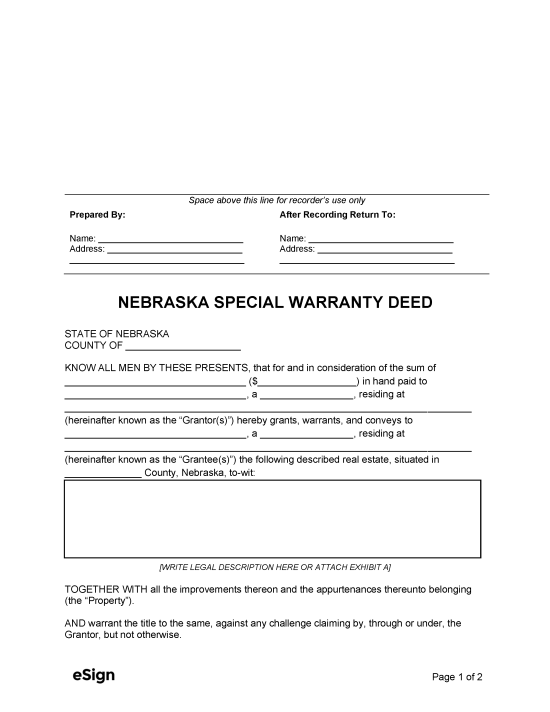

Recording Requirements

- The grantor must acknowledge before a notary that they have executed the deed.[1]

- White paper measuring between 8.5″ x 11″ and 8.5″ x 14″ must be used.

- The first page of the deed must have a 3″ top margin. All other margins must be 1″.

- Documents must be printed in black ink with a font size of at least 8pt.[2]

A deed can be entered into the county records by filing it with the Register of Deeds.[3] As of this writing, recording a deed costs $10 for the first page and $6 for each additional page.[4]

Special Warranty Deed (Preview)

Additional Forms

Real Estate Transfer Statement (Form 521) – This document must be filed with the deed to report the transaction and parties’ information to the Register of Deeds.[5]

Certificate of Exemption – If applicable, this form must be included in the filing to allow the grantor to claim exemption from documentary stamp tax.[6]