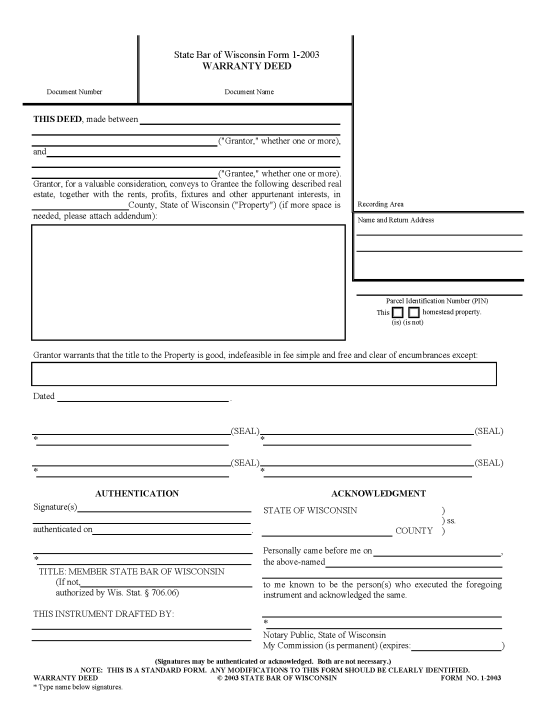

How to Format

Layout

- All pages must have margins of 0.5″ on the top and 0.25″ on the sides and bottom.

- Certain blank spaces must be present for recording information.

- The ink must be either black, blue, or red.

- The document must be on 8.5″ x 11″ (or 14″) 20lb white paper.[1]

Signatures

Warranty deeds must be signed by the grantor and their signature authenticated or acknowledged before a notary public or other officer.[2]

Recording

After execution, deeds should be recorded with the Register of Deeds in the county where the property is located.[3] The fee for recording is $30 as of this writing.[4]

Real Estate Transfer Return – Details of the property transfer must be provided by the grantor by completing a transfer return form (filed online through eRETR). A receipt will be supplied, which must be filed at the time of recording the deed.[5]