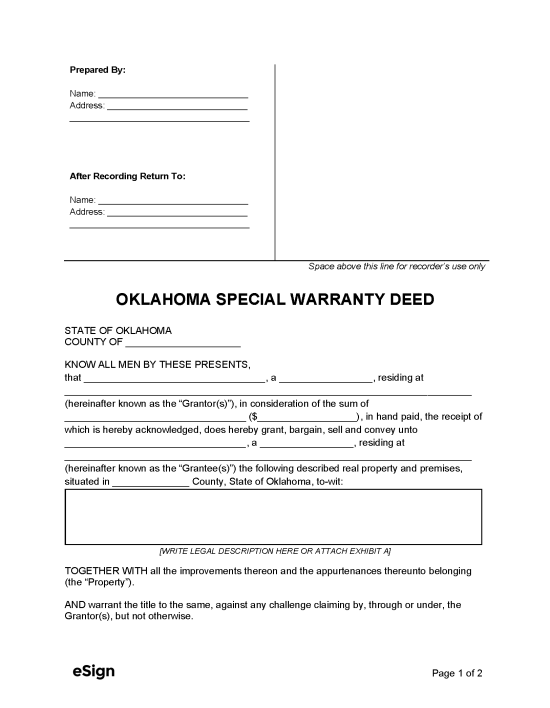

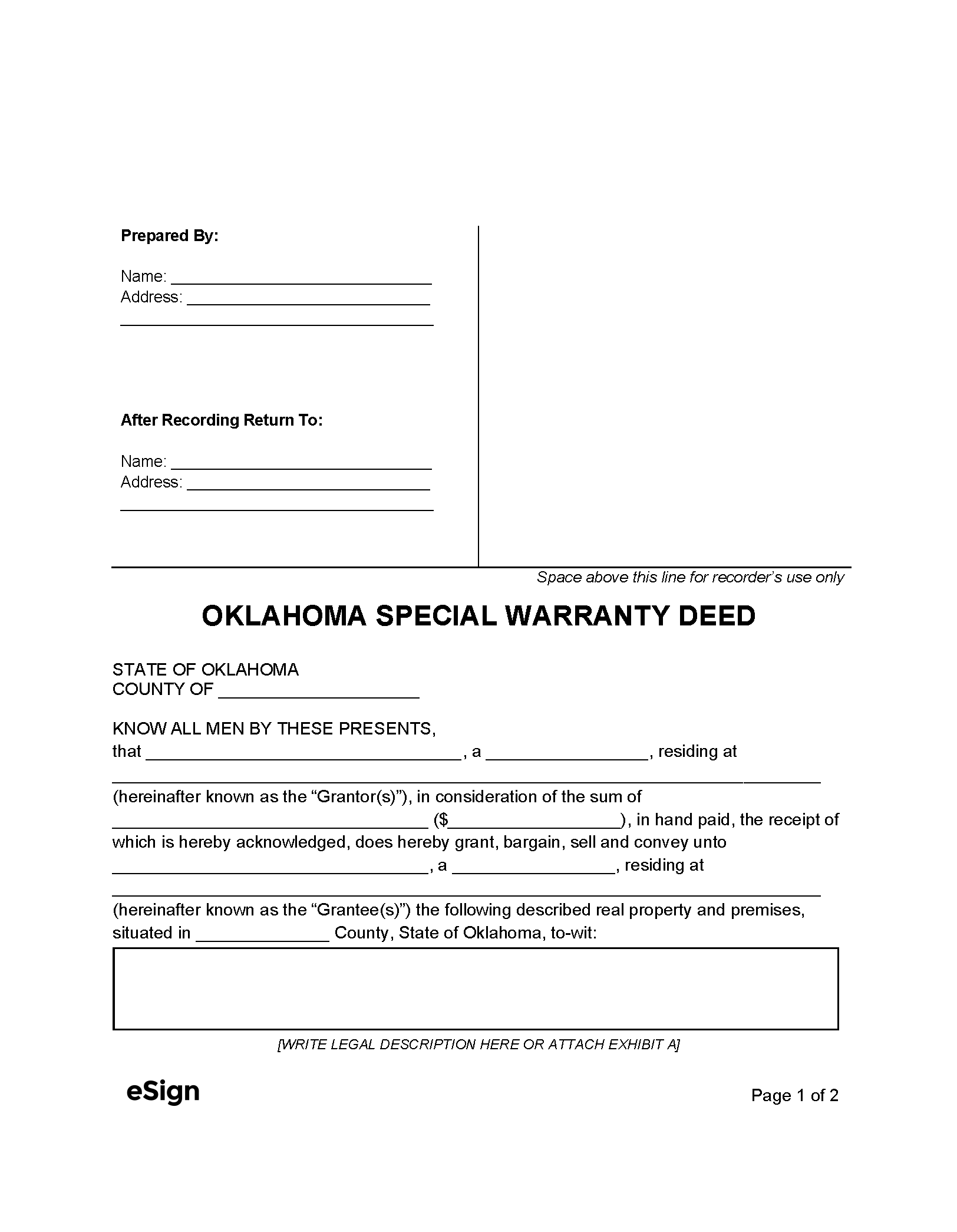

Recording Requirements

- The grantor must execute the deed (along with their spouse if the property qualifies as a homestead) and acknowledge their signature in front of a notary.[1]

- Documents cannot be larger than 8.5″ x 14″.

- At least a 2″ top margin and 1″ margin on the sides and bottom of pages.

- Dark ink must be used.[2]

Filers must submit deeds to the County Clerk for the county of the property being conveyed.[3] The filing fee at the time of this writing is $18 and $2 for each additional page.[4]