What It Should Include (7)

- Scope of Work

- Project Description

- Timeline

- Costs

- Contract Length

- Compensation/Payment Terms

- Expenses

- Permits and Licensing Requirements

- Liability Insurance Obligations

- Termination Procedures

Retainage

Retainage is a percentage of payment the client withholds to ensure the contractor fulfills their duties correctly. It gives the client security should issues develop and offers the contractor a financial incentive to finish the project on schedule.

Retainage rates typically range from 5% to 10% of the total contract price, although exact amounts will vary depending on state law and whether the project is a private, state, or federal contract.

How to Pay (4)

1. Lump Sum (fixed-price)

With a lump sum contract, the contractor undertakes a construction project for a predetermined price that covers all service, material, and labor costs. The fixed amount cannot be modified to compensate for any setbacks or overages the contractor might face.

If the actual construction costs are less than the initial estimate, the contractor will profit. However, if the project goes over budget, the contractor could lose money.

2. Unit Price

A unit price contract is when a contractor charges a fixed amount for each segment, or “unit,” of work, and the client pays only for the units they receive.

If a project’s scope evolves as it’s being carried out, the contractor will add or subtract units from the final bill. This pricing structure benefits jobs where the total quantity of work is uncertain.

3. Cost-Plus

Cost-plus or cost-reimbursement contracts require the client to pay for all expenses plus an amount designated for the contractor’s profit.

The additional amount is typically a fixed fee or a percentage of the total contract price. While potentially lucrative for contractors, they must provide comprehensive estimated projected expenses, and the client must agree to the terms beforehand.

4. Time and Materials

A time and materials contract is an agreement where the client pays for each hour of labor plus the cost of materials, with contractors typically adding a 15% to 35% markup on materials used.

Some contracts will include a “not-to-exceed” clause, which limits the maximum billable amount.

Sample

Download: PDF, Word (.docx), OpenDocument

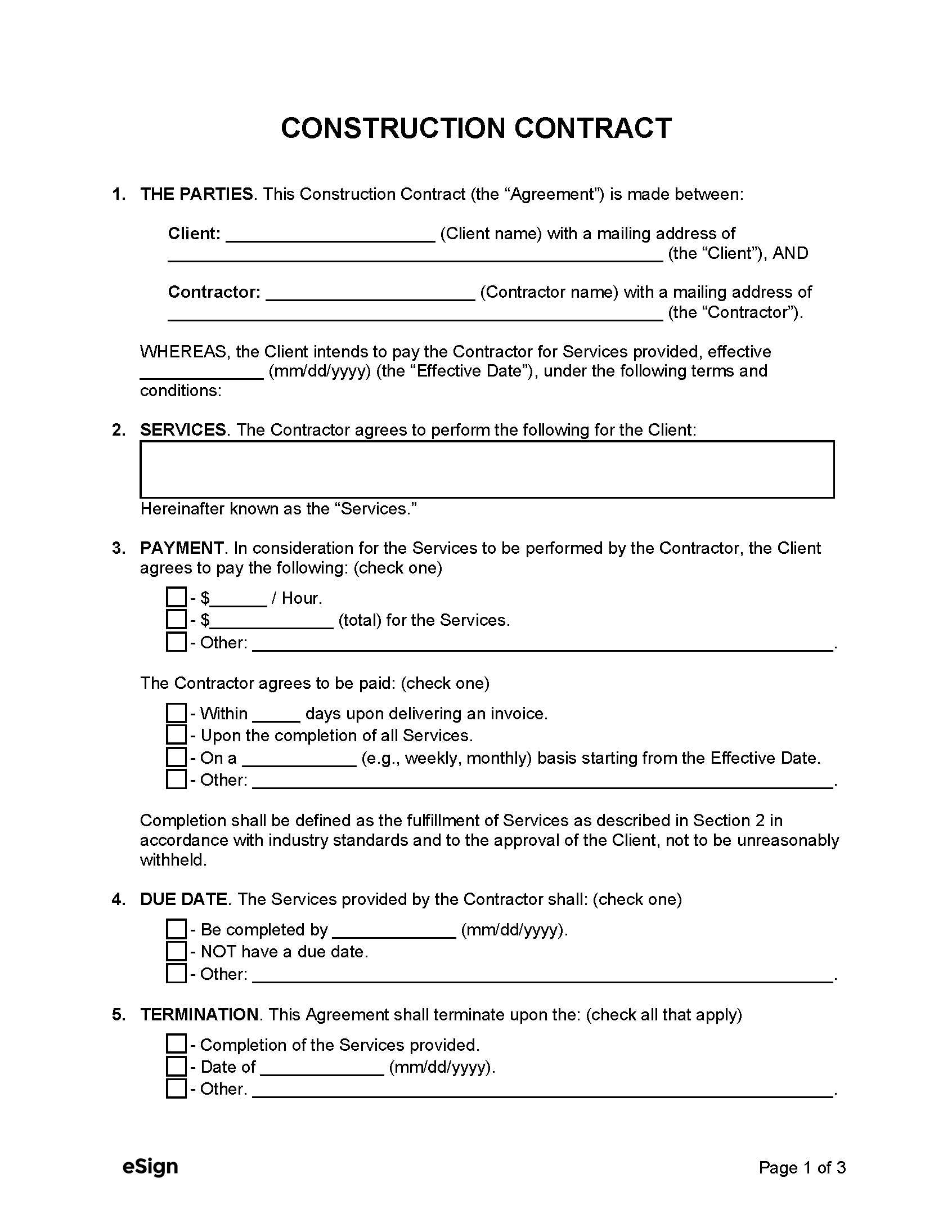

CONSTRUCTION CONTRACT

1. THE PARTIES. This Construction Contract (the “Agreement”) is made between:

Client: [CLIENT NAME], with a mailing address of [CLIENT ADDRESS] (the “Client”), AND

Contractor: [CONTRACTOR NAME], with a mailing address of [CONTRACTOR ADDRESS] (the “Contractor”).

WHEREAS, the Client intends to pay the Contractor for Services provided, effective [MM/DD/YYYY], under the following terms and conditions:

2. SERVICES. The Contractor agrees to perform the following for the Client: [LIST ALL SERVICE(S)]. Hereinafter known as the “Services.”

3. PAYMENT. In consideration for the Services to be performed by the Contractor, the Client agrees to pay $[AMOUNT]. The Contractor agrees to be paid in the following manner: [DESCRIBE PAYMENT METHOD/FREQUENCY].

4. START & END DATES. The Contractor shall be permitted to begin the Services on [MM/DD/YYYY] and shall complete the Services in a reasonable time period in accordance with industry standards.

5. TERMINATION. This Agreement shall terminate upon the completion of the Services provided.

6. OPTION TO TERMINATE. The Client and the Contractor shall each have the option to terminate this Agreement at any time by providing [#] days’ written notice.

7. EXPENSES. The Contractor shall be responsible for all expenses related to providing the Services under this Agreement unless otherwise stated here: [REIMBURSABLE EXPENSES (IF ANY)].

8. INSURANCE. The Contractor agrees to bear all responsibility for the actions related to themselves and their employees or personnel under this Agreement. In addition, the Contractor agrees to obtain comprehensive liability insurance coverage in case of bodily or personal injury, property damage, contractual liability, and cross-liability.

9. CONTRACTOR STATUS. The Contractor, under the Internal Revenue Service (IRS) code, is an independent contractor, and neither the Contractor nor the Contractor’s employees or contract personnel are or shall be deemed to be the Client’s employees.

10. ASSIGNMENT. Neither the Client nor the Contractor may assign this Agreement without the express written consent of the other party.

11. REQUIRED LICENSES. All parties to this Agreement, including other contractors and the parties’ employees and agents, must be licensed per state laws governing their trade.

12. INDEMNIFICATION. The Contractor shall indemnify and hold the Client harmless from any loss or liability from performing the Services under this Agreement.

13. GOVERNING LAW. This Agreement shall be governed by the laws of the State of [STATE].

14. SEVERABILITY. This Agreement shall remain in effect if a section or provision is unenforceable or invalid.

15. ADDITIONAL TERMS & CONDITIONS. [ADDITIONAL TERMS].

IN WITNESS WHEREOF, the parties have indicated their acceptance of the terms of this Agreement by their signatures below on the dates indicated.

Client’s Signature: _________________ Date: [MM/DD/YYYY]

Print Name: [CLIENT NAME]

Contractor’s Signature: __________________________ Date: [MM/DD/YYYY]

Print Name: [CONTRACTOR NAME]

Company: [COMPANY NAME (IF APPLICABLE)]