Work Agreements: By Type (3)

Sample

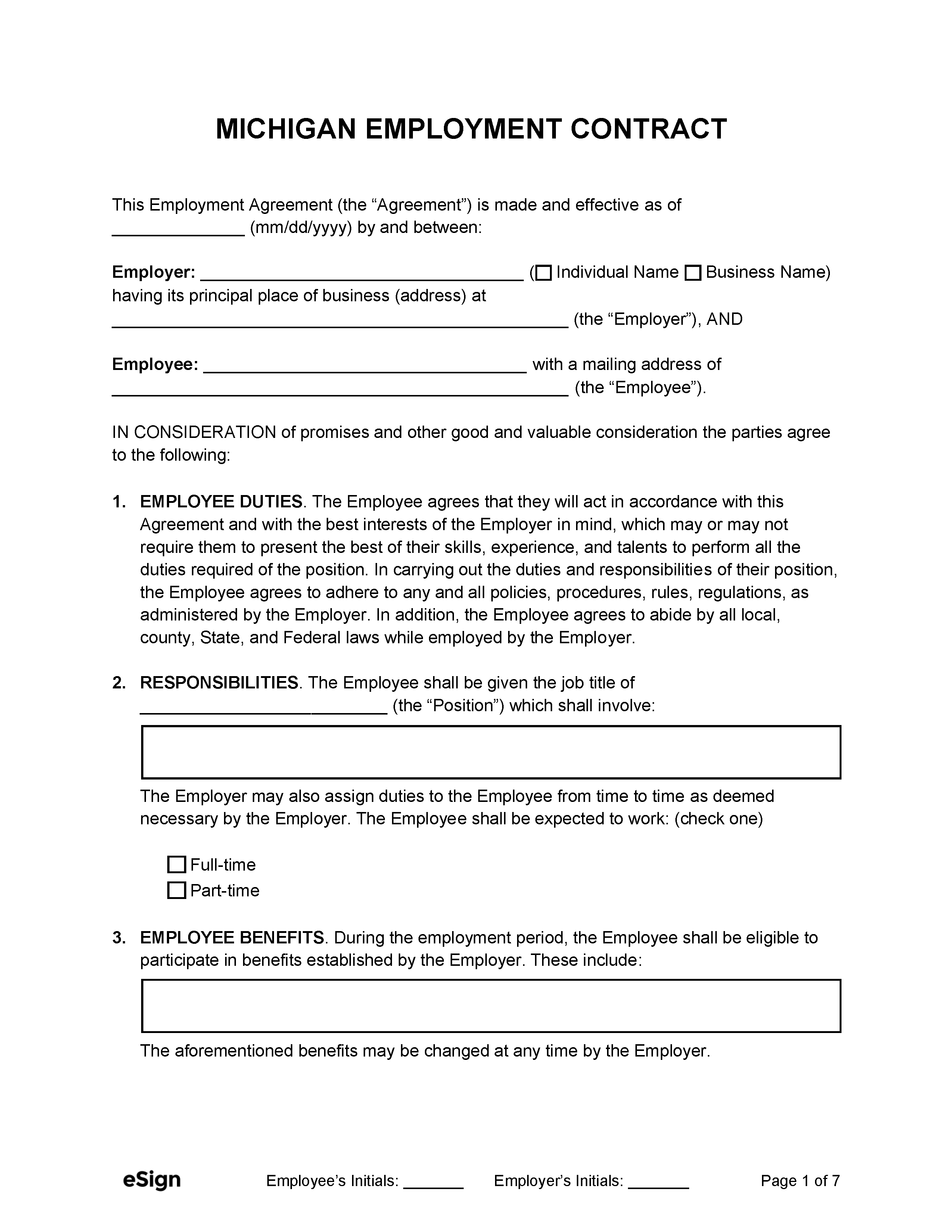

MICHIGAN EMPLOYMENT AGREEMENT

This Employment Agreement (the “Agreement”) is made and effective as of [MM/DD/YYYY] by and between:

Employer: [EMPLOYER NAME] having its principal place of business at [EMPLOYER ADDRESS] (the “Employer”), AND

Employee: [EMPLOYEE NAME] with a mailing address of [EMPLOYEE ADDRESS] (the “Employee”).

IN CONSIDERATION of promises and other good and valuable consideration the parties agree to the following:

1. EMPLOYEE RESPONSIBILITIES. The Employee shall be given the job title of [POSITION] (the “Position”) which shall involve: [DESCRIBE EMPLOYEE POSITION].

2. PAY. As compensation for the services provided, the Employee shall be paid $[PAY] ☐ per hour ☐ salary on an annual basis (the “Compensation”).

3. EMPLOYMENT PERIOD. The Employer agrees to hire the Employee: (check one)

☐ At-Will Employment – Either the Employer or the Employee may terminate this Agreement at any time, with or without cause, by providing [#] days’ written notice.

☐ Fixed-Term Employment – The employment shall begin on [MM/DD/YYYY] and end on [MM/DD/YYYY], unless terminated earlier by either party with [#] days’ written notice.

4. EMPLOYEE BENEFITS. During the employment period, the Employee shall be eligible to participate in the following benefits: [DESCRIBE EMPLOYEE BENEFITS].

5. TIME OFF. Employee is entitled to the following time off:

- Vacation: [#] days a year.

- Personal leave: [#] days a year.

- Holidays: [LIST HOLIDAYS].

6. CONFIDENTIALITY. The Employee agrees not to disclose or misuse the Employer’s proprietary or confidential information without prior written consent, except as needed to perform the Position.

7. SEVERABILITY. This Agreement shall remain in effect in the event a section or provision is unenforceable or invalid.

8. GOVERNING LAW. This Agreement shall be governed under the laws in the State of Michigan.

9. ENTIRE AGREEMENT. This Agreement, along with any attachments or addendums, represents the entire agreement between the parties.

IN WITNESS WHEREOF, the Parties hereto agree to the above terms and have caused this Agreement to be executed in their names.

Employer Signature: _________________________________ Date: [MM/DD/YYYY]

Print Name: [PRINTED NAME] Title: [TITLE]

Employee Signature: _________________________________ Date: [MM/DD/YYYY]

Print Name: [PRINTED NAME]