Where to Record

Deeds in New York City must be recorded at the City Register either in person or online. Deed recordings in Staten Island are carried out at the Richmond County Clerk’s office or online.

Properties located in other NYC boroughs may utilize online deed filings.

Foreclosure

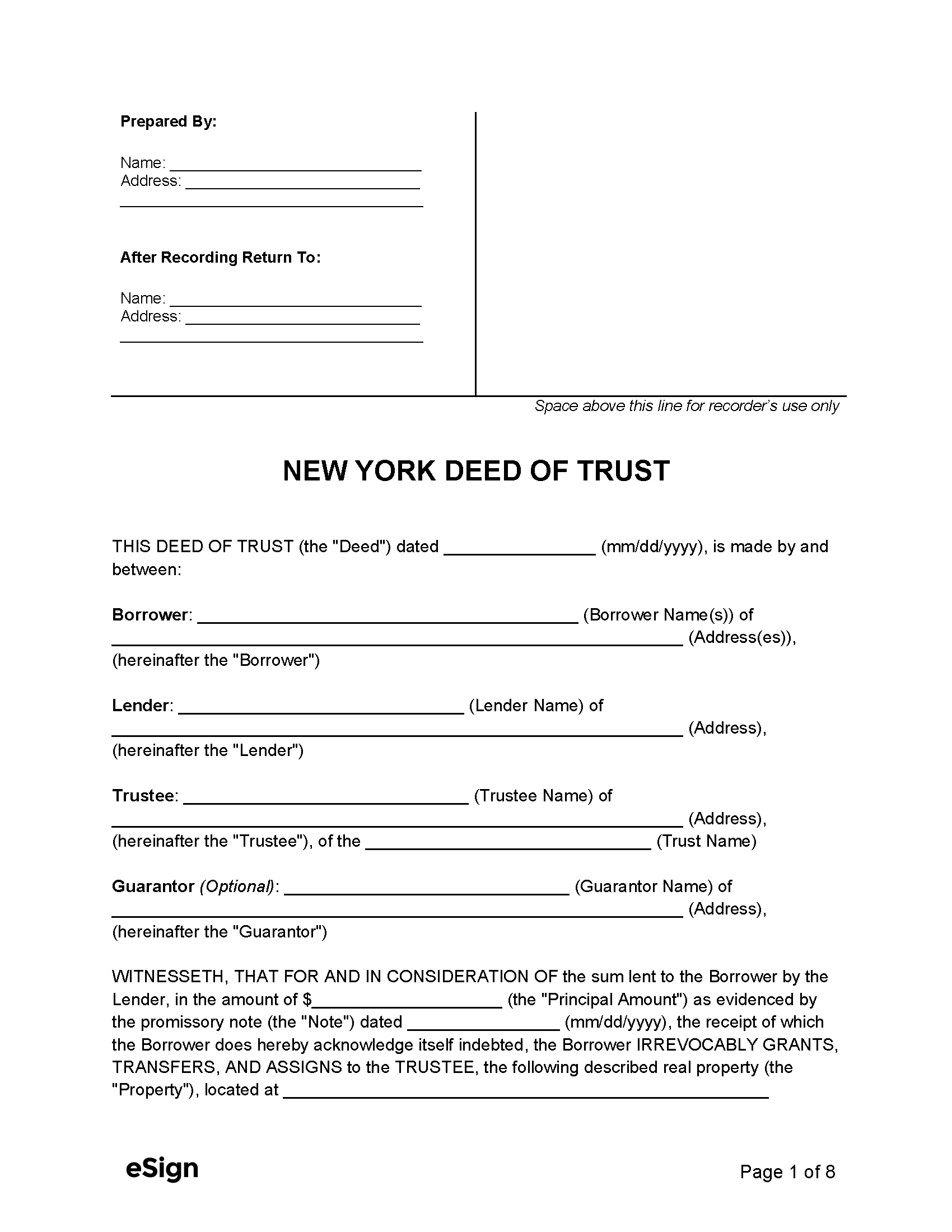

Deed of Trust (Preview)

Additional Forms

Inside New York City

TP-584-NYC – Details any mortgage tax due and any exceptions. Must be filed with the deed.

RP-5217NYC – Must be submitted with the deed to detail additional transaction information.

Outside New York City

RP-5217-PDF – Provides additional details to the clerk/register at recording.

TP-584 – Included with the deed and used for calculating the transfer tax.