Bookkeeping vs. Accounting

Bookkeeping is the process of documenting an individual or business’s financial transactions. A bookkeeper is responsible for maintaining records, which an accountant uses to create financial statements, tax reports, and audits.

Sample

Download: PDF, Word (.docx), OpenDocument

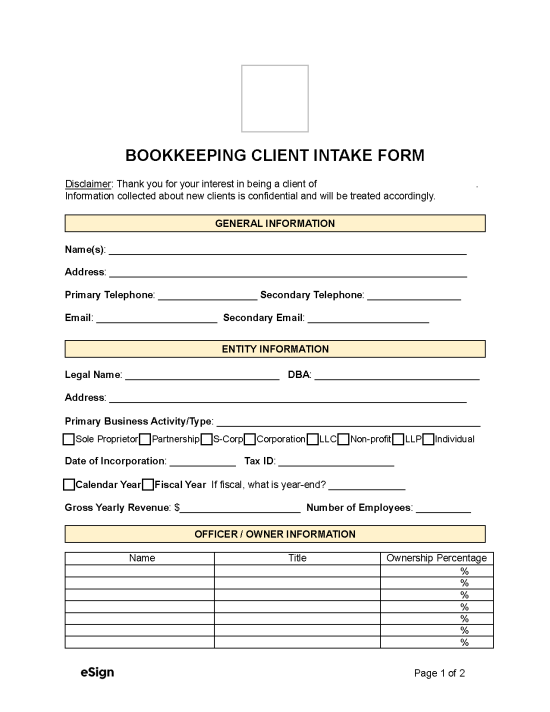

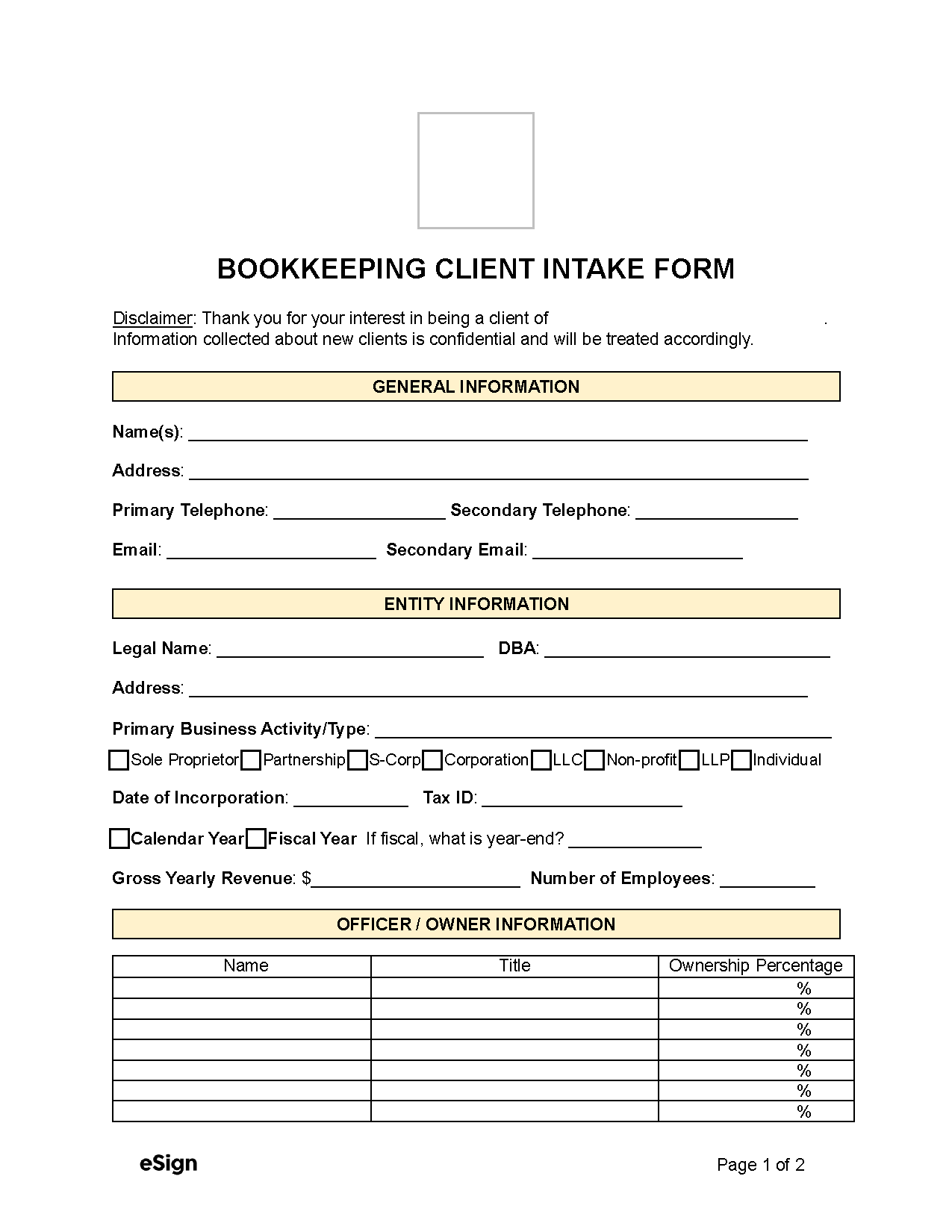

BOOKKEEPING CLIENT INTAKE FORM

DISCLAIMER: Thank you for your interest in being a client of __________________. Information collected about new clients is confidential and will be treated accordingly.

| GENERAL INFORMATION |

Name: __________________ Address: ____________________

Phone: ____________________ Email: ____________________

| ENTITY INFORMATION |

Legal Name: ____________________ Address: ____________________

Primary Business Activity/Type: ______________________________

☐ Sole Proprietor ☐ Partnership ☐ S-Corp ☐ Corporation ☐ LLC ☐ Individual

Date of Incorporation: ___________ Tax ID: _______________________

☐ Calendar Year ☐ Fiscal Year -If fiscal, what is year-end? ______________

Gross Yearly Revenue: $________________ Number of Employees: _____

| OFFICER / OWNER INFORMATION |

Name Title Ownership Percentage

________________ __________________ _________%

________________ __________________ _________%

________________ __________________ _________%

| CPA / TAX ACCOUNTANT INFORMATION |

Name: ____________________________ Telephone: ________________

Address: __________________________

| INTAKE ASSESSMENT |

My financial statements are current.

☐ 0 ☐ 1 ☐ 2 ☐ 3 ☐ 4 ☐ 5

I understand my financial statements.

☐ 0 ☐ 1 ☐ 2 ☐ 3 ☐ 4 ☐ 5

I use KPIs to measure my business effectiveness in various areas.

☐ 0 ☐ 1 ☐ 2 ☐ 3 ☐ 4 ☐ 5

My cashflow is good and easily meets business demands.

☐ 0 ☐ 1 ☐ 2 ☐ 3 ☐ 4 ☐ 5

My accounting procedures are well documented in the Operations manual.

☐ 0 ☐ 1 ☐ 2 ☐ 3 ☐ 4 ☐ 5

I review liquidity, leverage, efficiency, and profitability ratios regularly.

☐ 0 ☐ 1 ☐ 2 ☐ 3 ☐ 4 ☐ 5

How is your bookkeeping being done at present?

What financial goals have been established?

What changes would you like to see in your bookkeeping process?

| ACKNOWLEDGMENT |

Signature: _________________________ Date: ___________

Printed Name: _______________________