At-Will Employment: Quick Overview

At-will employment is a work arrangement with no guaranteed job security. Employees can quit without cause, and often without notice (depending on the contract terms). Likewise, employers may end the job at any time, as long as it is not for unlawful reasons (see exceptions).

If an employer offers a specific job guarantee, such as keeping a position after reaching a sales target, the employment is no longer at-will and cannot be terminated without a valid reason.

At-Will vs. Contract Employment

At-Will Employment

- May be ended at any time by either party

- No fixed duration or end date

- Termination permitted for any lawful reason

- Employers can change wages without notice (within legal limits)

- Most common form of employment in the U.S.

Contract Employment

- Ends only according to the contract terms

- A fixed duration or end date is specified

- Termination requires cause (e.g., misconduct, breach of confidentiality)

- Compensation and benefits are set for the contract term

- Common for executive and specialized roles

Exceptions to “At-Will” Termination

Federal Exceptions

Under federal law, employers cannot terminate an employee for the following reasons:

- Discrimination – Firing someone because of race, sex, color, national origin, religion, or disability is illegal.[1]

- OSHA Retaliation – Employees cannot be punished or discharged for reporting or raising concerns about OSHA safety violations.[2]

- Lie Detectors – The Employee Polygraph Protection Act (EPPA) bars employers from firing employees who refuse to take a lie detector test.[3]

State Exceptions

There are three at-will exceptions enforced across various states[4]:

Public Policy – Employers cannot fire an employee for exercising state-protected rights, such as filing for workers’ compensation or refusing illegal work.

Not recognized in: AL, FL, GA, LA, ME, NE, NY, RI

Implied Contract – Employers cannot fire an employee who has been given a guarantee of job security, whether oral or written. Examples include promises of continued employment for good performance or handbook clauses allowing termination only for “just cause.”

Not recognized in: DE, FL, GA, IN, LA, MA, MS, MT, NC, PA, RI, TX, VA

Covenant of Good Faith – Prevents employers from firing employees for reasons made in bad faith or malice, such as firing an employee for attempting to collect commissions owed to them.

Recognized in: AL, AK, AZ, CA, DE, ID, MA, MT, NV, UT, WY

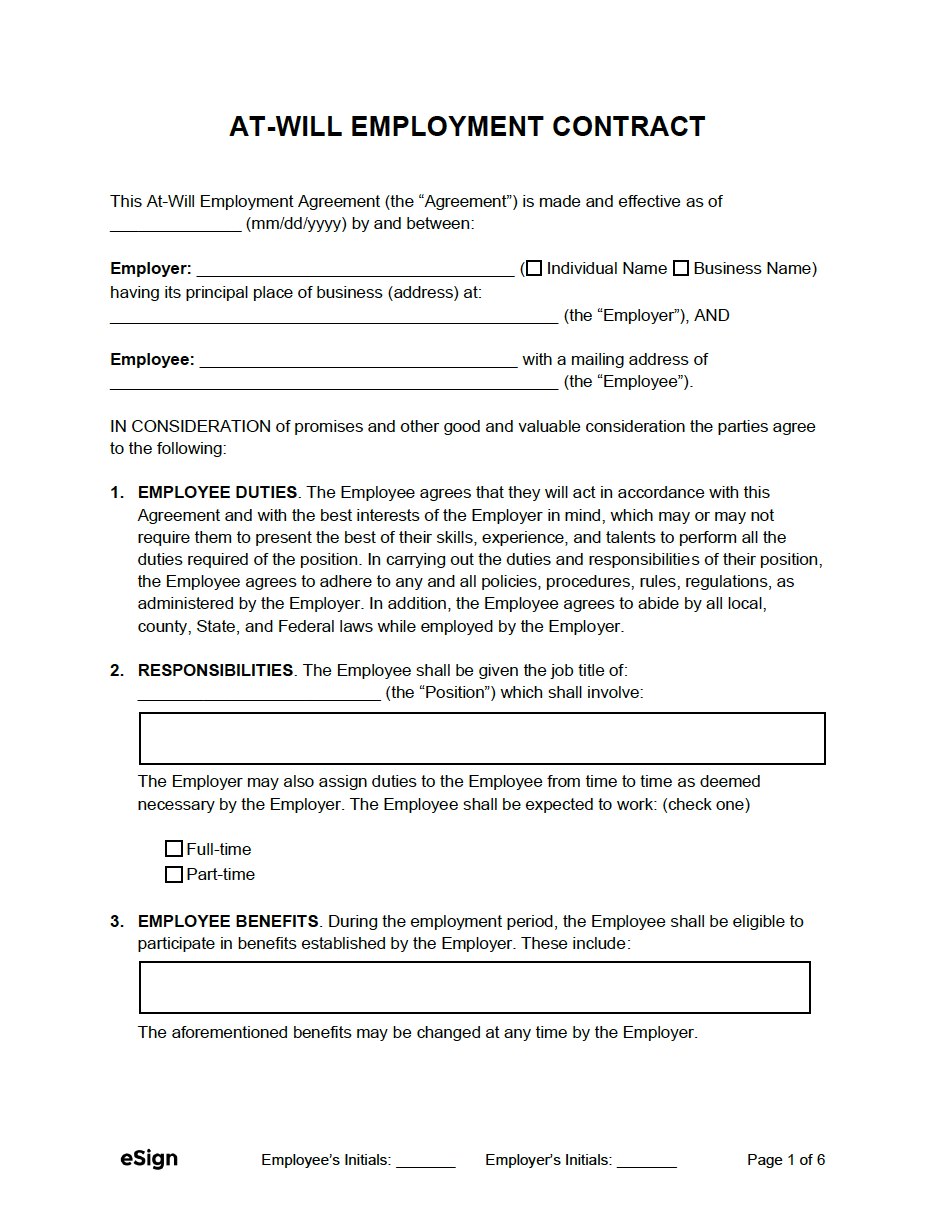

Sample

Employer: [EMPLOYER NAME], having its principal place of business at [EMPLOYER ADDRESS] (“Employer”), AND

Employee: [EMPLOYEE NAME], with a mailing address of [EMPLOYEE ADDRESS] (“Employee”).

IN CONSIDERATION of promises and other good and valuable consideration, the parties agree to the following:

1. EMPLOYEE DUTIES. The Employee agrees to perform all duties in the best interests of the Employer. The Employee will follow all Employer policies, procedures, rules, and regulations, and will comply with all applicable local, state, and federal laws while employed.

2. RESPONSIBILITIES. The Employee shall be given the job title of [POSITION] (“Position”), which is a ☐ full-time ☐ part-time position that shall involve: [DESCRIBE DUTIES].

3. EMPLOYEE BENEFITS. During employment, the Employee shall be eligible to participate in benefits established by the Employer. These benefits include: [DESCRIBE BENEFITS].

4. AT-WILL. The Employer agrees to hire the Employee “At-Will,” which means either party may terminate this Agreement at any time.

5. PAY. As compensation for the services provided, the Employee shall be paid $[PAY] ☐ per hour ☐ salary on an annual basis (“Compensation”). The Compensation is a gross amount subject to all local, state, federal, and other taxes and deductions as prescribed by law. Payment shall be distributed on a [FREQUENCY] basis.

6. OUT-OF-POCKET EXPENSES. The Employer agrees to reimburse the Employee for any expenses that are incurred, including: [LIST EXPENSES].

7. TRIAL PERIOD. Other than certain benefits prescribed by law, the Employee will not be eligible for benefits, vacation time, or personal leave until after the first [#] days of employment (“Trial Period”).

8. VACATION TIME. After the Trial Period is complete, the Employee is entitled to [#] days off per year. The Employee must give notice before scheduling their vacation. Any unused vacation time shall be: [DESCRIBE (E.G., CONVERTED TO CASH, FORFEITED].

9. PERSONAL LEAVE. After the Trial Period, the Employee shall be eligible for [#] days of ☐ paid ☐ unpaid time off per year for personal or medical issues. Any unused personal leave shall be: [DESCRIBE (E.G., CONVERTED TO CASH, FORFEITED].

If, for any reason, the Employee depletes their allotted number of days of personal leave in a given year, the Employee ☐ MAY ☐ MAY NOT be able to use any remaining vacation time.

10. FEDERAL HOLIDAYS. The Employee shall be entitled to [#] federal holidays per calendar year, as designated by the Employer and subject to change annually. If the Employee requests a federal holiday off, the Employer may decide whether the absence is permitted and whether it will be charged to personal leave or vacation time.

11. DISABILITY. If the Employee cannot perform their duties due to physical or mental disability, the Employer may terminate this Agreement by giving the Employee [#] days’ written notice.

12. CONFIDENTIALITY. The Employee agrees to keep all proprietary information of the Employer (“Confidential Information”) strictly confidential, including but not limited to business plans, products, services, processes, trade secrets, intellectual property, customer data, pricing, and financial information. Any direct or indirect disclosure of Confidential Information may result in litigation, equitable relief, and recovery of losses, damages, and attorney’s fees.

This obligation shall continue for [#] months after employment ends (“Confidentiality Term”), subject to the maximum period allowed by applicable law.

13. COMPLIANCE. The Employee agrees to follow this Agreement, Employer policies, and all applicable laws.

14. AMENDMENTS. This Agreement may be modified or amended if any such amendment is attached and authorized by all parties.

15. SEVERABILITY. If any part of this Agreement is found unenforceable or invalid, the remaining provisions shall remain binding. Any affected provision will still be enforced to the maximum extent permitted by law.

16. WAIVER OF CONTRACTUAL RIGHT. If the Employer or Employee fails to enforce a provision or section of this Agreement, it shall not be determined as a waiver or limitation. Each party shall retain the right to enforce and compel the compliance of this Agreement to its fullest extent.

17. GOVERNING LAW. This Agreement shall be governed under the laws of the State of [STATE].

18. ENTIRE AGREEMENT. This Agreement, along with any attachments or addendums, represents the entire agreement between the parties. Therefore, this Agreement supersedes any prior agreements, promises, conditions, or understandings between the Employer and Employee.

19. SIGNATURES. IN WITNESS WHEREOF, this Agreement was signed by the parties under the hands of their duly authorized officers and made effective as of the undersigned date.

Employer Signature: ____________________ Date: [MM/DD/YYYY]

Print Name: [PRINTED NAME]

Employee Signature: ____________________ Date: [MM/DD/YYYY]

Print Name: [PRINTED NAME]