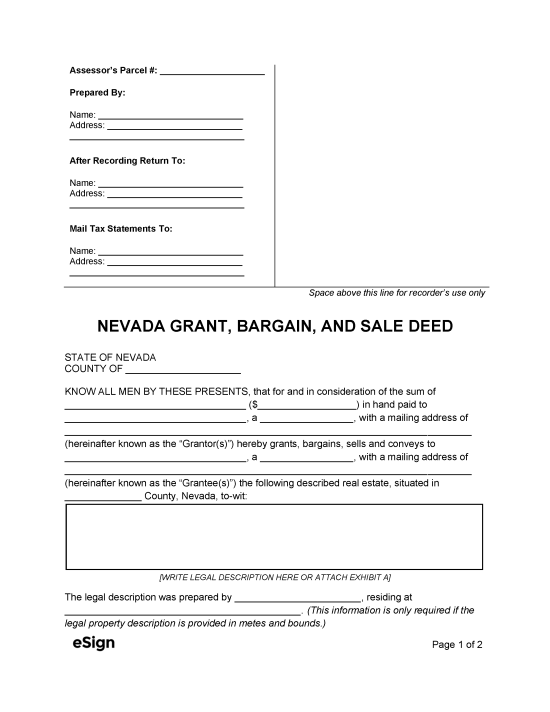

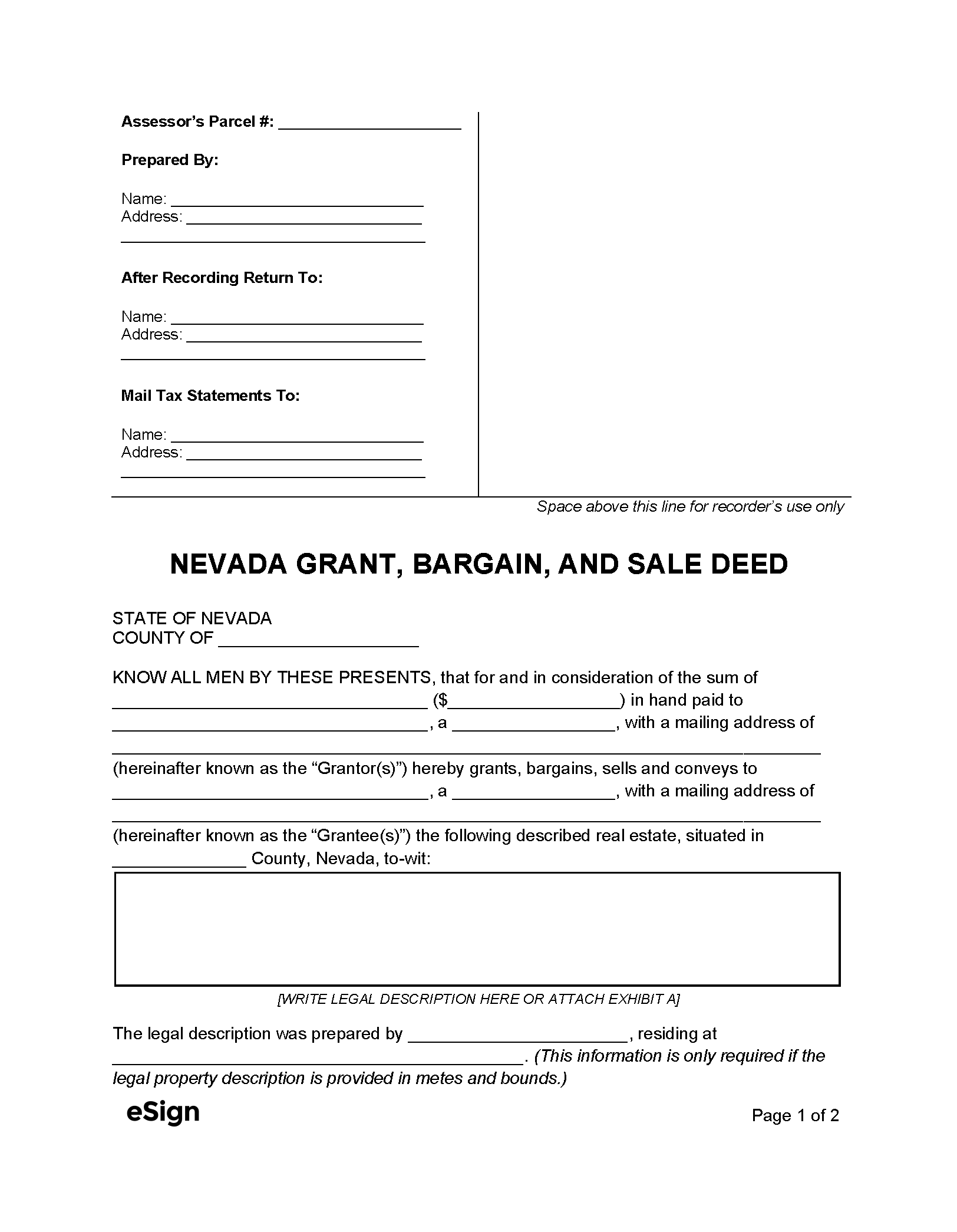

Recording Requirements

- A notary public must verify the grantor’s signature.[1]

- Documents must be printed on white paper measuring 8.5″ x 11″ in size.

- 3″ x 3″ blank space in the top right corner of the first page, 1″ margin on remaining sides.

- Text must be in black ink and size 10pt or greater.[2]

Deeds are recorded by the County Recorder of the county where the property is located.[3] State statutes set the cost for filing at $42 (actual fees imposed by counties vary).[4]

Grant, Bargain, and Sale Deed (Preview)

Additional Forms

Declaration of Value Form (Form LGS-F049) – Must accompany deed filings to report and pay the transfer tax amount due.[5]