Laws

- Statute: § 114.515

- Maximum Estate Value (§ 114.510(1)): $75,000 for personal property and $200,000 for real property ($275,000 total, not including debts or liens).

- Mandatory Waiting Period (§ 114.515(3)): Thirty (30) days

- Where to File: Circuit Court

How to File (5 Steps)

- Step 1 – Estate Requirements

- Step 2 – Complete Affidavit

- Step 3 – Send Notices

- Step 4 – Pay Debts and Expenses

- Step 5 – Distribute Estate

Step 1 – Estate Requirements

Before filing a small estate affidavit, the following conditions must be met:

- At least thirty (30) days have passed since the decedent’s death.

- The estate value doesn’t exceed $75,000 in personal property and $200,000 in real property.

- There are no other probate cases or personal representatives appointed for the estate.

- The affiant is an heir, devisee, creditor, or personal representative named in the decedent’s will.

- The affiant is over eighteen (18) and does not have a criminal record.

Step 2 – Complete Affidavit

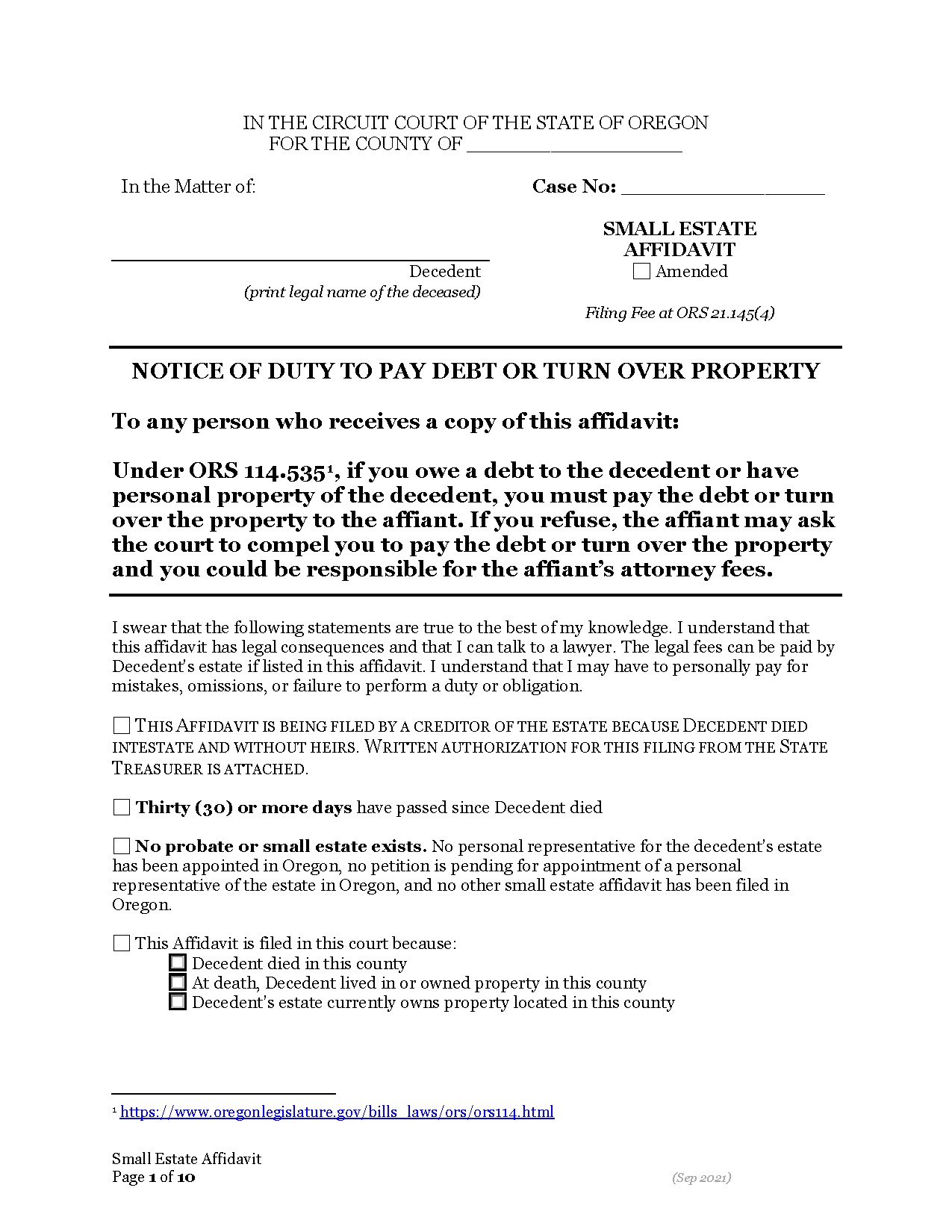

The affiant will need to complete the Small Estate Affidavit, identifying the decedent’s heirs and creditors, along with any claims or expenses against the estate.

The affidavit can be filed with the circuit court clerk for a $124 filing fee (§ 21.145). The form should be signed before a notary public and have the death certificate and will attached, if any.

If there is a will, an affidavit of attesting witness or affidavit regarding a genuine signature must be provided.

Step 3 – Send Notices

After filing, the affiant will need to send copies of the affidavit and attachments to the estate’s heirs, devisees, creditors, and any other required party indicated in the form. Mailed copies and notices must be sent within thirty (30) days of filing.

Step 4 – Pay Debts and Expenses

Claims against the estate must be presented to the affiant within four (4) months of the affidavit’s filing, after which point, they’ll be deemed invalid (§ 114.540(1)(a)). The affiant is responsible for settling all expenses (e.g., funeral costs, administration fees, taxes, and claims by creditors) from the estate funds. If necessary (and with the consent of an heir or devisee, if required under § 114.547), the affiant may transfer or sell the decedent’s property to a third party to settle expenses and claims.

The affiant must wait four (4) months after filing the affidavit and resolve all claims, expenses, and taxes before distributing the estate in the next step.

Step 5 – Distribute Estate

After waiting the required period, the affiant can distribute the estate’s assets as outlined in the form. They may also begin collecting debts and property by presenting the affidavit to debtors or custodians. No further court involvement is required unless the owing party refuses to comply upon being served the affidavit.