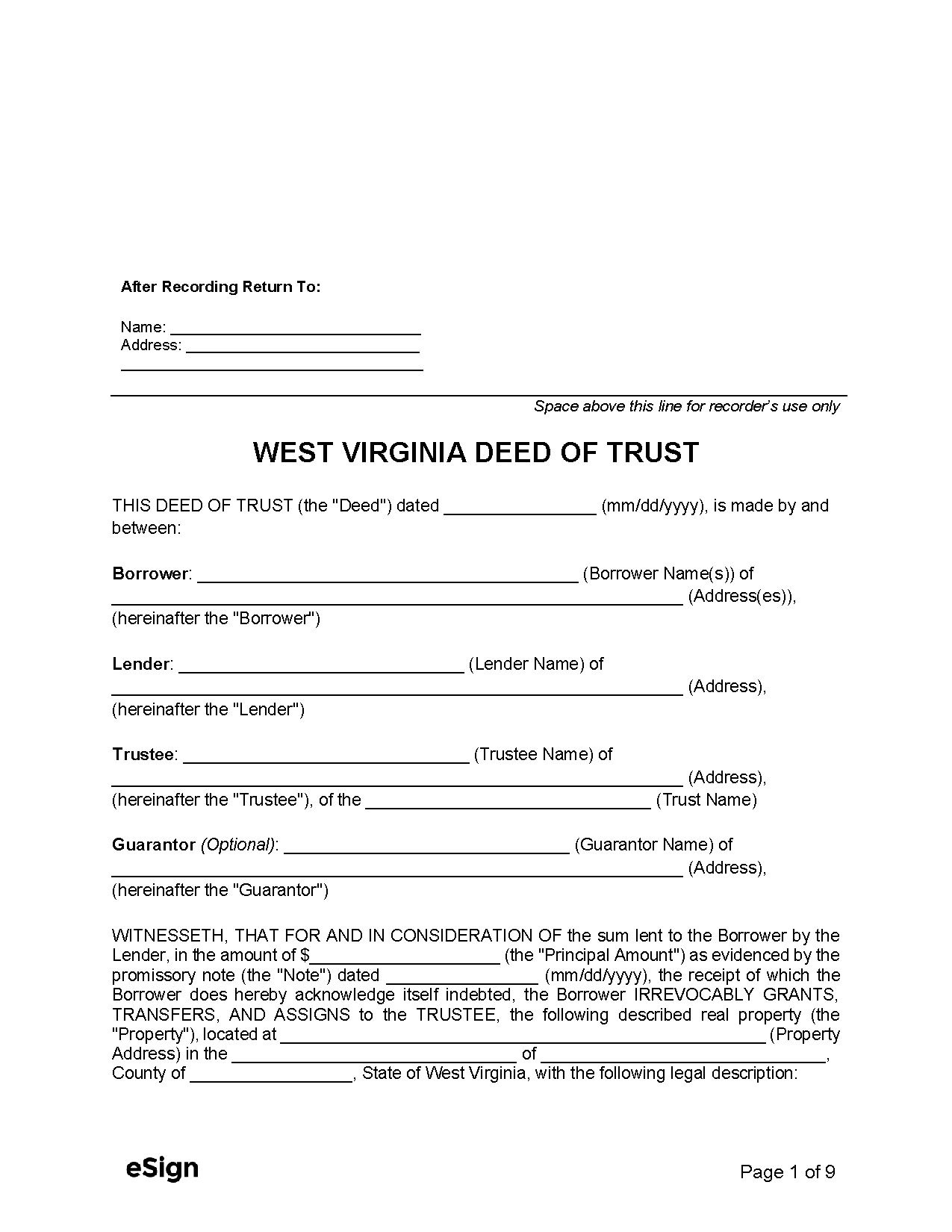

Formatting Requirements

Trust deeds are submitted to the County Clerk’s Office for recording.[1] The document must be notarized and follow certain formatting standards[2]:

- 8.5″ x 14″ paper

- 10pt font size

Users should check with their local office to see if their county has other formatting requirements.

Power of Sale Clause

One advantage for lenders using a deed of trust is that they contain a “power of sale” clause, which allows for a non-judicial foreclosure on a defaulted loan. This eliminates certain legal expenses and expedites the foreclosure process.