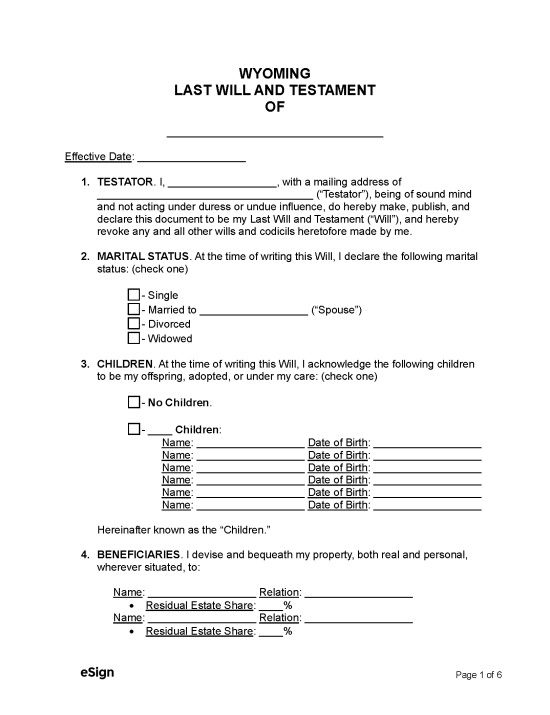

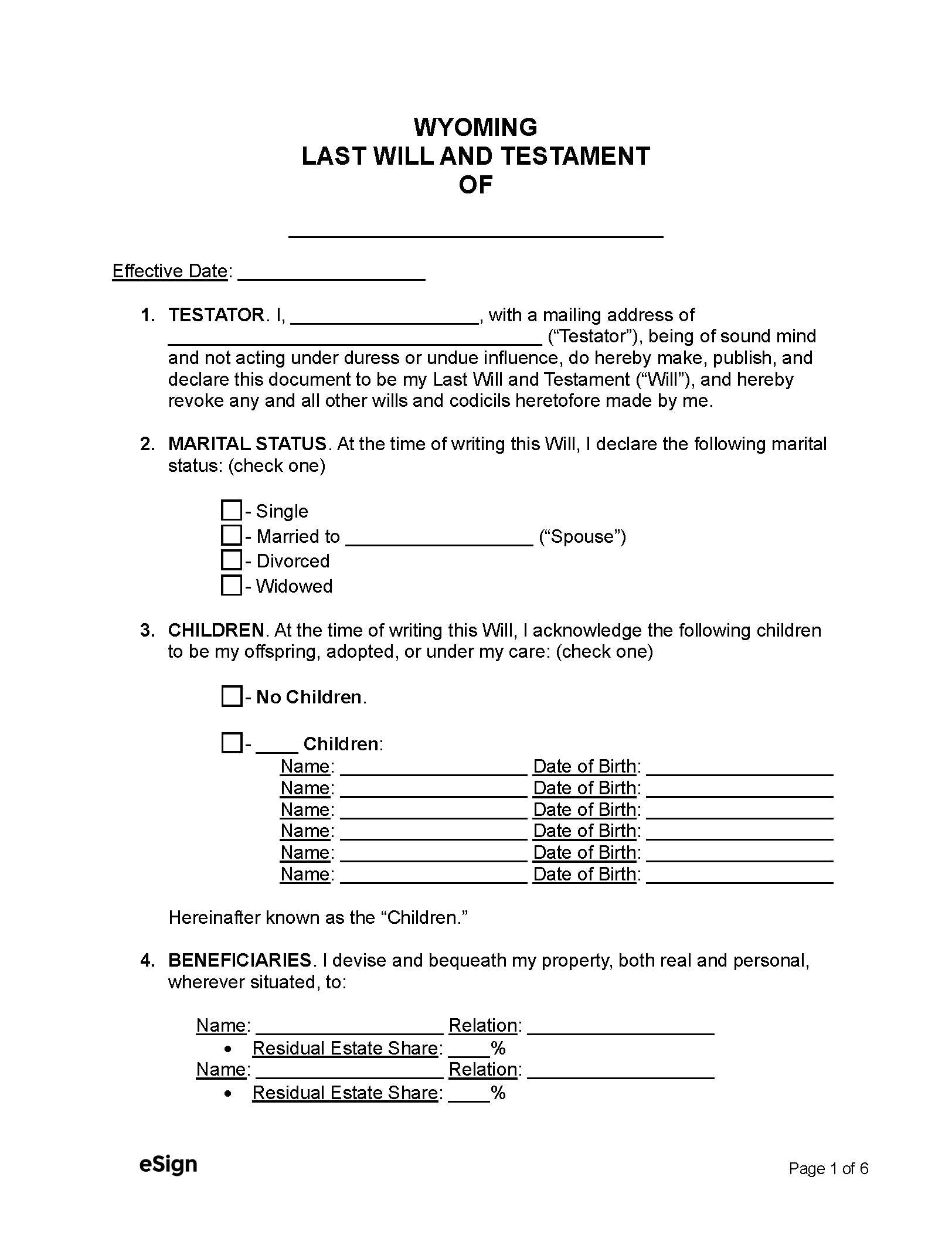

A Wyoming last will and testament communicates how an individual wants their assets and property distributed after they pass away. The individual, known as a testator, will use the document to designate a personal representative (PR), also known as an executor, to manage their affairs and distribute the assets to beneficiaries named in the will. The will serves as a clear roadmap for the legal transfer of assets and helps simplify what can be a difficult process.

Any individual 18 years of age or older who is sound of mind may make a will in Wyoming.[1]

State Laws

Holographic Wills – A holographic or handwritten will is permissible as long as it is entirely in the testator’s handwriting and includes their signature.[2]

Revocation – A will is revoked if the testator destroys the document, has another party destroy it on their behalf, or if they replace it with another will.[3]

Signing Requirements – The will must be signed by two competent witnesses and the testator.[4]

Probate Process in Wyoming (10 Steps)

The executor must petition the court within 30 days of becoming aware of the testator’s death and of their role as executor. If the executor fails to file without showing a good cause for the delay, the court may appoint another representative.[5]

- Filing the Will

- Appointing the Personal Representative

- Petition for Probate

- Personal Representative Oath

- Probate Bond (If Applicable)

- Giving Notice

- Inventory and Appraisal

- Paying Taxes and Debts

- Final Report and Accounting

- Petition for Final Discharge

The following is meant to be a general overview of the probate process. It is recommended that executors/personal representatives consult with an attorney if they’re unsure of any step.

1. Filing the Will

If the deceased party’s estate is valued at or below $200,000, it may be possible to avoid probate with an Application for a Decree of Summary Distribution of Property.[6]

Wyoming law states that probate should be completed within one year of the appointment of the personal representative.[7] When the testator dies, the individual with the will has ten days to deliver it to the named personal representative or file it with the Clerk of the District Court in the county where the testator lived.[8] Once the will is filed with the court, the clerk will inform the personal representative (or appoint one) and the distributees named in the will (who can easily be located).[9]

2. Appointing the Personal Representative

Usually, the decedent will name an individual to act as the personal representative for the estate, i.e., the person in charge of paying debts and distributing assets. If no one is named, or the representative is unable to serve as the PR, the court will select another individual based on this order:

-

- An individual named in the will as a beneficiary or someone the other beneficiaries nominate

- A company or individual that the estate owes a debt to (a creditor) or a person nominated by the creditor

- Another individual whom the court deems qualified[10]

3. Petition for Probate

The personal representative has 30 days to file a petition for probate, which states whether the executor accepts their appointment and includes information about the heirs, the value and type of property, and any other information that may vary by jurisdiction.[11]

A copy of the death certificate must also be submitted to the court, which can be requested online from the Wyoming Department of Health. Alternatively, the certificate can be obtained by mailing a Request for Certified Copy of a Wyoming Vital Record, along with a cheque or money order for the filing fee, to:

Vital Statistics Services

2300 Capitol Avenue

Hathaway Building

Cheyenne, WY 82002

The will’s validity may need to be proven to the court if it is not self-proving. A will deemed self-proving is accompanied by an affidavit signed by the testator, two witnesses, and an authorized officer, such as a notary public.[12]

If the will is not self-proving, then a witness to the will must provide oral or written testimony to its validity.[13]

4. Personal Representative Oath

5. Probate Bond (If Applicable)

The personal representative may be required to submit a probate bond to the court unless waived by a clause in the will or by a written statement by the distributees.[15] The purpose of the bond is to safeguard the estate’s beneficiaries or creditors against any incompetence or wrongdoing by the personal representative. If a bond is required, it must be either one corporate surety or two or more individual sureties approved by the district court, clerk, or commissioner.[16]

At the minimum, the bond must cover the value of the personal property and the estimated value of any potential income (rent, profits, etc.) from the real property belonging to the estate. Each surety must provide a written oath to be attached to the bond when the representative files it with the court.

6. Giving Notice

Once the personal representative receives Letters Testamentary, they will be required to publish notice of probate and appointment of the personal representative in a local newspaper once a week for three weeks.[17] The notice will state the representative’s name and notify creditors that they have three months to bring forth any claims against the estate.

A copy of the notice must also be sent to:

-

- Any spouse, lawful heirs, and beneficiaries listed in the will within one week of publication.[18]

- Each reasonably ascertainable creditor at least 30 days before the three-month deadline.[19]

- The Wyoming Department of Health if the decedent received government medical assistance.[20]

- The Wyoming Department of Family Services if the agency is enforcing a child support order against the decedent or any legal heir.[21]

8. Paying Taxes and Debts

The personal representative may need to file a tax return for the decedent, an income tax return for the estate, and an estate tax return. Any outstanding debts or taxes must be paid before the estate can be distributed to the beneficiaries.[24] The personal representative may need to sell some of the estate’s assets in order to repay creditors and taxes.

9. Final Report and Accounting

Once all funeral and administration expenditures, creditor claims, and taxes have been paid, a Final Report and Accounting and Petition for Distribution must be filed with the court.[25] The report will include:

- A summary of all the steps the PR has gone through.

- Detailed information about any money or property the personal representative has managed.

- The name and location of any surviving spouse.

- The names and addresses of each devisee and their relationship to the testator.

- Whether there are any monetary or real estate gifts and the amount and nature of those gifts.

- Whether any distributee has a legal disability.

- A declaration of whether or not all tax-related legal obligations have been dealt with.

- How the personal representative plans to distribute the estate.

Once the final report has been submitted to the court, the court will have a hearing to hear any objections by interested parties and decide whether to approve the Final Report.

When the court approves the final report, the personal representative may distribute the estate.[26]

10. Petition for Final Discharge

Sources

- § 2-6-101

- § 2-6-113

- § 2-6-117

- § 2-6-112

- § 2-6-202

- § 2-1-205(a)

- § 2-7-801(c)

- § 2-6-119(a)

- § 2-6-120

- § 2-6-208

- § 2-6-201

- § 2-6-114

- § 2-6-205

- § 2-3-101

- § 2-3-111

- § 2-3-102

- § 2-7-201

- § 2-7-205(a)(i)

- § 2-7-205(a)(ii)

- § 2-7-205(a)(iii)

- § 2-7-205(a)(iv)

- § 2-7-403

- § 2-7-404

- § 2-7-812

- § 2-7-811

- § 2-7-813

- § 2-7-814