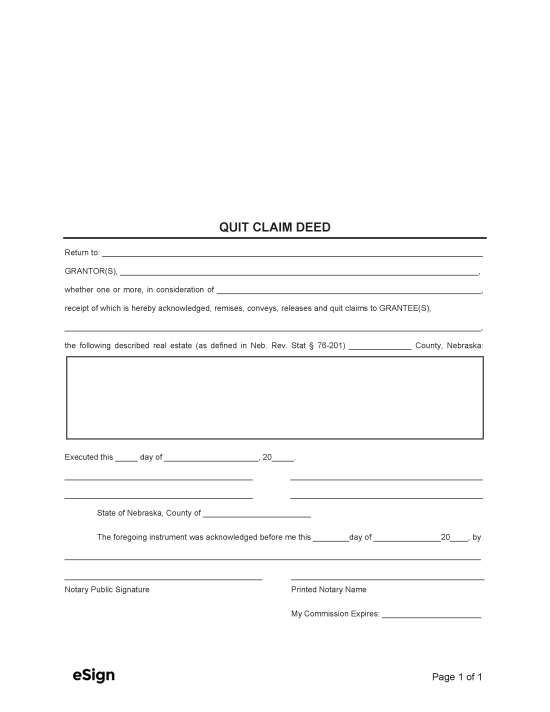

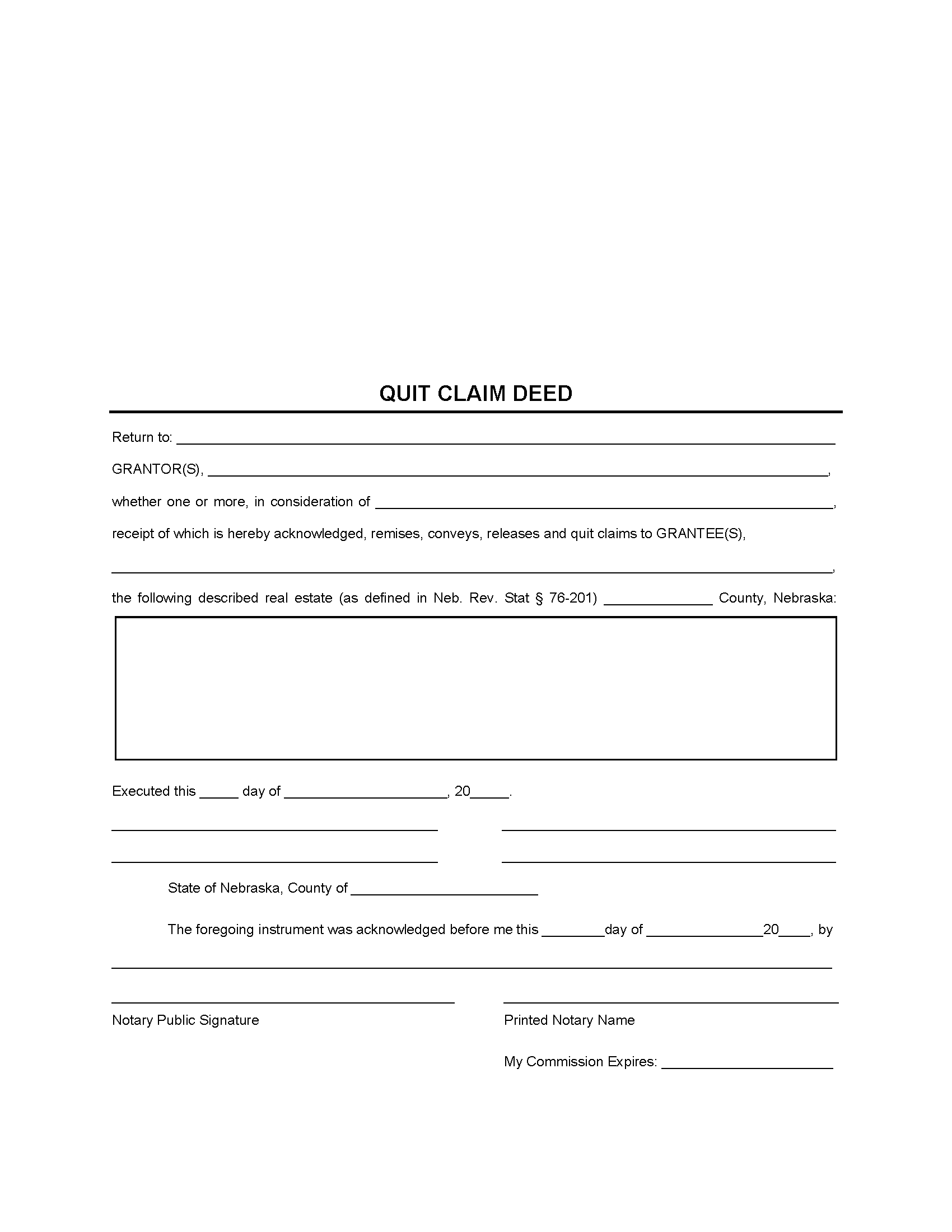

Recording Details

- Signing Requirements – The grantor and a notary public must sign the deed.[1]

- Where to Record – County Register of Deeds[2]

- Recording Fees – $10 for the first page + $6 for each additional page (as of this writing).[3]

Formatting Requirements

Quit claim deeds submitted for recording must adhere to the following formatting standards[4]:

- Margins: At least 3″ x 8.5″ space at the top of the first page and a 1″ margin everywhere else.

- Paper: At least 8.5″ x 11″ but not larger than 8.5″ by 14″.

- Font: At least 8 points.

- Ink: Black or dark blue.

Certificate of Exemption – If the deed is exempt from the documentary stamp tax, this form will need to be completed and filed with Form 521.[5]