By Type (5)

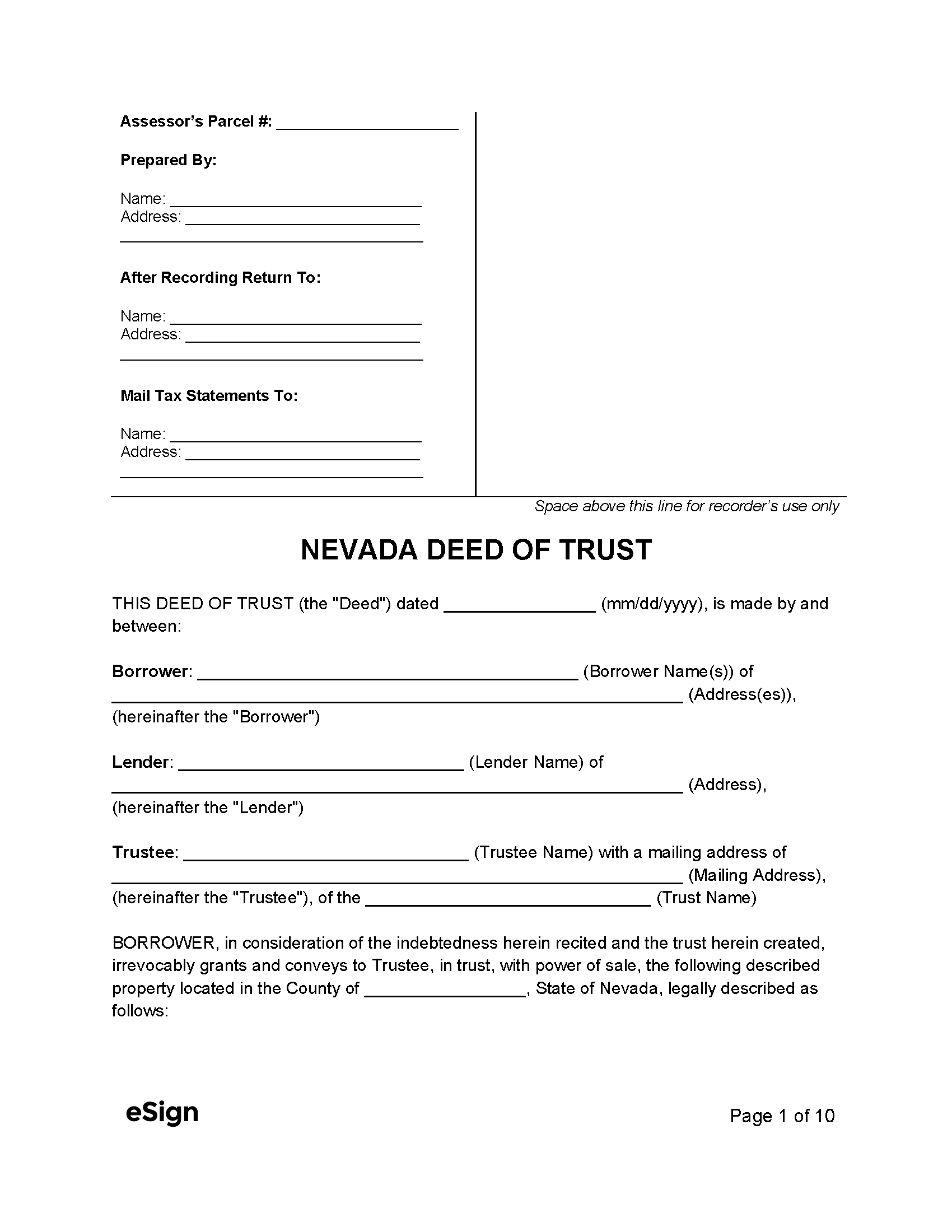

Deed of Trust – Used to transfer a property title to a trustee as collateral for a loan. Deed of Trust – Used to transfer a property title to a trustee as collateral for a loan.

|

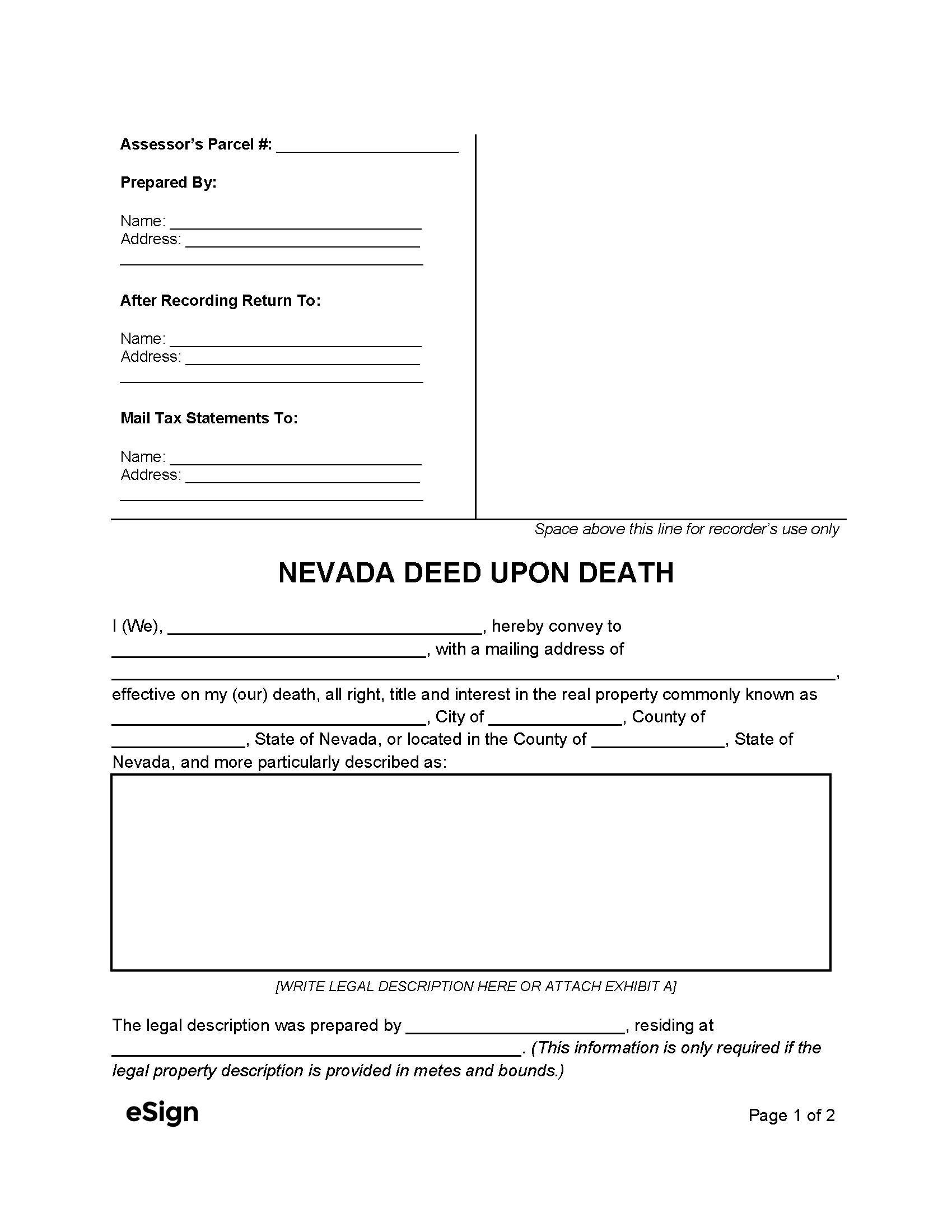

Deed Upon Death – Allows a beneficiary to inherit property upon the grantor’s death. Deed Upon Death – Allows a beneficiary to inherit property upon the grantor’s death.

|

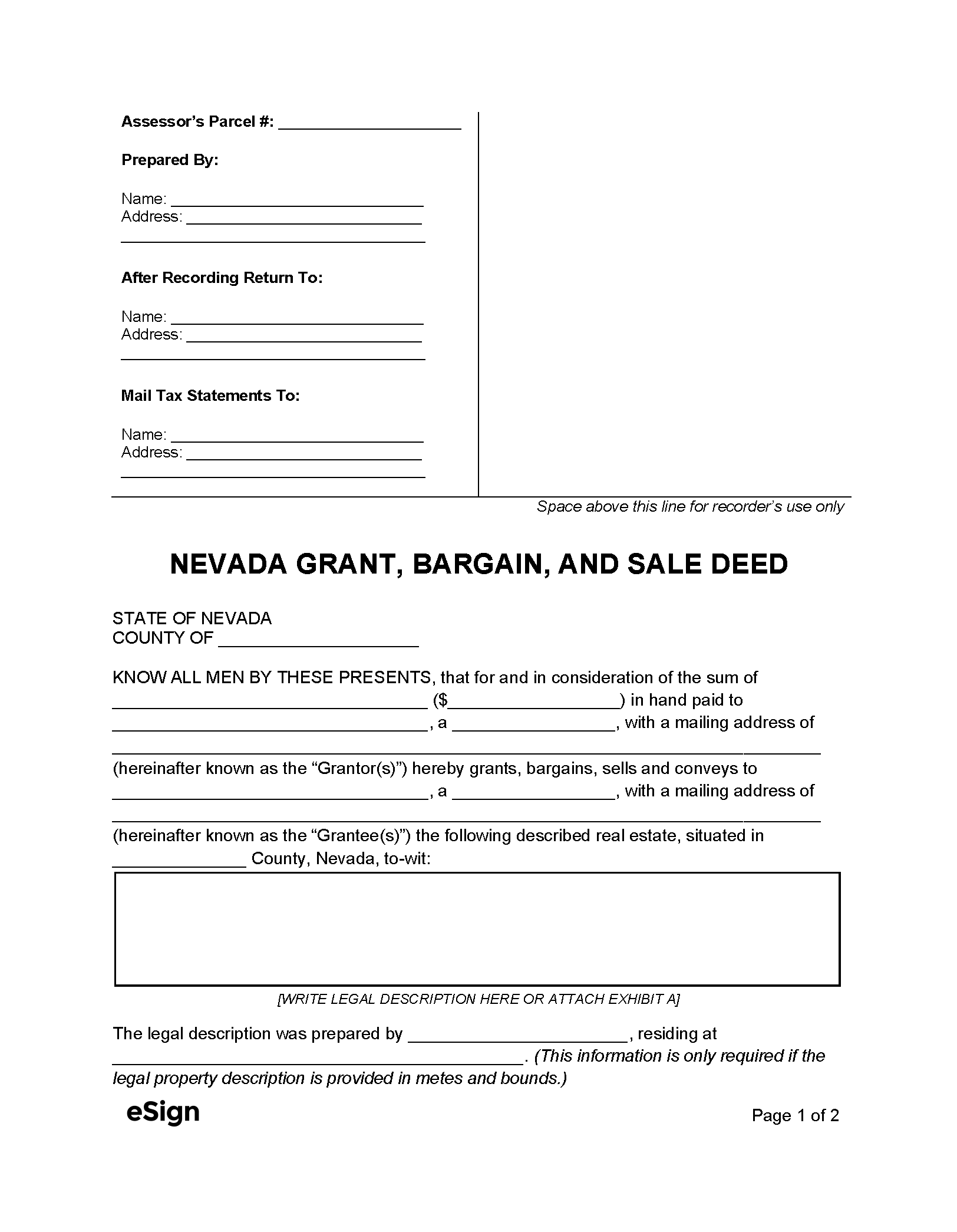

Grant, Bargain, and Sale Deed – Protects against title issues tied to the grantor’s ownership. Grant, Bargain, and Sale Deed – Protects against title issues tied to the grantor’s ownership.

|

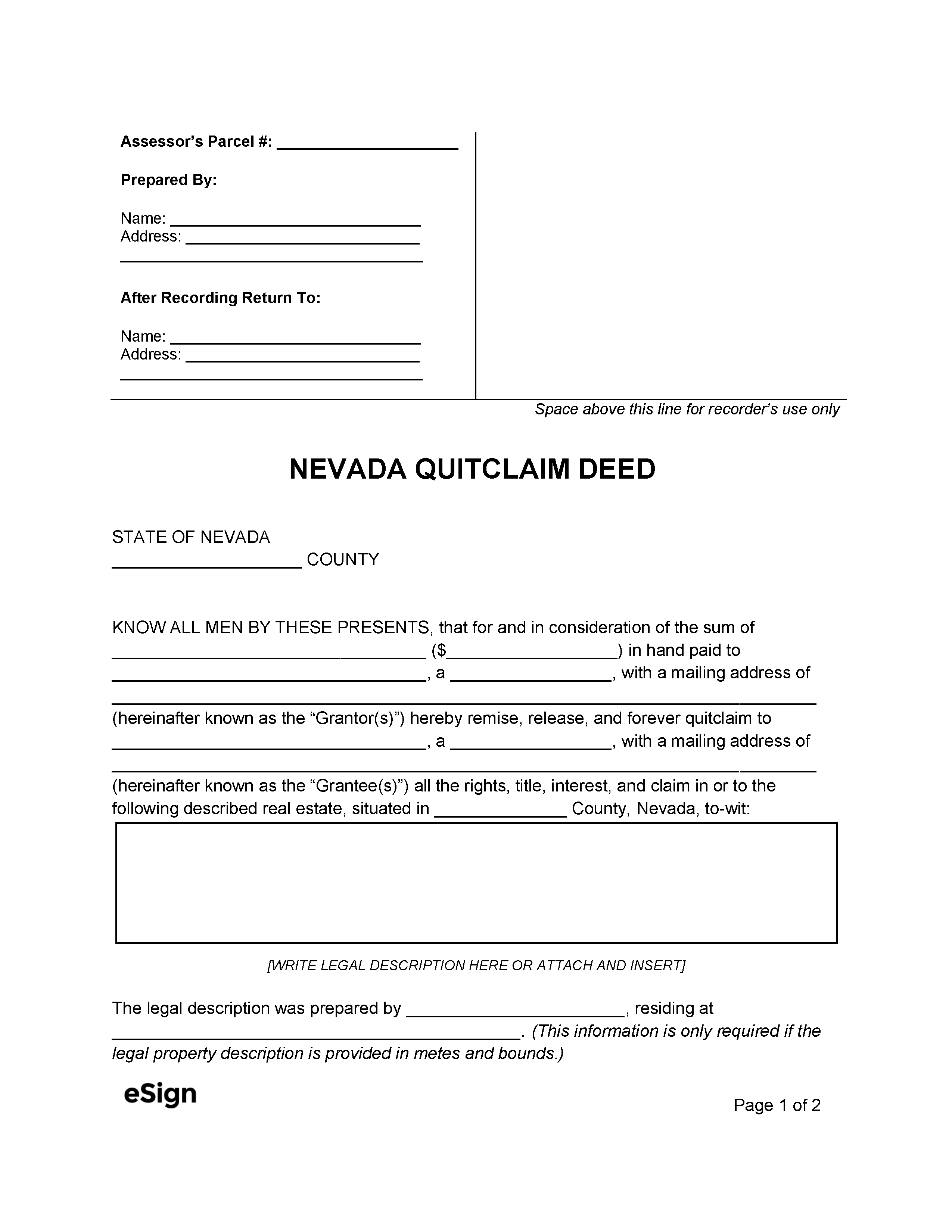

Quit Claim Deed – This deed transfers ownership without guaranteeing a clear title. Quit Claim Deed – This deed transfers ownership without guaranteeing a clear title.

|

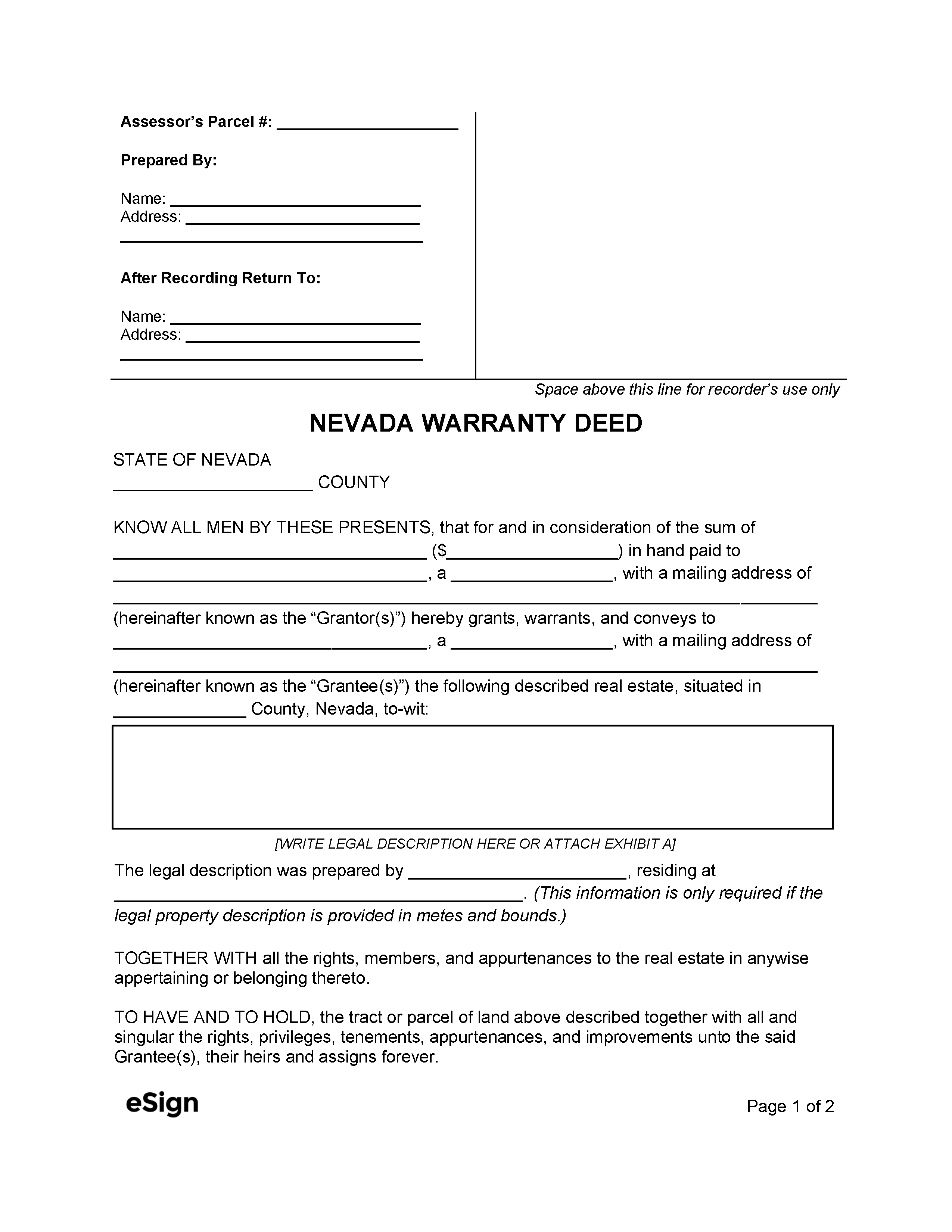

Warranty Deed – Offers full protection against title defects. Warranty Deed – Offers full protection against title defects.

|

Formatting

Paper – White, 20lbs, at least 8.5″ x 11″

Margins – 3″ x 3″ at the top right of the first page, 1″ everywhere else

Font – Black ink, not smaller than 10pt Times New Roman font[1]

Recording

Signing Requirements – A notary public must notarize the grantor’s signature.[2]

Where to Record – Deed must be filed with the County Recorder in the same county where the property is situated.[3]

Cost – Approximately $42 (as of this writing).[4]

Additional Forms

Recording Cover Page – Grantors are often required to complete a cover page, which they can obtain from the County Recorder.

Declaration of Value Form – Must accompany the deed at recording to declare the property’s value and the applicable transfer tax.[5]