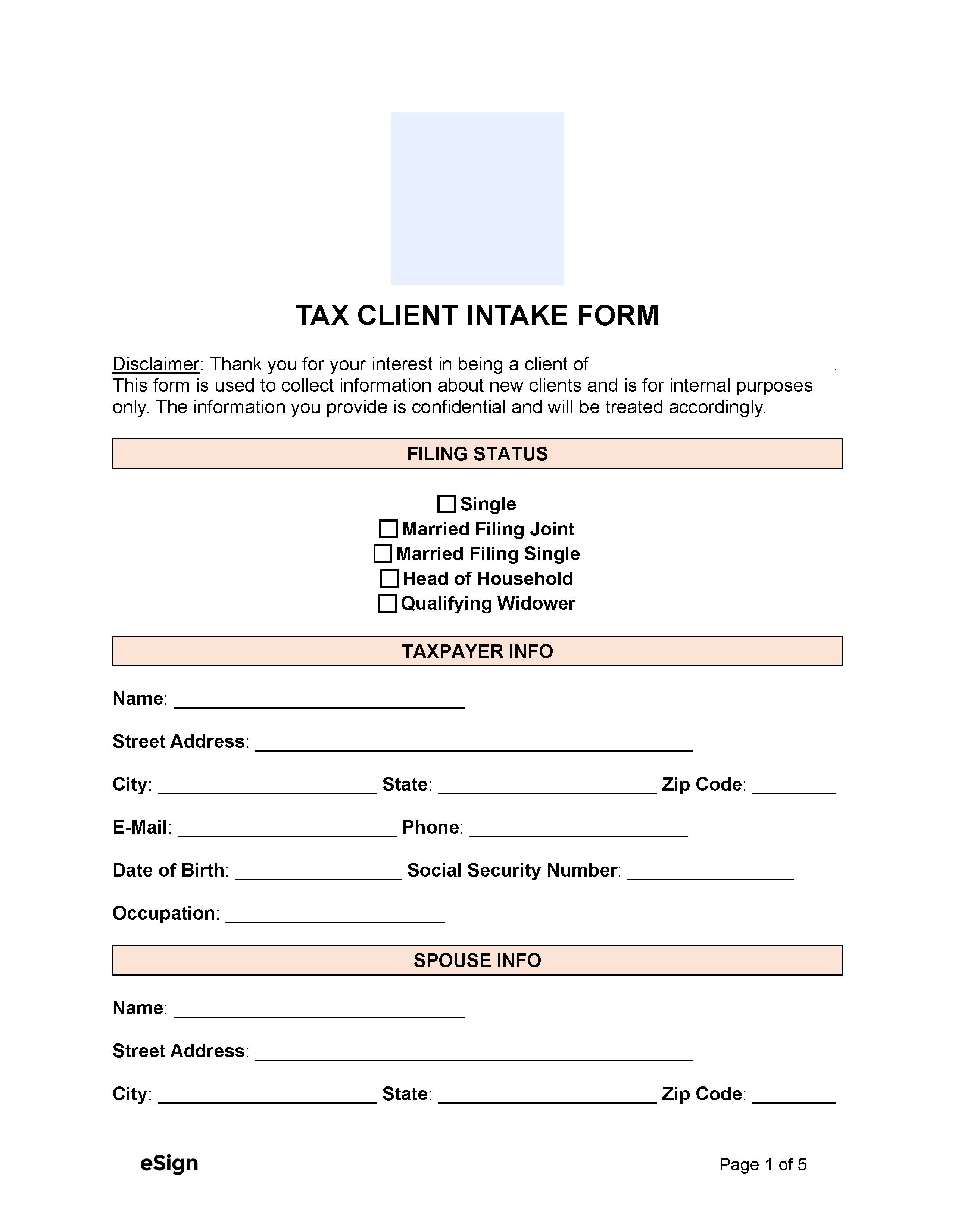

IRS Form 13614-C – This IRS client intake form is completed by taxpayers who are seeking free tax preparation services through the Volunteer Income Tax Assistance (VITA) or the Tax Counseling for the Elderly (TCE) programs (apply here).

Key Information

Taxpayers generally need to provide tax preparers with the information detailed below.

Contact Information

In order for the preparer to file a tax return on behalf of the client, they will need the following pieces of information:

- Full name

- Home address

- Email and phone number

- Date of birth

- Social Security Number

Income

The client is asked a series of questions regarding their revenue streams so the tax specialist will know what documentation they’ll need from the client and how much they will need to charge for their services.

Dependents

The client’s tax return will be affected if they are responsible for other individuals, such as children, the elderly, younger brothers/sisters, and other relatives. All dependents must be listed in the intake form also.

Deductions

Deductions are expenses that can be subtracted from the client’s gross income, such as:

- Mortgage interest

- Childcare expenses (daycare)

- Contributions to retirement (IRA, 401(k), etc.)

- Charitable contributions

- Medical expenses

Payments

A tax preparer will want to know if their client filed their taxes last year at the state and federal levels. If they have an outstanding balance, the client should include this information.

Additional Documentation

Once a client has completed the intake form, the preparer will look it over to assess what additional documentation they’ll need to file a return. The list below includes some of the essential documents needed to prove income and prepare an individual’s taxes.

- W-2 forms (employment)

- 1099 forms (various income)

- K-1 forms (partnership/corporation income)

- Proof of self-employed income (invoices, statements, etc.)

- Form 1095 (A, B, or C)

- Lists/receipts for deductible expenses

Liability Disclosure

According to the IRS, “Taxpayers are ultimately responsible for all the information on their income tax return.”[1] A client can hold their accountant liable if they file an inaccurate return, but the client is responsible for providing accurate information.