State Laws

Probate in Alabama

Petition for Probate of Will

At least five days after someone dies in Alabama, the probate process must be initiated through the local Probate court, and the court has a five-year limit to probate the will.[4]

The personal representative appointed by the testator must file the following:

- Petition for Probate of Will (Sample)

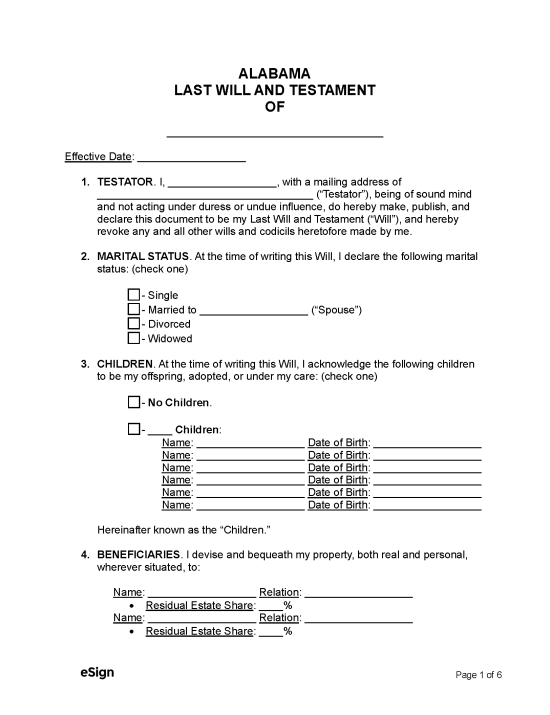

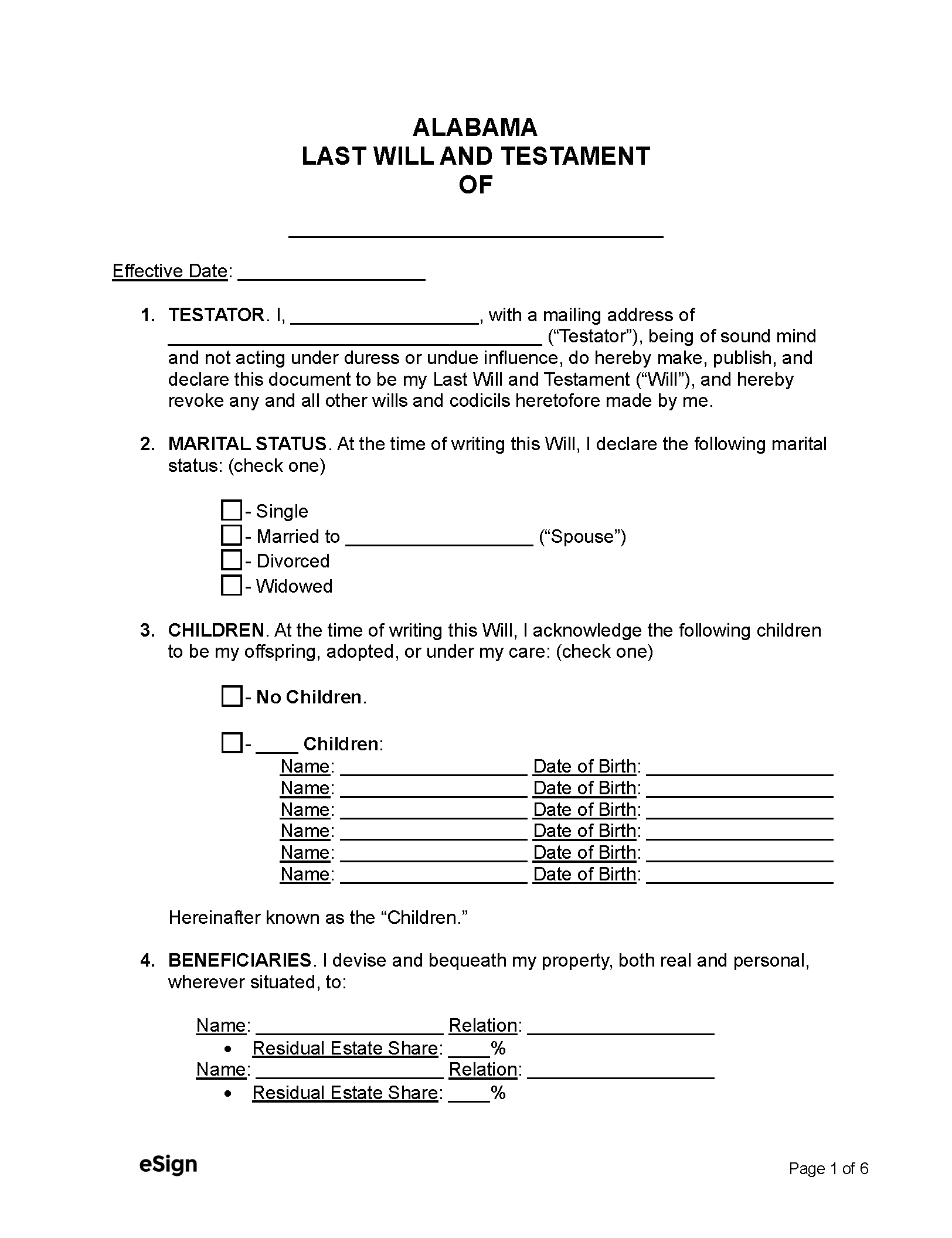

- Testator’s Last Will and Testament

- Certified copy of the testator’s death certificate

The representative will need to request the court to provide them with Letters Testamentary (SAMPLE) to gain authorization to handle all matters related to the testator’s estate.

Six months after the Letters Testamentary are granted, the personal representative may request a final settlement from the court.[5] A court hearing will only be required if a dispute arises.

Small Estates

If the net value of a decedent’s estate is under $37,075,[6] the estate can avoid the probate process and file a Petition for Summary Distribution (also known as a small estate affidavit).