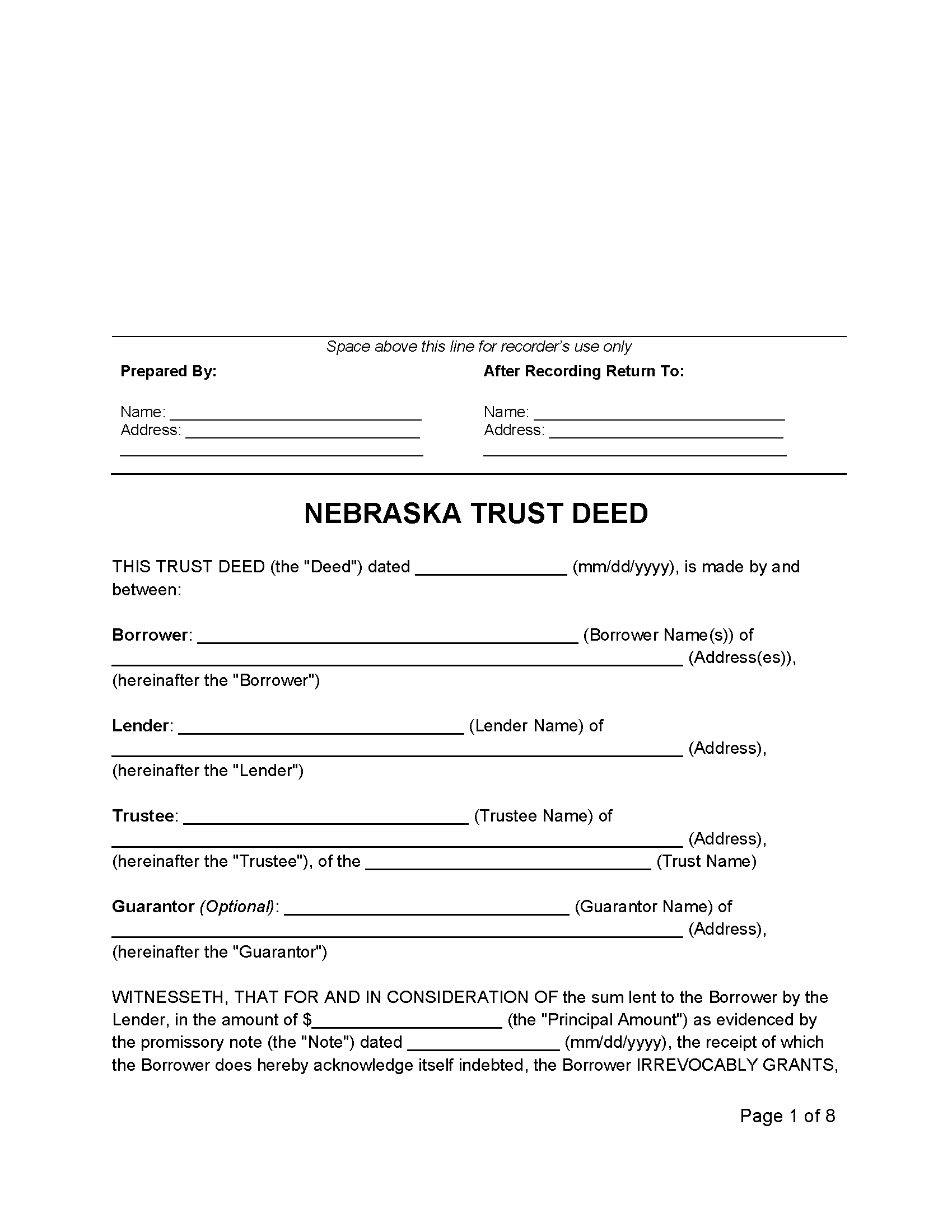

Trust Deed (Preview)

Real Estate Transfer Statement – This form must be filed alongside deeds for tax assessment purposes.[4]