How to Use an Engagement Letter

After gathering a client’s details through an intake form, an accountant or bookkeeper can write an engagement letter to set the conditions of the service relationship. The document should be written to include the:

- Names of the client and the individual or firm providing services.

- Duration of the agreement, which may be for a defined period or ongoing.

- Services to be performed for the client.

- Fee structure and payment terms.

The completed engagement letter must be provided to the client and signed before any work begins.

Sample

Download: PDF, Word (.docx), OpenDocument

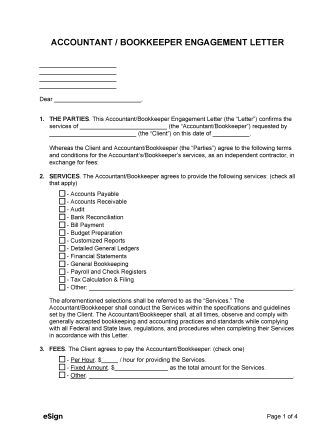

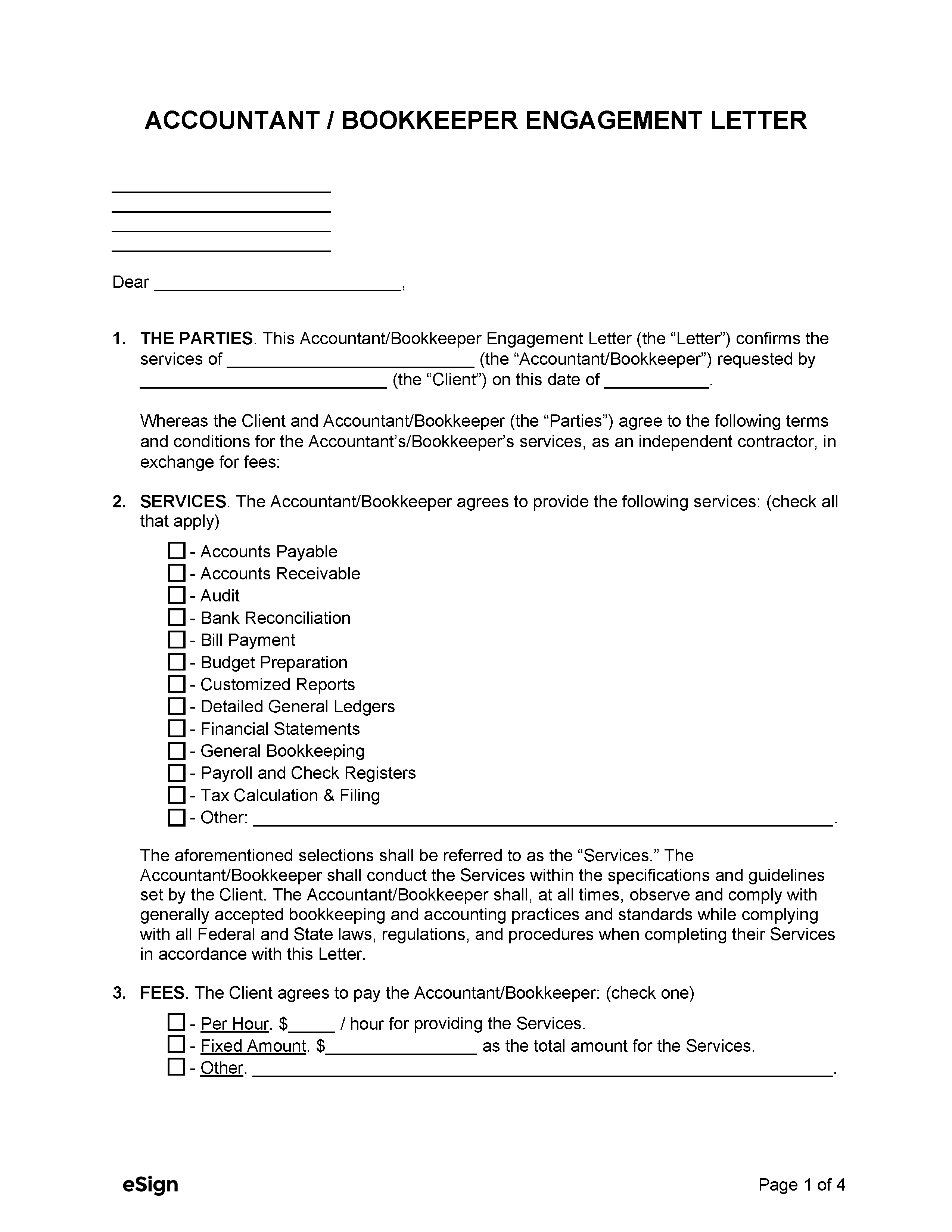

ACCOUNTING / BOOKKEEPING ENGAGEMENT LETTER

1. THE PARTIES. This Engagement Letter (“Letter”) confirms the services of [SERVICE PROVIDER] (“Service Provider”) requested by [CLIENT NAME] (“Client”) on this date of [MM/DD/YYYY].

WHEREAS the Client intends to pay the Service Provider for services provided under the following terms and conditions:

2. SERVICES. The Service Provider agrees to provide the following services: [LIST SERVICE(S)] (“Services”).

3. PAYMENT. In consideration for the Services provided, the Service Provider is to be paid in the following manner: [DESCRIBE COMPENSATION].

4. TERM. The Services shall commence on [MM/DD/YYYY] and terminate upon either party providing [#] days’ written notice to the other.

5. EXPENSES. The Service Provider shall be responsible for all expenses related to providing the Services under this Agreement unless otherwise stated here: [REIMBURSABLE EXPENSES (IF ANY)].

6. CONFIDENTIALITY. The Service Provider agrees not to disclose or misuse the Client’s proprietary or confidential information without prior written consent, except as needed to perform the Services, recognizing that such actions would cause irreparable harm to the Client.

7. INDEPENDENT CONTRACTOR. The Service Provider is an independent contractor, and neither the Service Provider nor their employees or contract personnel are or shall be deemed to be the Client’s employees.

8. CLIENT’S OBLIGATIONS. The Client is responsible for providing accurate financial information, materials, and documents necessary for the Service Provider to perform the Services. The Client agrees to bear full responsibility for the accuracy of the information and holds the Service Provider harmless from any liability arising from inaccuracies.

IN WITNESS WHEREOF, the parties have indicated their acceptance of the terms of this Letter by their signatures below on the dates indicated.

Service Provider Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [PRINTED NAME]

Client’s Signature: ______________________ Date: [MM/DD/YYYY]

Printed Name: [PRINTED NAME]