Recording Details

- Signing Requirements – The grantor must have their signature verified by a justice of the peace or a notarial officer.[1]

- Where to Record – County Recorder of Deeds[2]

- Recording Fees – Varies by county, approximately $80 to $100 (as of this writing).

Formatting Requirements

The following are the formatting requirements of the Pennsylvania Recorders of Deeds Association[3][4]:

- Margins: Three inches on the top of the first page, one inch on every other side and page.

- Font: Black recommended, no smaller than 10 point.

- Paper:

- 8.5 x 11 in.

- White

- 20 lb

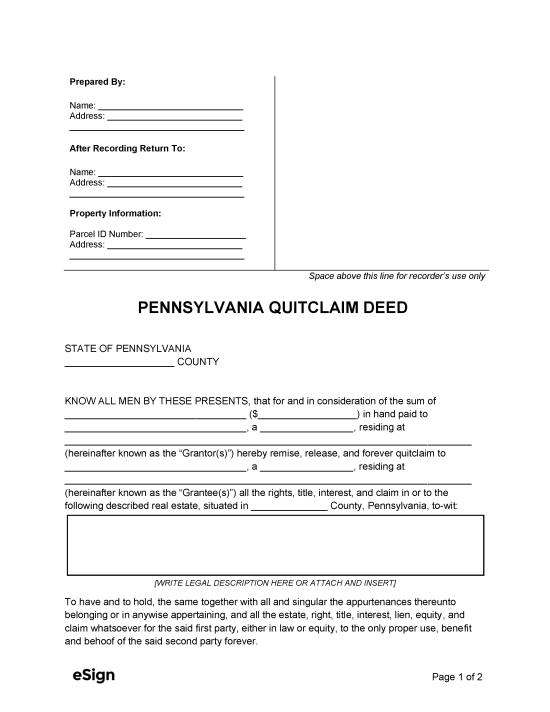

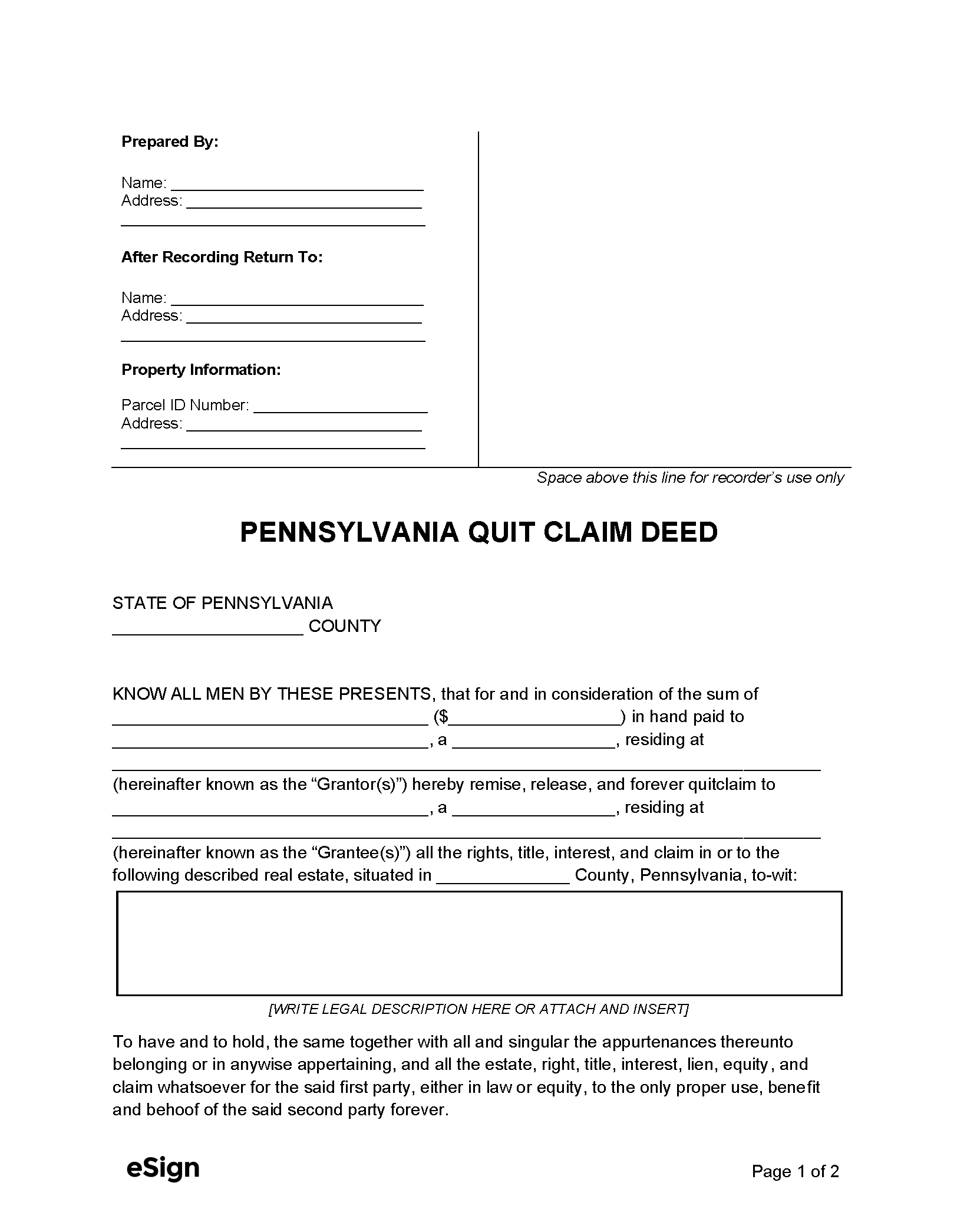

Quitclaim Deed (Preview)

Form REV-183 (Realty Transfer Tax Statement of Value) – Must be filed if the deed doesn’t have the full amount of consideration listed or an explanation of the real estate tax exemption.[5]

Bituminous Coal Notice – This notice is required in certain lands containing bituminous coal.[6]