10-Day Demand Letters for Bad Checks

In several states, a person or business that issues a bad check must first be sent a demand letter for payment before the payee can file criminal charges or a civil action. The number of days’ notice required will depend on the state in which the transaction occurred because the notice period can range from 10 to 60 days.

States that use the 10-day demand letter for bad checks include:

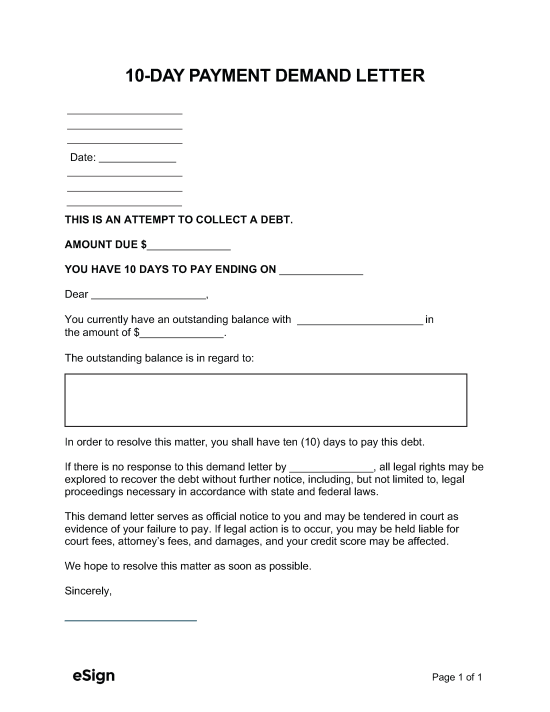

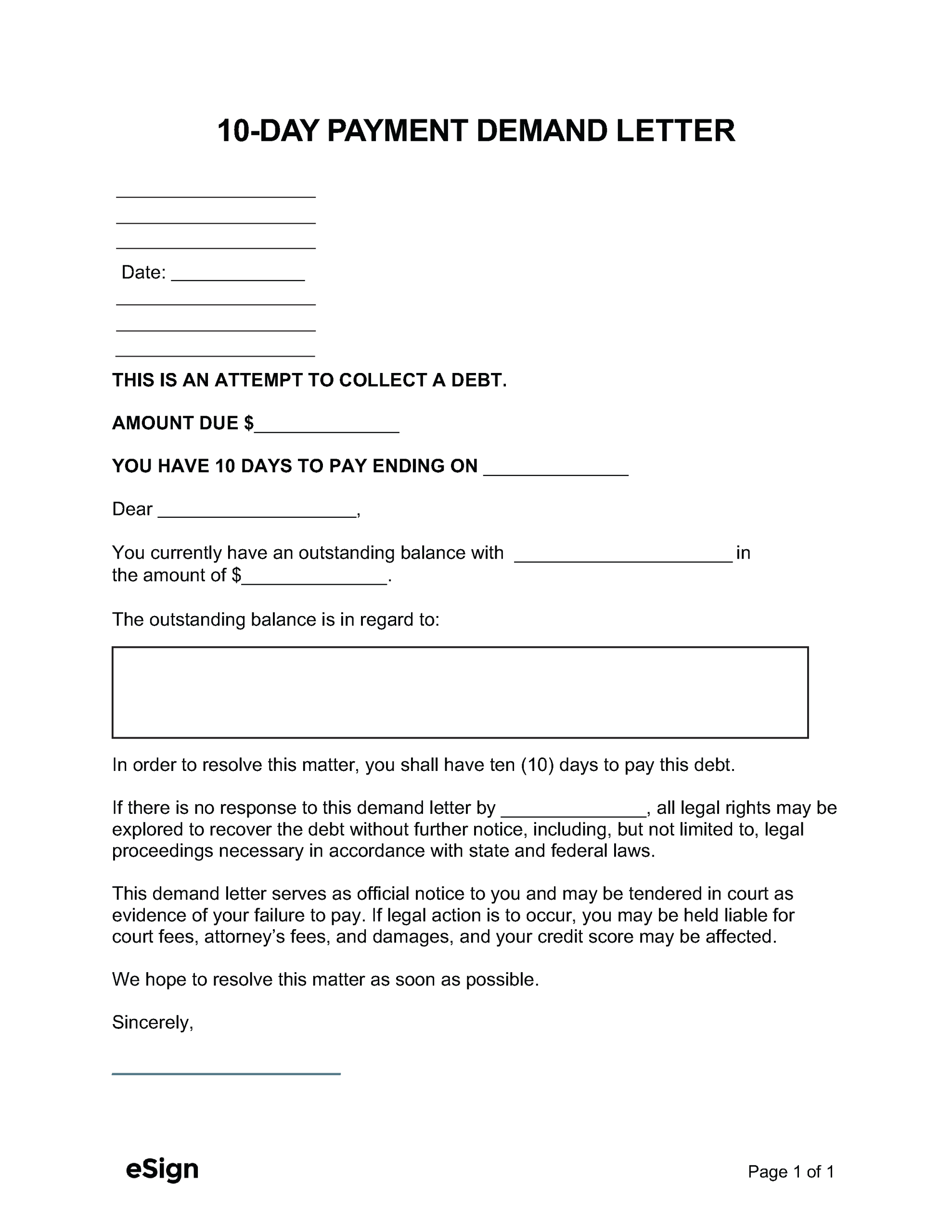

Sample

Download: PDF, Word (.docx), OpenDocument

[SENDER NAME]

[SENDER ADDRESS]

[SENDER CONTACT INFO]

Date: [DATE]

[RECIPIENT NAME]

[RECIPIENT ADDRESS]

THIS IS AN ATTEMPT TO COLLECT A DEBT.

AMOUNT DUE $[AMOUNT DUE]

YOU HAVE 10 DAYS TO PAY ENDING ON [DATE]

Dear [RECIPIENT NAME],

You currently have an outstanding balance with [NAME OF CREDITOR] in the amount of $[AMOUNT DUE].

The outstanding balance is in regard to: [REASON FOR DEBT].

In order to resolve this matter, you shall have ten (10) days to pay this debt.

If there is no response to this demand letter by [DATE], all legal rights may be explored to recover the debt without further notice, including, but not limited to, legal proceedings necessary in accordance with state and federal laws.

This demand letter serves as official notice to you and may be tendered in court as evidence of your failure to pay. If legal action is to occur, you may be held liable for court fees, attorney’s fees, and damages, and your credit score may be affected.

We hope to resolve this matter as soon as possible.

Sincerely,

______________________

[SENDER’S NAME]