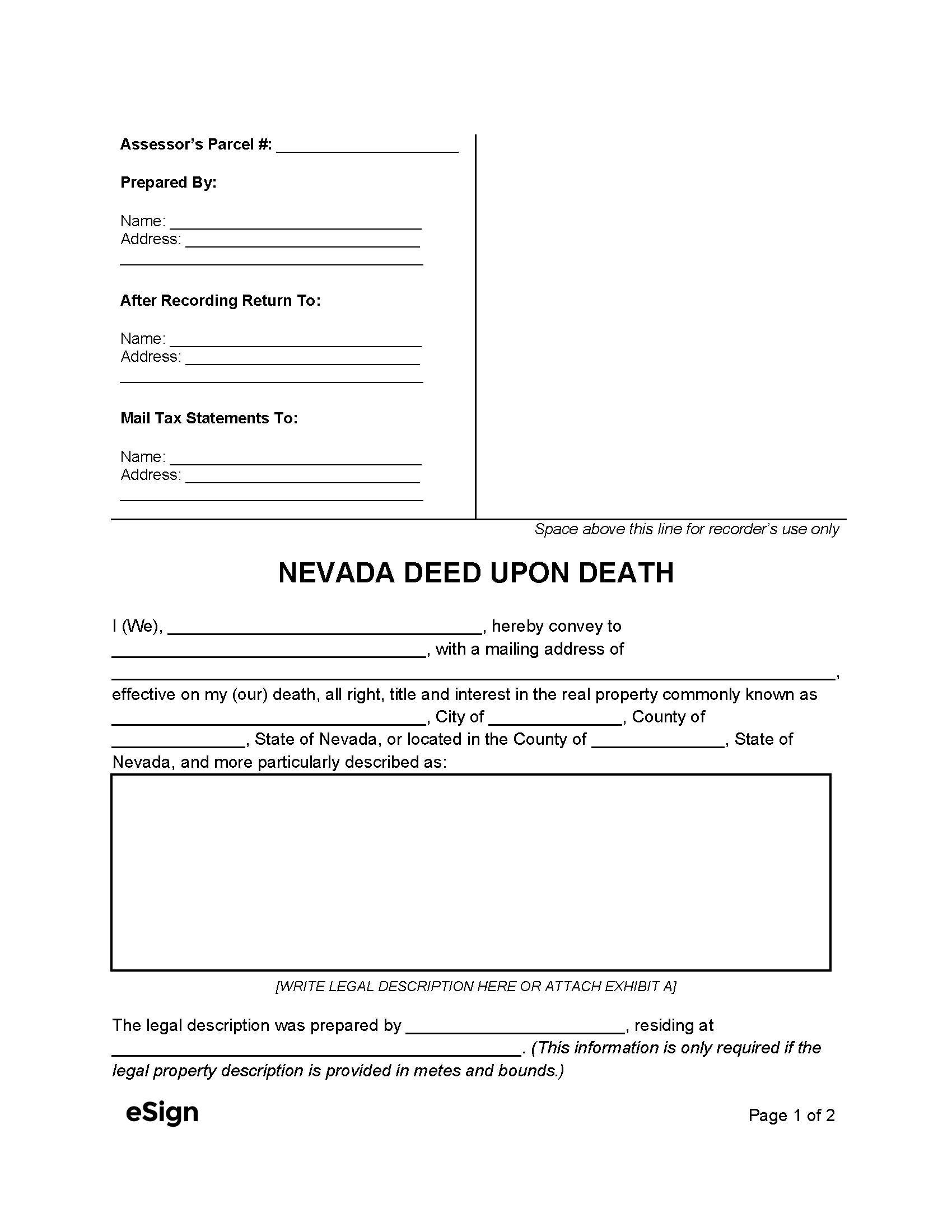

A Nevada deed upon death, also known as a “transfer on death” or “beneficiary” deed, is a legal tool used for transferring real estate to a beneficiary following the death of the grantor (the property owner). The document doesn’t transfer ownership until the grantor passes away, and the grantor retains full title rights throughout their lifetime. The grantor can also revoke the deed at any time prior to death. When the property owner dies, the beneficiary will receive title to the property without probate administration.

- Statutes: NRS Title 10, Ch. 111, §§ 111.105 – 111.235 & §§ 111.655 – 111.699

- Formatting: NRS 247.110, NRS 111.312

- Signing Requirements (NRS 111.105): Notary Public

- Where to Record (NRS 111.681): County Recorder

- Recording Fees (NRS 247.305): $25 + local fees (generally around $42 in total)

- Forms:

- Recording Cover Page: May be required to accommodate additional recording information; individuals can obtain a cover page from the County Recorder.

- Declaration of Value Form (NRS 375.060): Required by the County Recorder for each document evidencing the transfer of title.