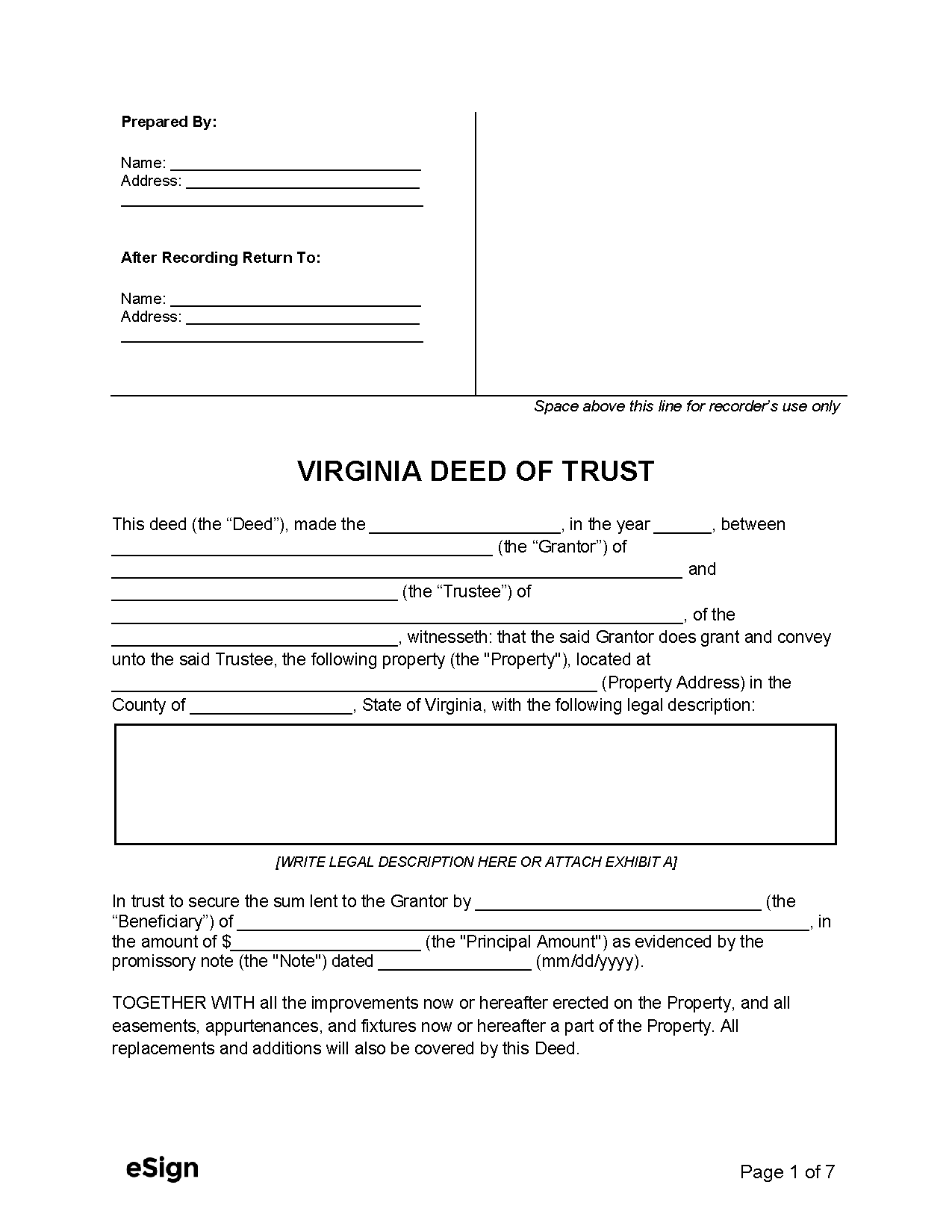

Formatting Requirements

The Circuit Court Clerk records trust deeds in Virginia.[1] The document must be notarized.[2]

While there are no state recording formatting requirements, users should check with their local Circuit Court Clerk for county-specific formatting standards.

Cover Sheet

In some counties, the deed must be accompanied by a cover sheet, which can be downloaded via the Virginia Circuit Court website.[3] Residents of Fairfax County must use their specific cover sheet.