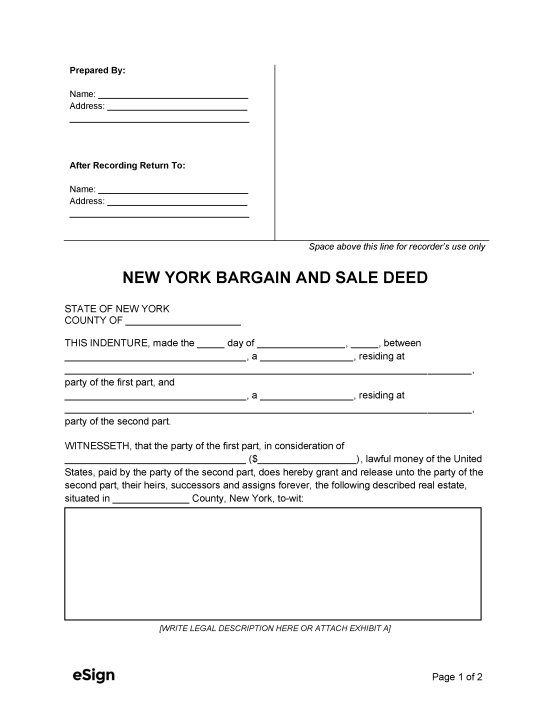

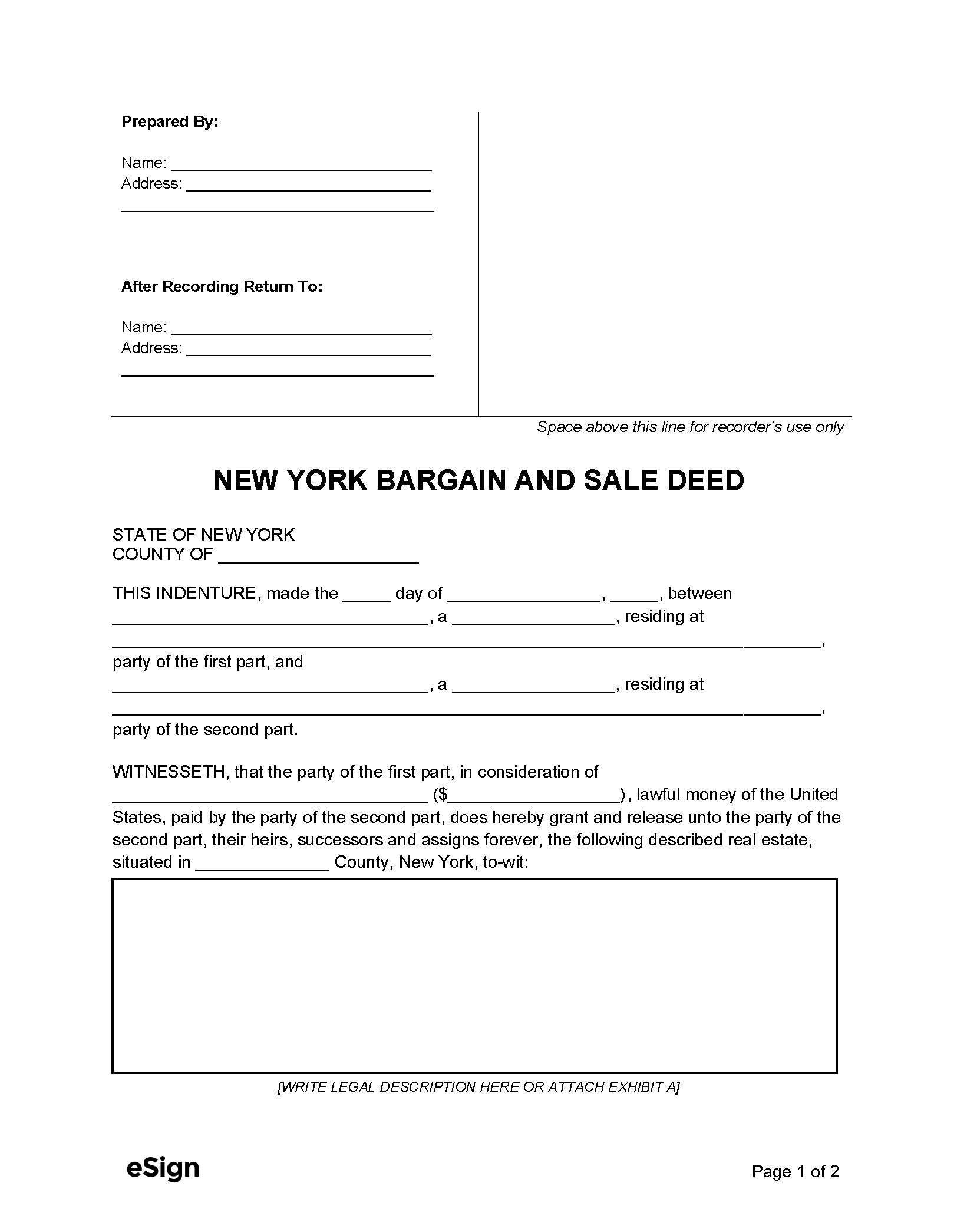

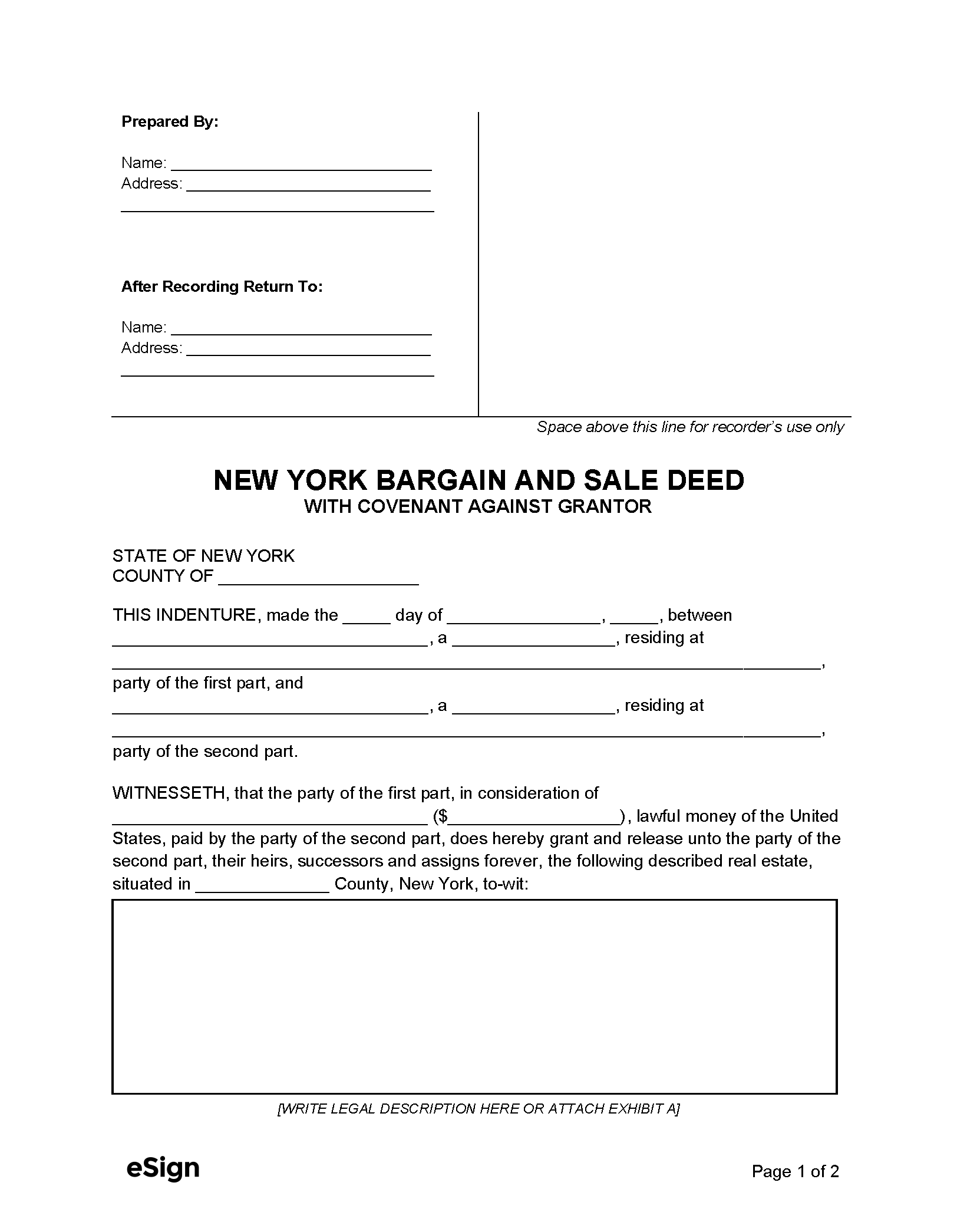

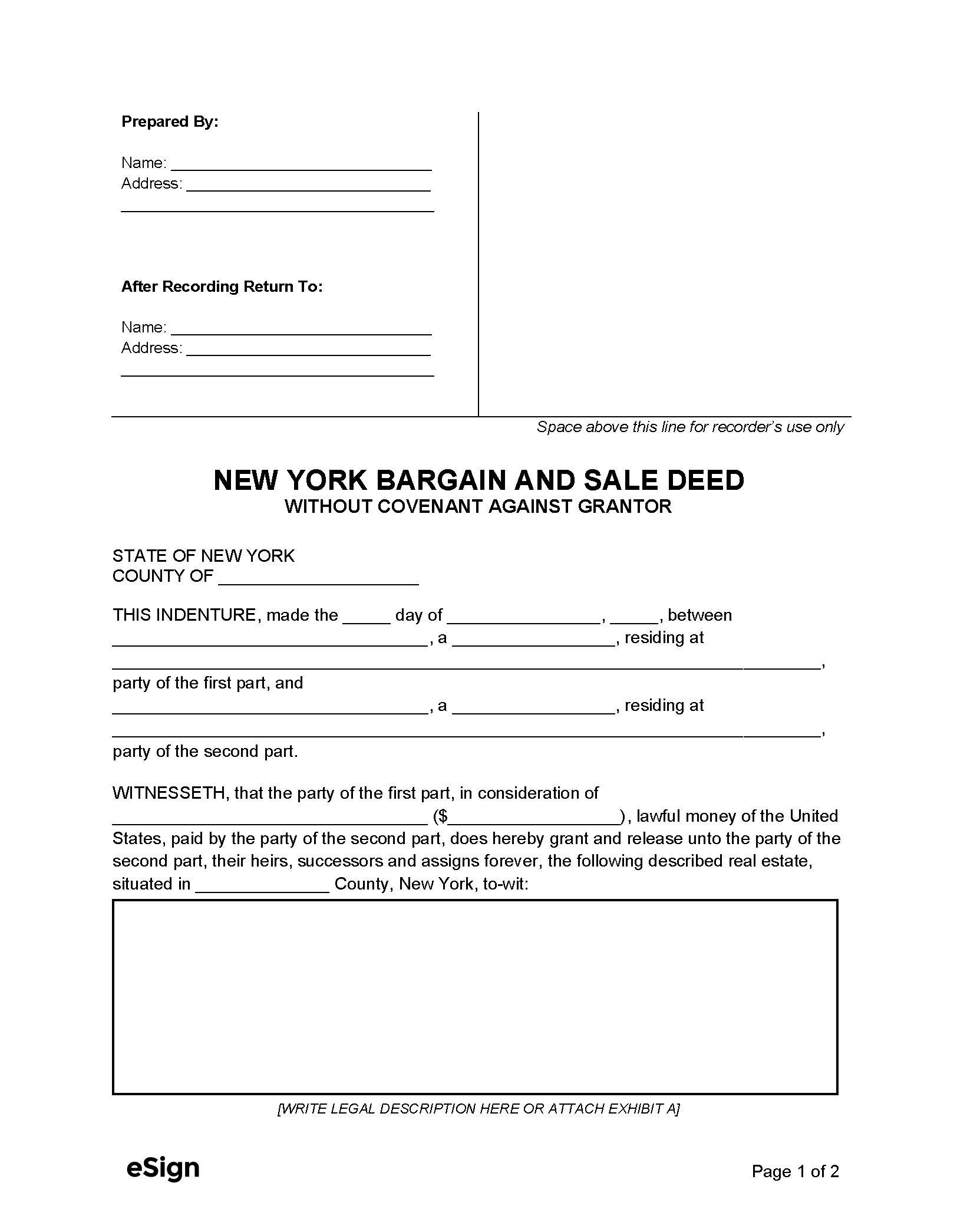

Forms by Type

Recording Requirements

- A notary must take the grantor’s acknowledgment of their signature.[1]

- Statewide formatting criteria are not specified in New York statutes. Documents may still be required to conform to standards set by the filer’s local office.

Deed recordings outside of NYC are done through the County Clerk.[2] Within NYC, deeds must be brought to the City Register or filed online (except in Staten Island; filings are submitted to the Richmont County Clerk in-person or online).[3]

The recording fees vary by county. Generally, counties charge around $45 for recording and $5 per page. It is recommended to contact the office to verify the exact cost before filing.

Additional Forms

Inside New York City

TP-584-NYC – Filed with the deed (or within 15 days) to report the transfer tax due.

RP-5217NYC – Outlines a transfer’s details and must be submitted at the time of filing.

Outside New York City

IT-2663 – Must be given with the deed to report and pay the transfer’s income tax.

RP-5217-PDF – Used to provide the clerk/register with the transaction’s information when filing a deed.

TP-584 – Provides details for calculating the transfer tax and must be included with the deed filing (or submitted within 15 days).