An operating agreement is not required in Arkansas, and the document needn’t be submitted to the Secretary of State. However, the company will still need to file a Certificate of Organization (domestic LLCs) or Certificate of Registration (foreign LLCs) and an annual franchise tax report.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 4, Subtitle 3, Chapter 38

- Definitions: § 4-38-102

- Formation: § 4-38-201

- Naming of LLCs: § 4-38-112

How to File (5 Steps)

- Step 1 – Reserve a Business Name

- Step 2 – File for Organization/Registration

- Step 3 – Create an Operating Agreement

- Step 4 – Obtain an EIN

- Step 5 – Annual Franchise Tax

Step 1 – Reserve a Business Name

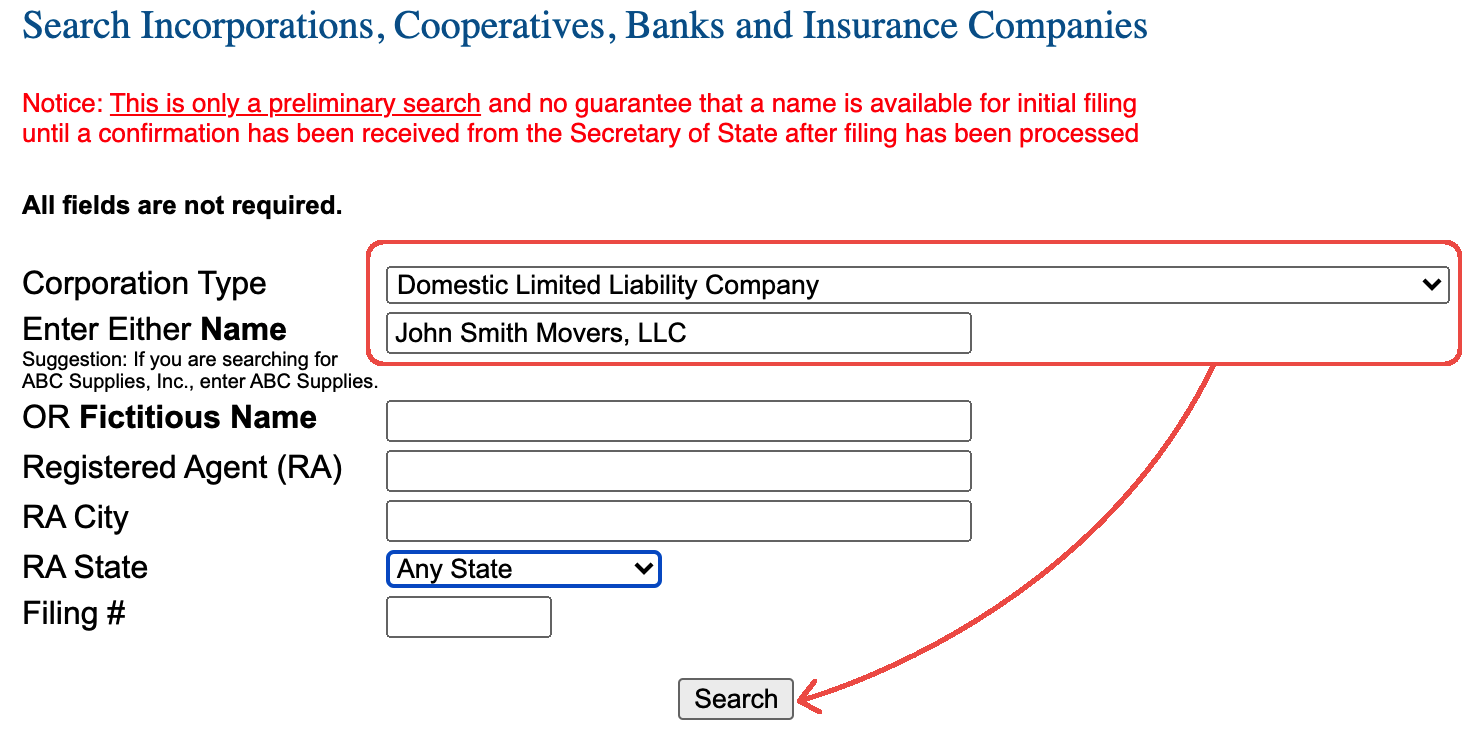

Individuals must start the filing process by choosing a unique name for their business. To ensure that another company hasn’t already taken the name, filers may search for the name on the Secretary of State (SOS) business database.

- To comply with Arkansas statute § 4-38-112, the company name must contain the words “limited liability company,” “limited company,” or one of the statutorily-approved abbreviations.

After choosing a name, the filer can reserve it for a total of one hundred and twenty (120) days. Business names can be reserved using either of the following methods:

Method 1 – Online (Domestic LLCs Only)

Access the SOS website and select “App. for Reservation of LLC Name – LLC-05.” From there, fill out the online application and pay the $22.50 filing fee.

Method 2 – Mail

Complete the Application for Reservation of Entity Name and mail it to the below address along with a $25 check made out to the “Arkansas Secretary of State.”

Secretary of State’s Business and Commercial Services Division

1401 W. Capitol, Suite 250

Little Rock, Arkansas 72201

Note on Fictitious Business Names:

An LLC can conduct business under a “fictitious name,” which is a name that differs from the one on file with the SOS. A fictitious name is often used for advertising purposes. For example, a company called “John Smith Commercial Movers, LLC” may wish to operate publicly under the fictitious name of “Super Commercial Movers.”

- A fictitious can be obtained by completing an online application ($22.50) or by filing a paper application by mail ($25).

Step 2 – File for Organization/Registration

The filing process varies depending on whether the company is a new entity being created in Arkansas (domestic LLC) or if the business already exists in another state (foreign LLC).

Domestic Registration

- File a Certificate of Organization.

- Online Application – Select “Certificate of Organization for Domestic LLC – LL-01” and fill out the online application. Complete the process by paying the $45 filing fee.

- Paper Application – Fill out the paper application and mail it to the SOS office. Included with the paper application must be a $50 check made out to the “Arkansas Secretary of State.”

Foreign Registration

- Obtain a Certificate of Existence (or document of similar relevance) from the SOS or other official office where the foreign LLC’s records are kept. This certificate must be submitted to the Arkansas SOS when filing the company’s registration documents.

- File a Certificate of Registration.

- Online Application – Select “App. for Certificate of Registration of For. LLC – FL-01” from the list of options. Fill out the online application and pay the $270 registration fee.

- Paper Application – Complete the paper application and send it by mail to the SOS office. Be sure to attach a $300 check made payable to the “Arkansas Secretary of State.”

Note on Selecting a Registered Agent:

Each LLC application must identify the company’s registered agent. The registered agent is an individual or entity appointed by the LLC to receive service of process, notices, and demands on the company’s behalf. In Arkansas, a registered agent must:

- Maintain an address in Arkansas;

- Be eighteen (18) years of age or older (if an individual); and

- Be available during regular business hours.

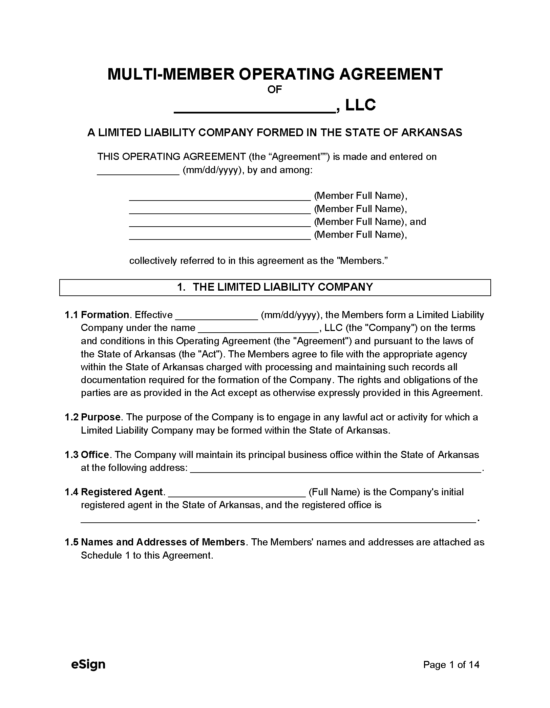

Step 3 – Create an Operating Agreement

Although not legally required in Arkansas, the LLC’s managing member or members are advised to draft an operating agreement to define the company’s management structure, ownership terms, and business policies.

Step 4 – Apply for an EIN

An Employer Identification Number, or EIN, is used by the Internal Revenue Service (IRS) to identify businesses for tax purposes. While not required in all cases, if the LLC plans to hire employees, obtain business loans, or open a company bank account, an EIN will be required. An EIN can be requested online (select “Apply Online Now“) or by mail using Form SS-4 (see mailing instructions).

Step 5 – Annual Franchise Tax

Both domestic and foreign limited liability companies must file an annual franchise tax report on or before May 1st of each year. When filing this report, the LLC will need to pay a $150 franchise tax. The tax report can be filed online or through the mail using the most current tax form.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|