By Type (5)

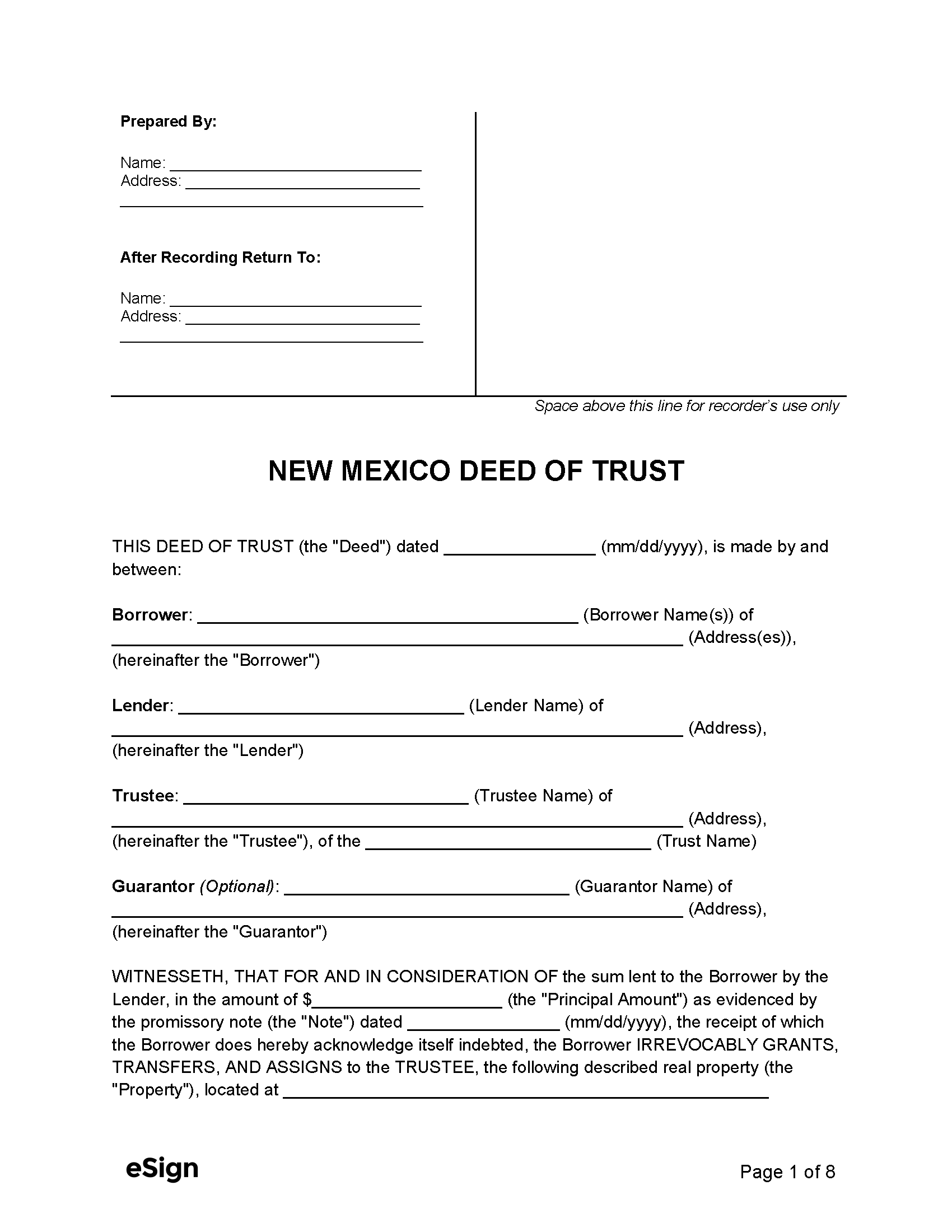

Deed of Trust – Conveys ownership to a third-party trustee to hold until the owner repays a loan. Deed of Trust – Conveys ownership to a third-party trustee to hold until the owner repays a loan.

|

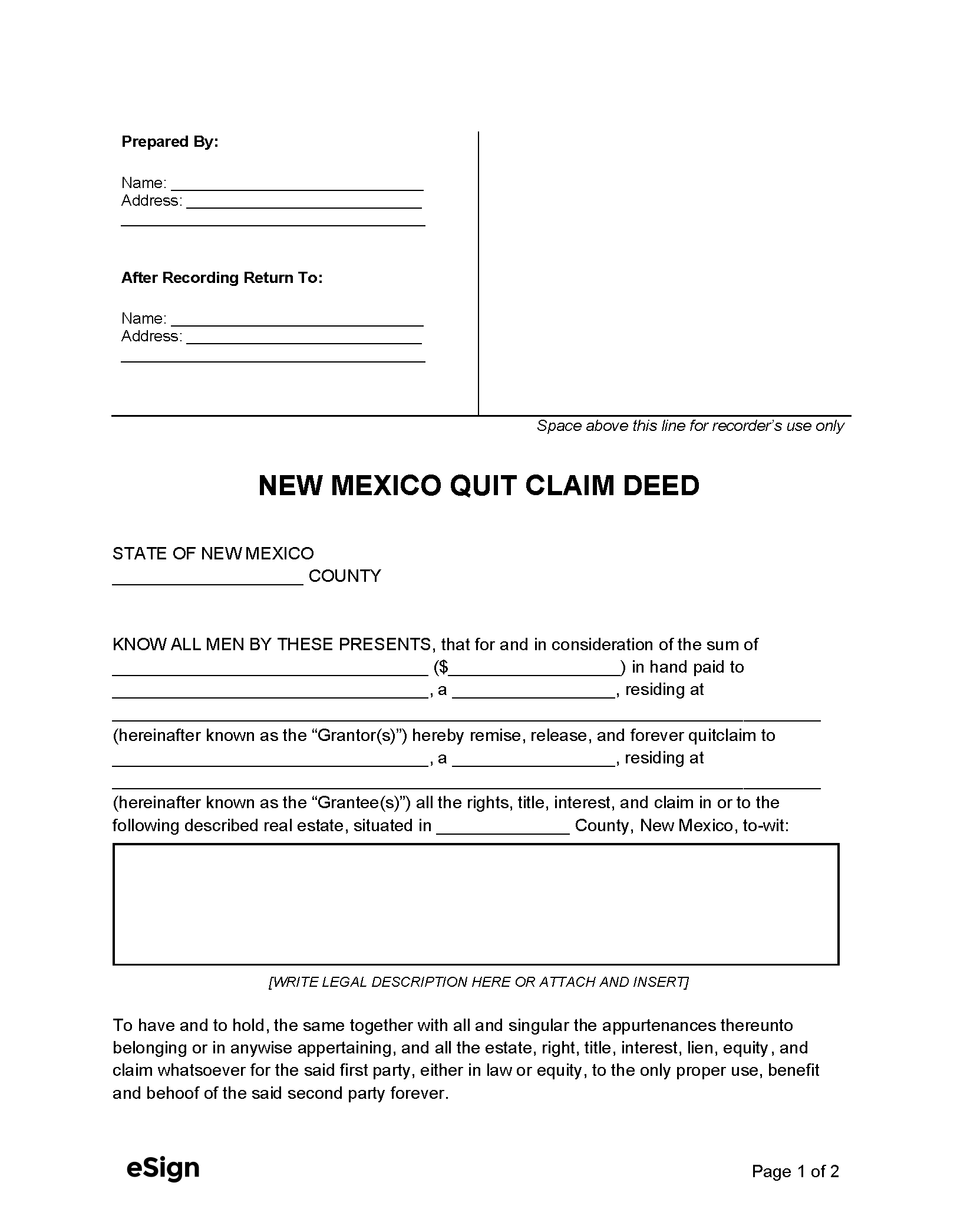

Quit Claim Deed – Includes no title warranties (grantee assumes all title risks). Quit Claim Deed – Includes no title warranties (grantee assumes all title risks).

|

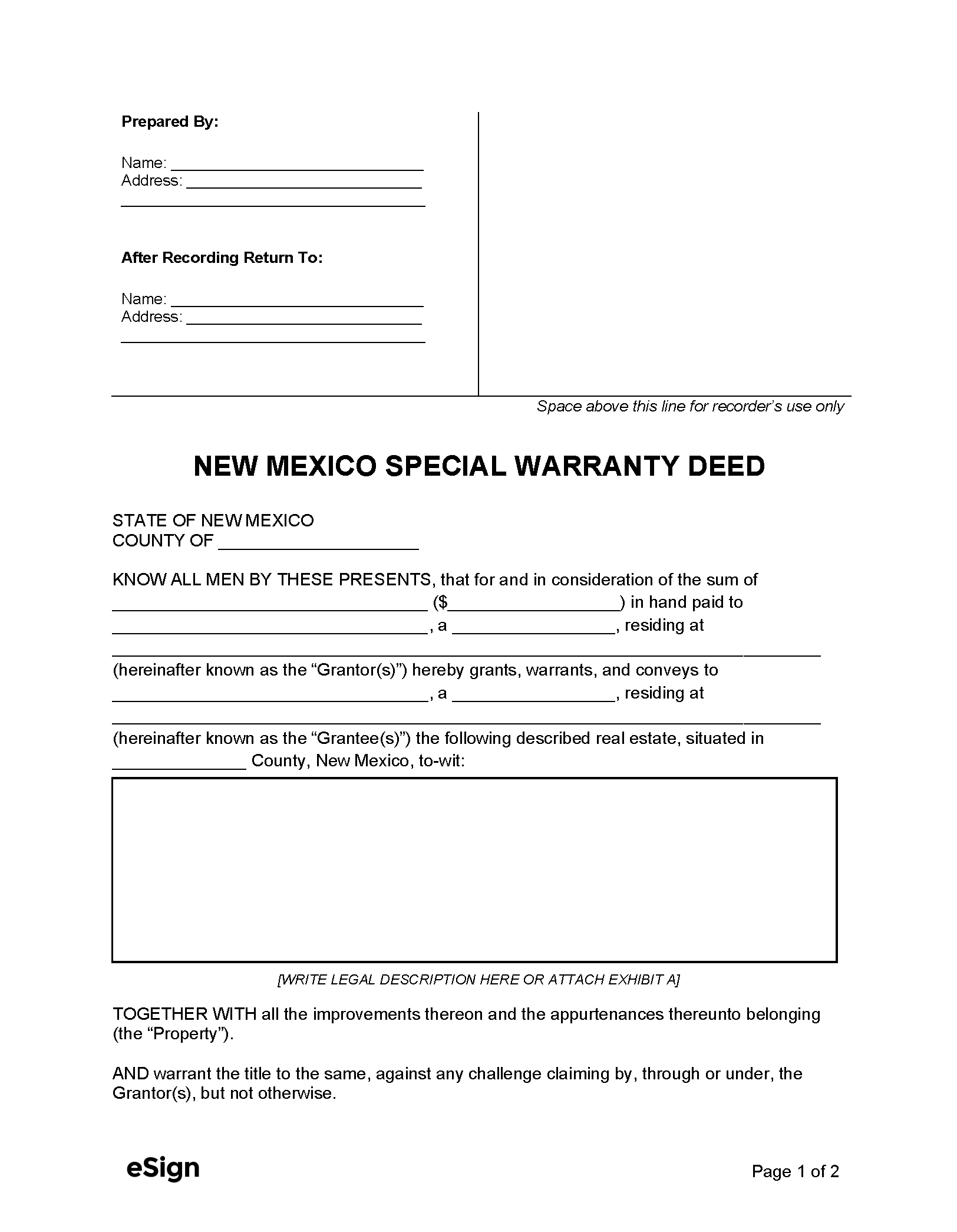

Special Warranty Deed – Offers a warranty against title defects from the grantor’s period of ownership. Special Warranty Deed – Offers a warranty against title defects from the grantor’s period of ownership.

|

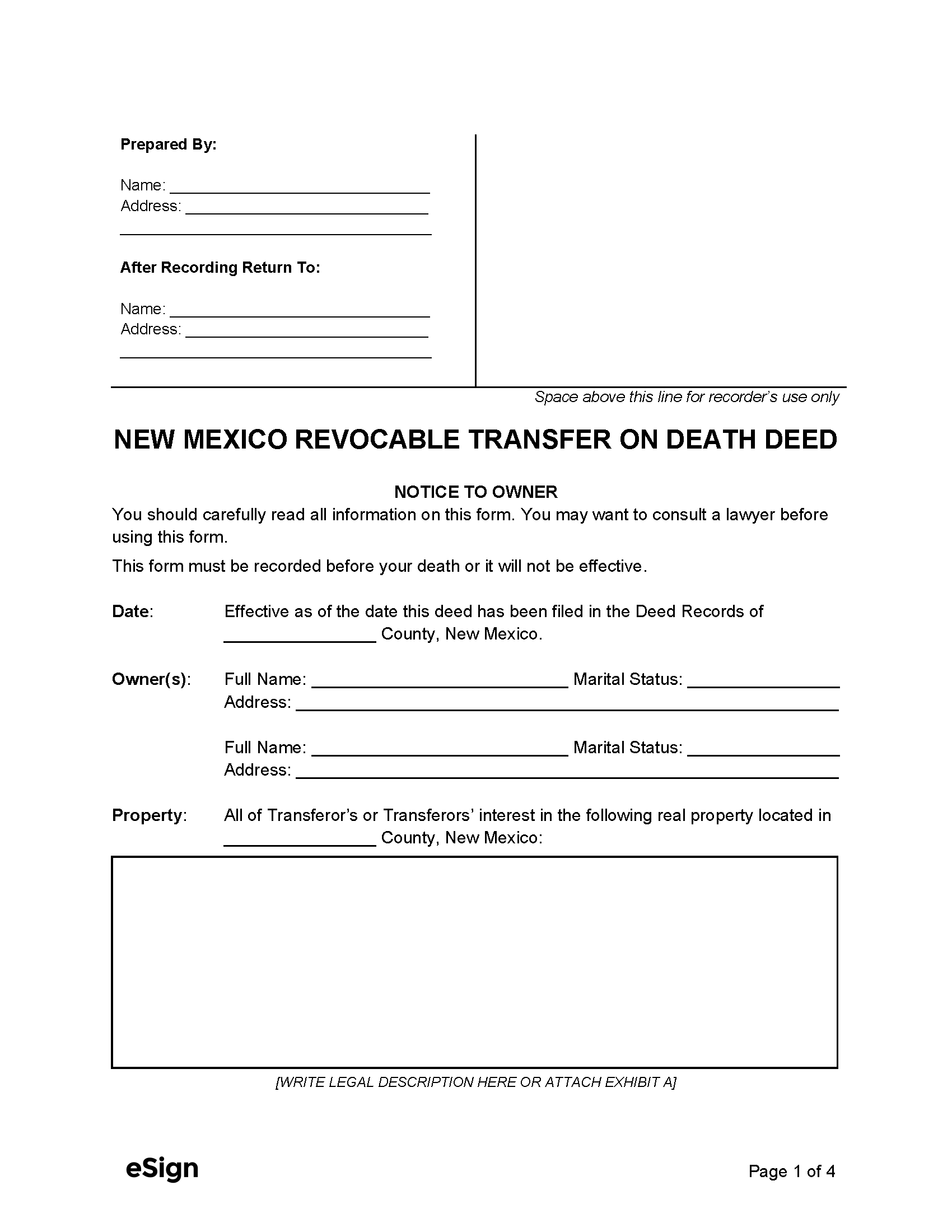

Transfer on Death Deed – Transfers property to beneficiaries upon the grantor’s death, bypassing probate. Transfer on Death Deed – Transfers property to beneficiaries upon the grantor’s death, bypassing probate.

|

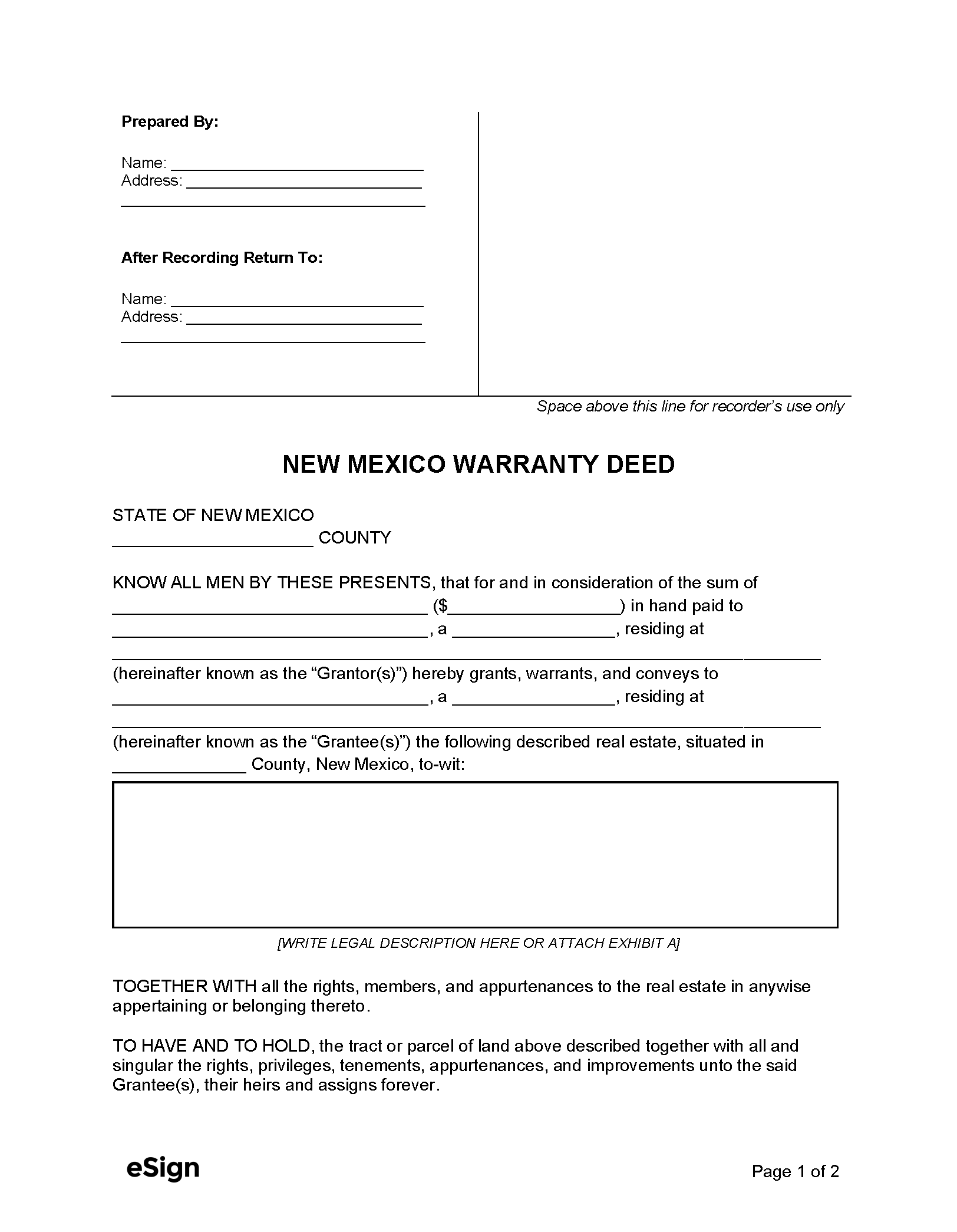

Warranty Deed – Protects against title encumbrances caused by the grantor and all previous owners. Warranty Deed – Protects against title encumbrances caused by the grantor and all previous owners.

|

Formatting

New Mexico does not have statewide formatting standards. Individuals should check with the County Clerk of their jurisdiction to see if local requirements exist.

Recording

Signing Requirements – A deed must include the grantor’s signature and be notarized.[1]

Where to Record – Recording takes place at the office of the County Clerk in the county where the property lies.[2]

Cost – $25 recording fee (as of this writing)[3]