State Laws

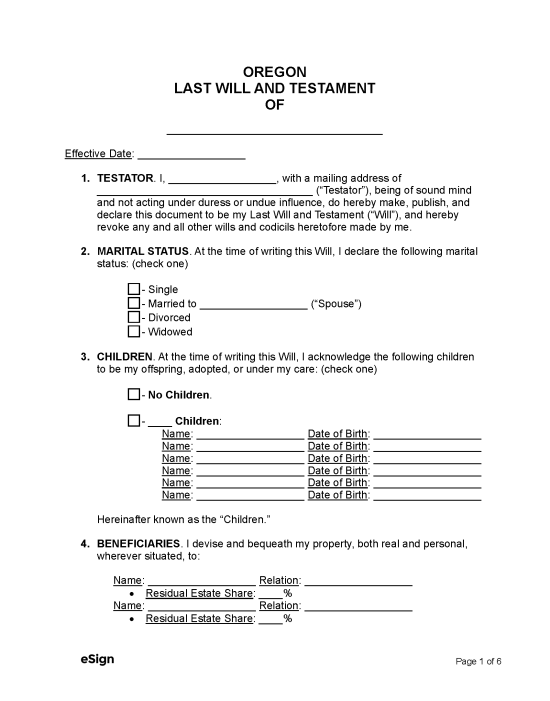

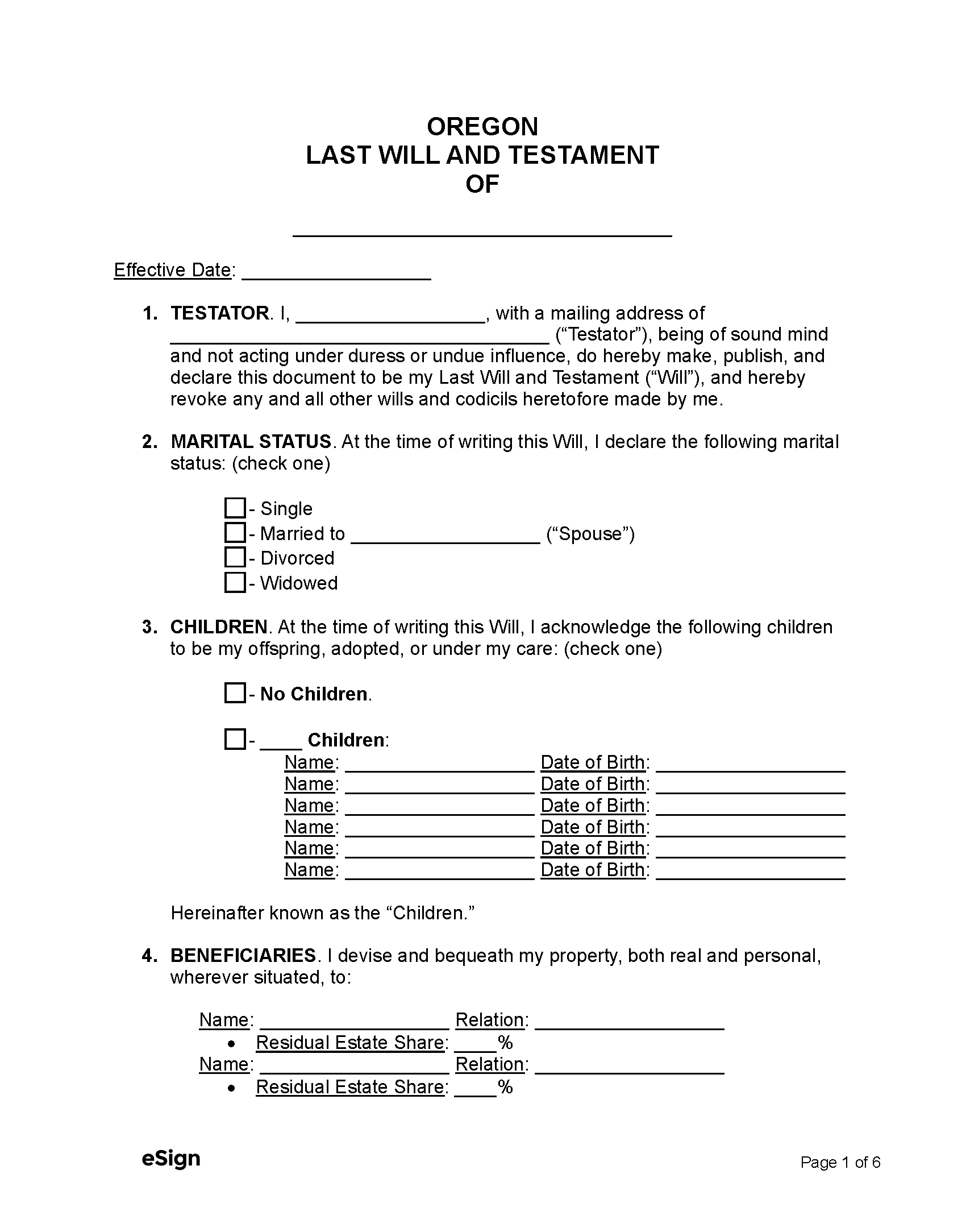

A will can be made by anyone who is of sound and either 18 years of age or older, lawfully married, or an emancipated minor.[1]

Holographic Wills – Handwritten wills are legally valid only if executed under the same criteria as traditional wills.

Revocation – The testator can revoke their will by destroying it or executing another one.[2] Remarrying will revoke a will if the new spouse survives the testator.[3] Also, a divorce or annulment revokes any part of the will in favor of the former spouse.[4]

Signing Requirements – The testator must sign the will or acknowledge their signature in the presence of two witnesses, and these witnesses must attest to the will by signing their names.[5]

Probate Process in Oregon (10 Steps)

In Oregon, a deceased person’s will must be admitted to the circuit court to start a probate proceeding. This legal process can begin immediately after the individual’s death and will take at least four months to complete.

- Petition for Probate

- Appointment of Executor

- Notice to Unknown Creditors

- Notice to Interested Parties

- Inventory and Appraisal

- Notice to Known Creditors

- Claims and Debts

- Taxes

- Final Accounting or Verified Statement

- Estate Settlement

1. Petition for Probate

A Small Estate Affidavit can be used to collect property from an estate without going through probate, so long as the decedent owned no more than $75,000 worth of personal property and $200,000 worth of real estate.[6]

A probate proceeding may be initiated by the executor named in the will or anyone else with an interest in the estate, such as an heir, beneficiary, or creditor.[7] Whoever files for probate must submit a Petition to the circuit court where the decedent lived before death.

The Petition must include a certified copy of the death certificate and payment for the filing fee (see probate fee schedule).

Court Forms

Most of the required probate documents aren’t available online. As a result, individuals must either draft their own or purchase them from a stationary store or bookstore that sells legal forms. The information that must be included in the Petition is laid out in the Oregon Revised Statutes.

2. Appointment of Executor

Within a few days after filing the Petition, a judge will issue a Limited Judgment that officially appoints an estate executor.[8] The judge will also sign the Letters Testamentary, certifying the executor’s legal authority to administer the estate.[9]

The court may require the executor to post a probate bond as a form of estate insurance.[10] If the executor neglects their administrative duties or acts dishonestly, they’ll be responsible for paying the total bond amount. The probate bond, when required, must be provided to the court before the Letters Testamentary are issued.

Note: The court will likely dismiss the need for a bond if the decedent’s will explicitly waives this requirement.

3. Notice to Unknown Creditors

Following their appointment, the executor will need to publish a notice in a newspaper distributed in the county where the probate case is pending.[11] This publication will inform unknown creditors that a probate case was filed and that they’re entitled to present claims.

The notice must be published once per week for three weeks in a row. After the publication, the executor must file proof of publication and a copy of the notice with the court.

Unknown creditors have four months after the initial publication date to present their claims against the estate.

4. Notice to Interested Parties

The executor’s next administrative duty is to deliver or mail notice of the probate proceeding to the devisees, heirs, and other interested parties listed in the Petition.[12] Alternatively, the parties can sign a Waiver of Notice.[13] Then, within 30 days after their appointment, the executor must do the following:

- Provide the court with proof that the notice was delivered or mailed, or provide a Waiver of Notice.

- The proof of delivery or mailing must include the name of each recipient and a copy of the notice.

- Mail or deliver the notice and a copy of the death certificate to the Department of Human Services and the Oregon Health Authority.

5. Inventory and Appraisal

An Inventory of the decedent’s assets must be submitted to the court within 90 days after the executor’s appointment.[14] The Inventory must list all known probate assets and include estimated values of every item as of the date of the decedent’s death. If there isn’t any estate property, the executor’s Inventory must state this fact.

6. Notice to Known Creditors

During the first three months after their appointment, the executor must make a diligent effort to obtain the names and addresses of all creditors who have claims against the estate.[15] Within 30 days after that period expires, the executor must provide each known creditor with a notice instructing them to present their claims within 45 days.

Not later than 60 days after the expiration of the 3-month period, the executor must provide the court with proof that the notice was delivered or mailed. The proof must include the names and addresses of the recipients, the delivery/mailing dates, and a copy of the notice.

7. Claims and Debts

Claims from creditors can be paid after the applicable notice period expires, which is either 45 days after the mailing or delivery of the notice (for known creditors) or 4 months after the initial publication date (for unknown creditors). The executor must also pay probate expenses, funeral costs, and taxes. Payments must be made in the order of preference set by law.[16]

8. Taxes

The executor is responsible for reporting the decedent’s earnings from the current tax year. This is accomplished by filing individual income tax returns with the Internal Revenue Service and the Oregon Department of Revenue. If the estate generated income after the decedent’s death, a fiduciary income tax return must also be filed in Oregon.

A federal estate tax return is required if the decedent’s property is valued above the filing threshold for the year of death. Similarly, if the estate is worth more than $1,000,000, a state estate tax return must also be filed.[17]

The executor must pay all taxes before submitting a final accounting to the circuit court.

9. Final Accounting or Verified Statement

After the creditors’ claims have been settled and all tax returns are filed and paid, the executor must file a Final Accounting (Form 9.160) that includes the statements, requests, and other information required by law to settle and distribute the estate.[18] Alternatively, the beneficiaries can waive the Final Accounting, and the executor would instead file a Verified Statement.[19]

10. Estate Settlement

After the Final Accounting or Verified Statement has been filed, a judge will sign a Judgment of Final Distribution to give the executor permission to distribute the estate to the beneficiaries.[20] Each distribution must be documented in a receipt, which must be signed by the property recipients and submitted to the court.

After all of the signed receipts have been submitted to the court, a judge will issue a Supplemental Judgment of Discharge to close the estate and release the executor from any further responsibility.[21]