Recording Details

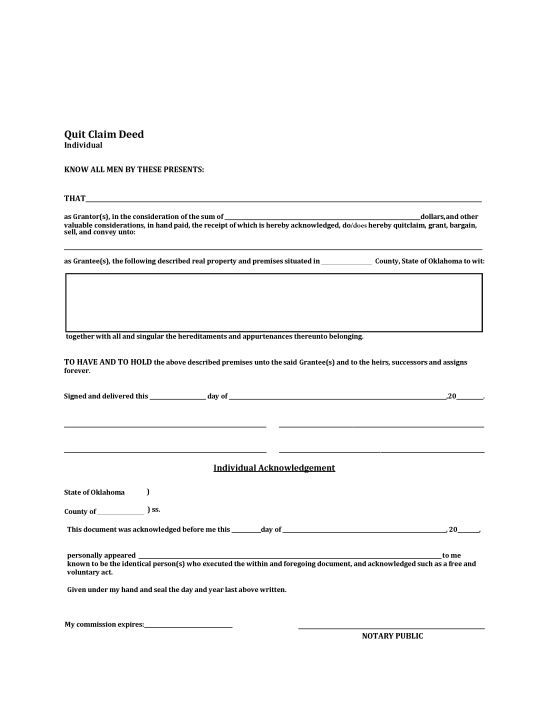

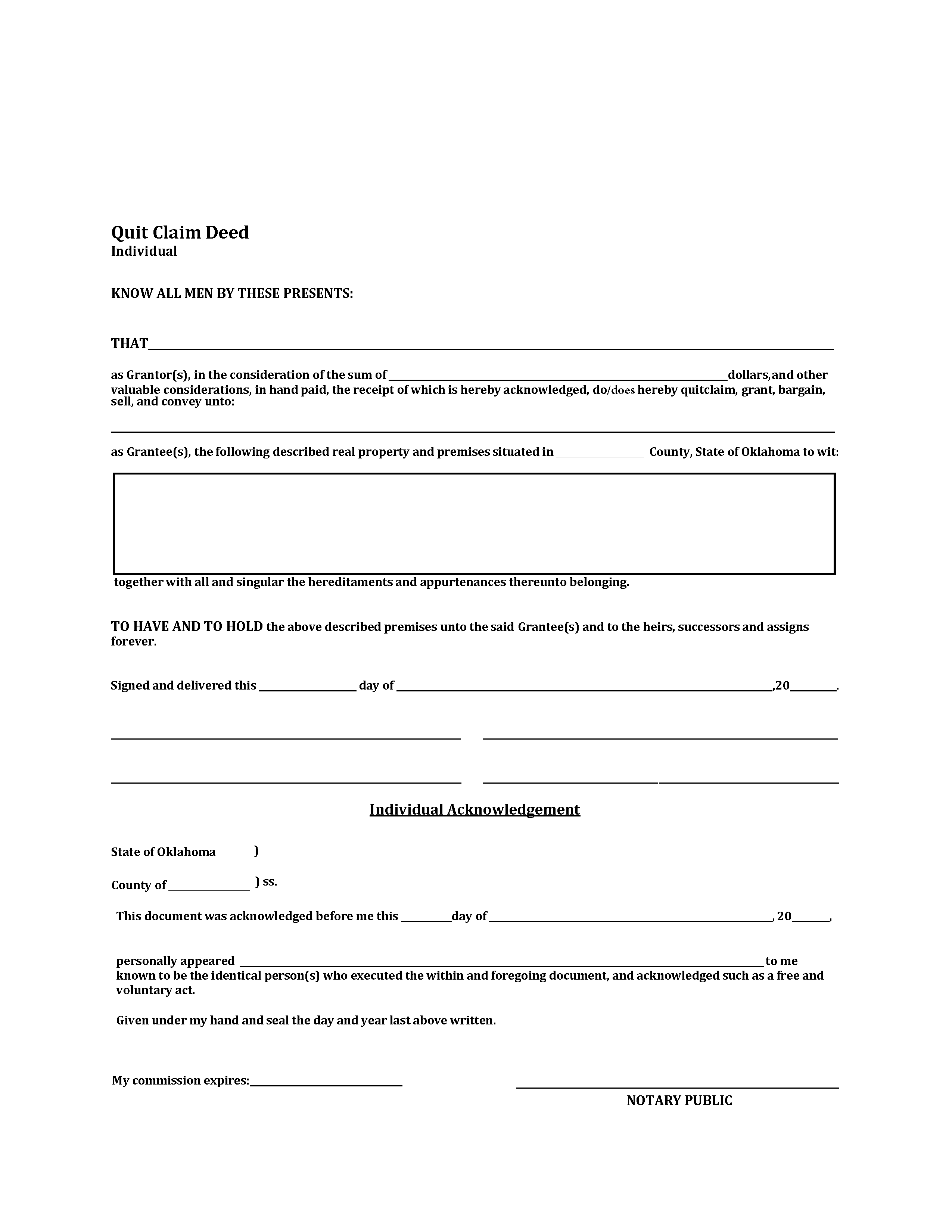

- Signing Requirements – The grantor and a notary public must sign the document. If the property is a homestead, the grantor’s spouse must also sign.[1]

- Where to Record – County Clerk’s Office[2]

- Recording Fees – $18 ($8 for the first page + $10 preservation fee); $2 for each additional page (as of this writing)[3]

Formatting Requirements

- Margins: Top margin of at least 2 inches, every other margin at least 1 inch.

- Spacing: Enough free space for the clerk to put documentary stamps, mortgage tax certification, and recording information.

- Paper: No larger than 8.5″ x 14″ and be xerographically reproducible.

- Ink: Dark enough to be reproduced.