How to Structure the Letter

1. Name the Parties

Provide the full names and mailing addresses of the buyer and seller. If one or both of the parties is a company, provide the name of that company instead.

2. Identify the Business

The parties must identify the name of the business being considered for purchase.

3. Establish the Payment Terms

The letter should include the proposed purchase price and due date. If applicable, the parties may also state whether a deposit is required and whether the buyer will require financing.

4. Detail the Terms and Conditions

Letters of intent include both binding and non-binding clauses in the agreement. Generally, the buyer has the right not to go through with the purchase. However, the parties are bound to any confidentiality, deposit, and good faith provisions.

5. Sign the Letter

Once the required information is provided, the parties may sign and date the letter.

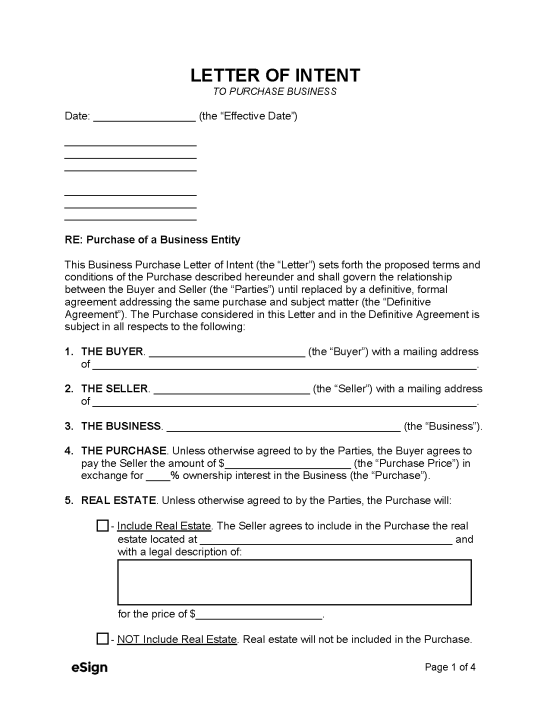

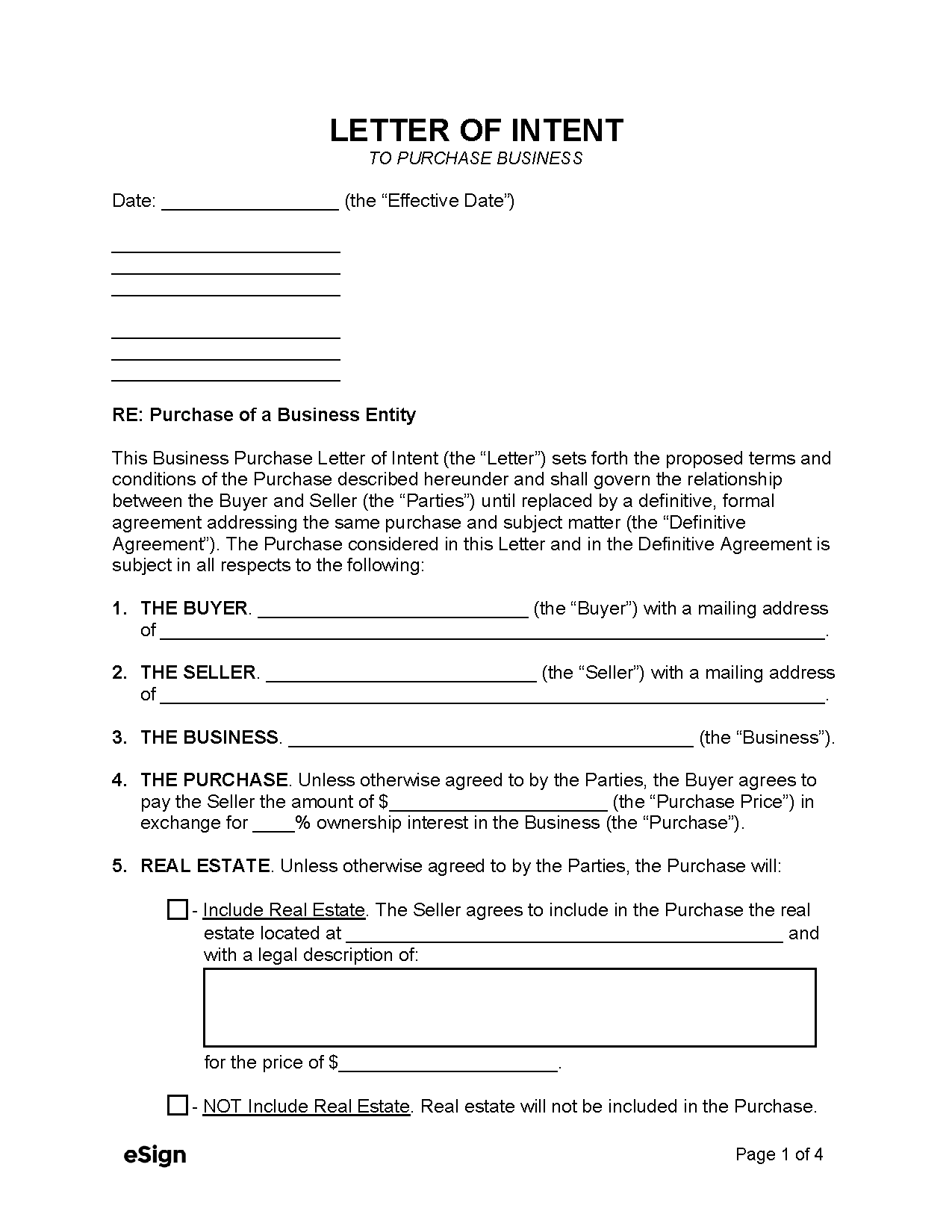

Sample

Download: PDF, Word (.docx), OpenDocument

BUSINESS PURCHASE LETTER OF INTENT (LOI)

Date: [DATE] (the “Effective Date”)

[SENDER NAME]

[SENDER STREET ADDRESS]

[SENDER CITY, STATE, ZIP]

[RECIPIENT NAME]

[RECIPIENT STREET ADDRESS]

[RECIPIENT CITY, STATE, ZIP]

RE: Purchase of a Business Entity

This Business Purchase Letter of Intent (the “Letter”) sets forth the proposed terms and conditions of the Purchase described hereunder and shall govern the relationship between the Buyer and Seller (the “Parties”) until replaced by a definitive, formal agreement addressing the same purchase and subject matter (the “Definitive Agreement”). The Purchase considered in this Letter and in the Definitive Agreement is subject in all respects to the following:

1. THE BUYER. [BUYER NAME] (the “Buyer”) with a mailing address of [ADDRESS].

2. THE SELLER. [SELLER NAME] (the “Seller”) with a mailing address of [ADDRESS].

3. THE BUSINESS. [BUSINESS NAME] (the “Business”).

4. THE PURCHASE. Unless otherwise agreed to by the Parties, the Buyer agrees to pay the Seller the amount of $[PURCHASE PRICE] (the “Purchase Price”) in exchange for [PERCENTAGE]% ownership interest in the Business (the “Purchase”).

5. PAYMENT. Payment shall be made as follows: [DESCRIBE MANNER OF PAYMENT].

6. DEPOSIT. The Parties agree that a deposit is: [REQUIRED/NOT REQUIRED].

7. FINANCING. The Buyer has made it known this Letter is [CONDITIONAL/NOT CONDITIONAL] upon financing.

8. SELLER’S CONDUCT. Until the closing date of the Purchase, the Seller must continue to fulfill their responsibilities in the best interests of the Business and shall not engage in any conduct that would adversely affect the Business and its respective operations.

9. ACCESS TO INFORMATION. The Buyer and their advisors shall have full access to the Business’s information, and they will be held to a fiduciary duty of confidentiality and must not misappropriate or disclose the information to any third (3rd) parties without the Seller’s authorization.

10. CONFIDENTIALITY. The Seller and Buyer shall maintain the negotiations and pertinent information confidential and limited only to the parties’ advisors, internal staff, or other necessary third (3rd) parties. Press or public releases are prohibited without prior mutual written authorization from the parties or as required by law.

11. GOOD FAITH NEGOTIATIONS. The Buyer and Seller are expected to negotiate the terms of the Purchase herein in good faith.

12. EXCLUSIVE OPPORTUNITY. The Buyer and Seller shall refrain from entering into negotiations or discussions concerning the Business with any other party unless another agreement (e.g., option to purchase, first right of refusal, etc.) is already in place.

13. INTENTION OF THE PARTIES. This Letter sets forth the intentions of the Parties to use reasonable efforts to negotiate, in good faith, a Definitive Agreement with respect to all matters herein. Notwithstanding paragraphs 6, 7, and 8 through 15, which shall be legally binding, any legal obligations with respect to all other matters shall only arise if and when the Parties execute and deliver a Definitive Agreement.

14. GOVERNING LAW. This Letter shall be governed under the laws of the State of [STATE NAME].

15. SIGNATURES.

Seller Signature: ___________________ Date: [MM/DD/YYYY]

Print Name: [SELLER NAME]

Buyer Signature: ___________________ Date: [MM/DD/YYYY]

Print Name: [BUYER NAME]