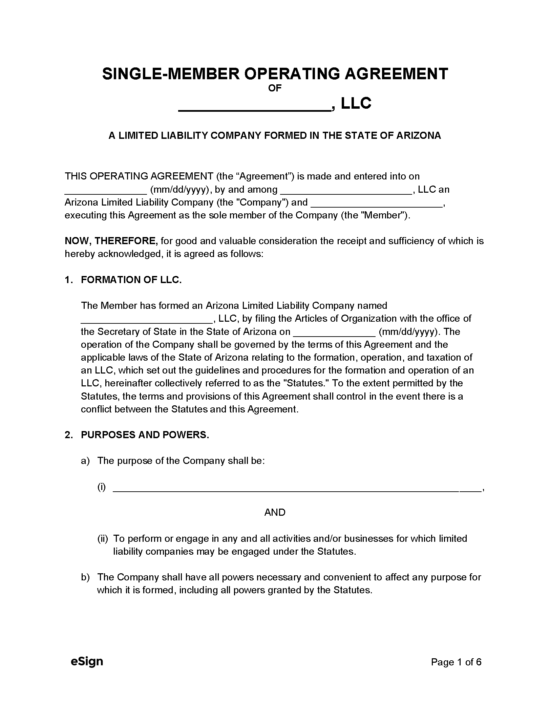

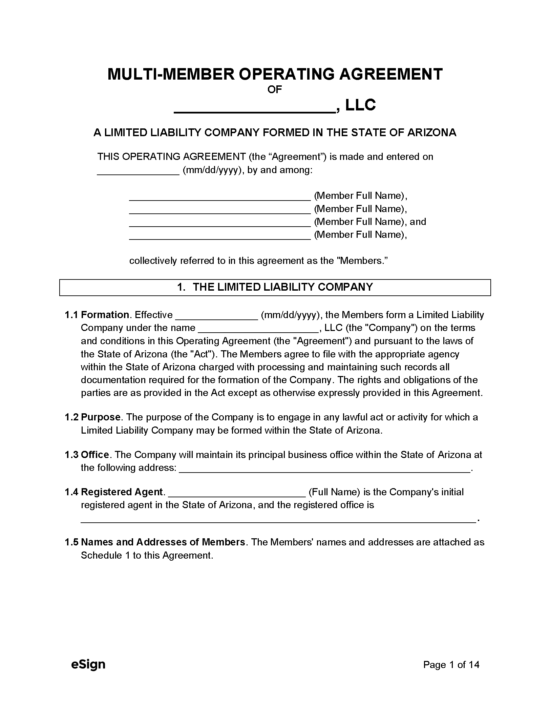

Arizona LLCs aren’t required by law to draft an operating agreement, and the form needn’t be filed with any government agency. Instead, the agreement should be reviewed by each member, signed, and stored at the company’s registered office.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 29, Chapter 7

- Definitions: § 29-3102

- Formation: § 29-3201

- Naming of LLCs: § 29-3112

How to File

- Step 1 – Choose a Business Name

- Step 2 – Appoint a Statutory Agent

- Step 3 – File with the Arizona Corporation Commission

- Step 4 – Create an Operating Agreement

- Step 5 – Publish a Notice of Formation

- Step 6 – Apply for an EIN

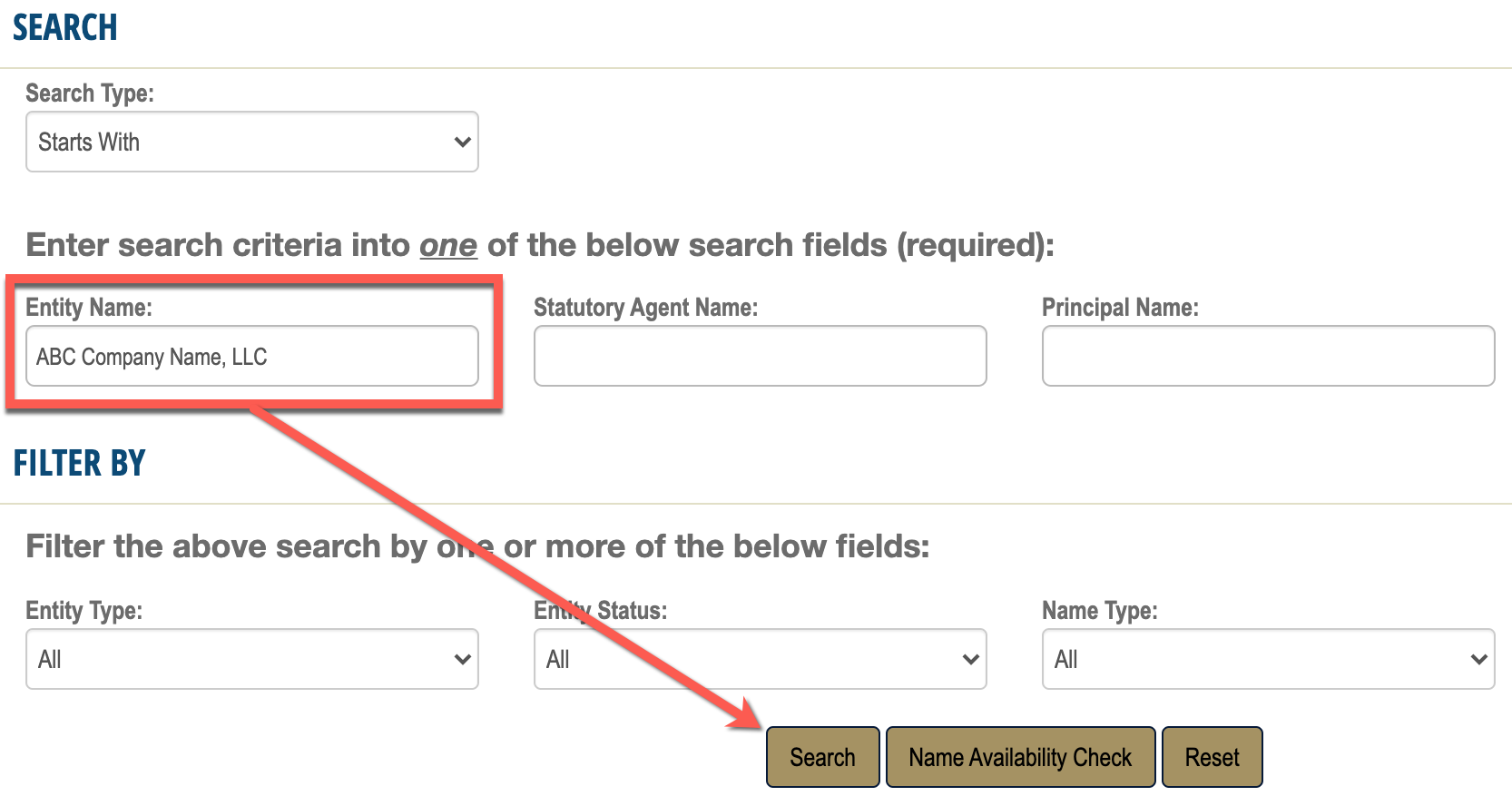

Step 1 – Choose a Business Name

Selecting a suitable business name is the first step in forming an Arizona LLC. It is important to choose a name that is distinguishable from other business names currently registered in the state. If the name already exists, the formation documents will be rejected by the Arizona Corporation Commission (ACC).

Perform a business search to see if another entity is already using the name.

Note on LLC Names:

The entity’s name needs to include the words “limited liability company” or “limited company,” or the abbreviations “LLC,” “L.L.C.,” “LC,” or “L.C.” The name must also satisfy the requirements of Arizona statute § 29-3112.

Reserve a Business Name (Optional)

The desired entity name can be reserved for one hundred and twenty (120) days by filing an Application To Reserve Limited Liability Company Name. Name reservations can be made online, in person, by mail, or by fax. The reservation fee is $10 for all filing methods.

- Reserve Online

- Create an online account.

- Sign in to the Arizona Corporation Commission filing service.

- Select Reserve a Name, then click Reserve an Entity Name.

- Fill out the reservation application.

- Pay the $10 fee with a credit card.

- Reserve by Mail, In Person, or by Fax

- Complete the Application To Reserve Limited Liability Company Name.

- Fill out a Cover Sheet.

- Submit the Application, Cover Sheet, and a $10 filing fee (see filing instructions for payment options).

- Fax Address: (602) 542-4100

- Mail & In-Person Address: Arizona Corporation Commission – Records Section, 1300 W. Washington St., Phoenix, Arizona 85007

Step 2 – Appoint a Statutory Agent

Limited liability companies must appoint a statutory agent for the purpose of receiving legal paperwork and official notices addressed to the company. A statutory agent may be either of the following:

- An individual residing in Arizona (including a company member or manager); or

- A corporation or LLC that is authorized to conduct business in Arizona (an LLC cannot be its own registered agent).

The statutory agent will need to authorize the appointed position in writing. To obtain authorization, have the agent sign a Statutory Agent Acceptance form. A Cover Sheet must then be filled out and attached to the acceptance form. Both of the aforementioned documents are required when registering the entity with the Arizona Corporation Commission.

Step 3 – File with the Arizona Corporation Commission

LLCs will need to register with the ACC to obtain authorization to conduct business in Arizona. Domestic entities are required to file the Articles of Organization. If the LLC is foreign (created in another state or country), it must file a Foreign Registration Statement.

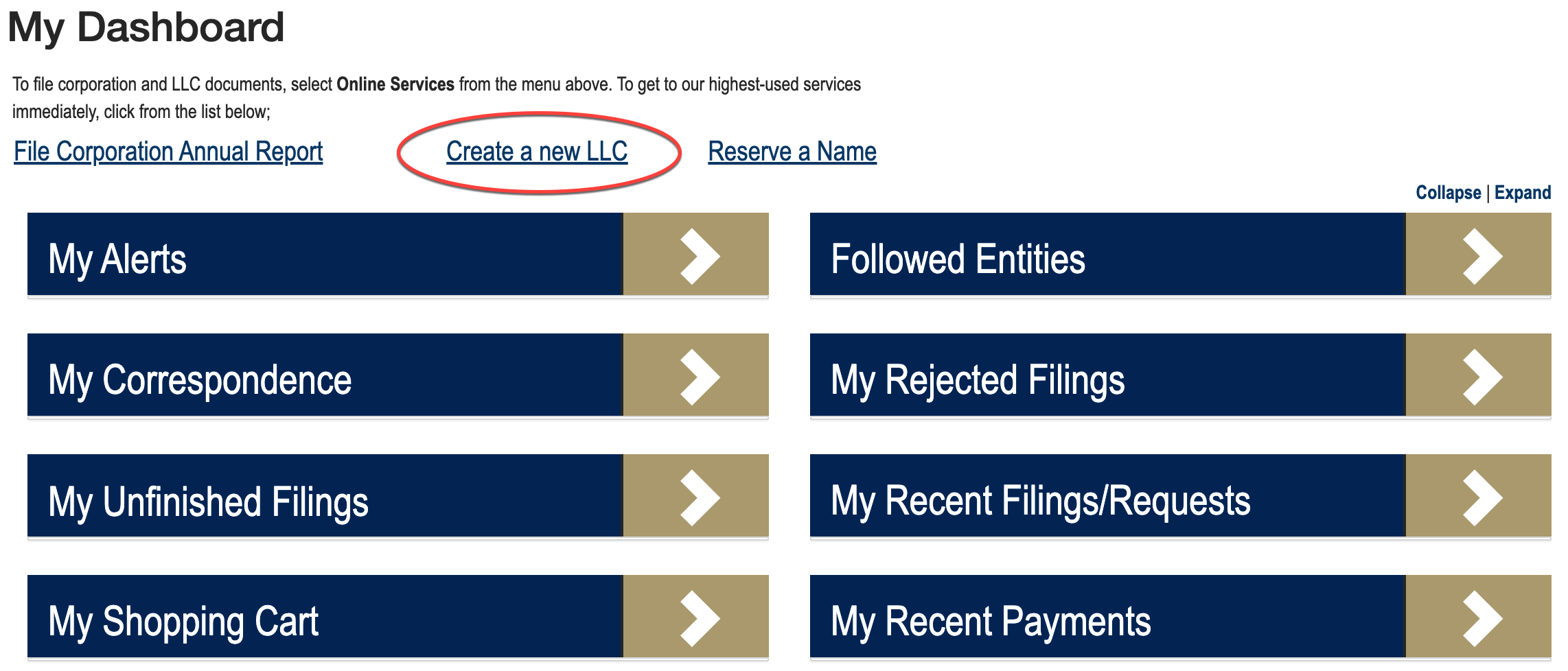

Form a Domestic LLC

The most efficient way to form a domestic entity is to file online. Create a user account and sign in to the eCorp filing service. From there, select Create a New LLC.

Fill out the Articles of Organization by supplying the necessary personal information and business details. Once complete, use a credit card to pay the $50 filing fee.

Domestic LLC paperwork can also be filed by mail, fax, or delivered in person. This process can be accomplished by doing the following:

- Fill out the Articles of Organization and Cover Sheet.

- Attach the Statutory Agent Acceptance form with its Cover Sheet (see Step 2).

- Fill out one (1) of the following structure attachments:

- Member Structure Attachment – For LLCs that will be member-managed.

- Manager Structure Attachment – For LLCs that will be manager-managed.

- File the above-mentioned items and pay the $50 filing fee (review the filing instructions to see the different payment options).

- Fax Address: (602) 542-4100

- Mail & In-Person Address: Arizona Corporation Commission – Examination Section, 1300 W. Washington St., Phoenix, Arizona 85007

Register a Foreign LLC

Foreign entities must file a Foreign Registration Statement in order to register with the ACC. Online filing is not available to foreign LLCs; the registration paperwork needs to be submitted in person, by mail, or by fax.

- Fill out a Foreign Registration Statement and a Cover Sheet.

- Attach the Statutory Agent Acceptance form with its Cover Sheet (see Step 2).

- Complete the applicable structure attachment:

- Member Structure Attachment – For member-managed LLCs.

- Manager Structure Attachment – For manager-managed LLCs.

- Obtain a Certificate of Existence or Certificate of Good Standing (dated within sixty (60) days) from the office where the foreign LLC filed its formation documents.

- Obtain a certified copy of the LLC’s formation documents (dated within sixty (60) days).

- Submit the above-mentioned items to the ACC and pay the $150 filing fee. The ACC accepts several payment options; see filing instructions for more information.

- Fax Address: (602) 542-4100

- Mail & In-Person Address: Arizona Corporation Commission – Examination Section, 1300 W. Washington St., Phoenix, Arizona 85007

Step 4 – Create an Operating Agreement

Arizona limited liability companies should, but are not required to, create an operating agreement that identifies the company owners, describes how the business will be managed, and establishes the company’s operating terms.

Step 5 – Publish a Notice of Formation

Within sixty (60) days after the Articles of Organization has been approved by the ACC, a notice of formation must be published in a newspaper of general circulation in the county where the statutory agent is located (see list of approved newspapers). Publication instructions will be delivered to the LLC by mail shortly after the entity’s formation.

Publication Information:

- The notice needs to be published in three (3) consecutive publications.

- The newspaper will issue an Affidavit of Publication once the publications are complete. Although not required, the Affidavit of Publication may be filed with the ACC.

- The LLC is not required to publish a notice of formation if the statutory agent’s address is in Maricopa or Pima county.

Step 6 – Apply for an EIN

An Employer Identification Number (EIN) is issued to business entities by the IRS for tax administration, reporting, and identification purposes. While an EIN isn’t technically required for all LLCs, it must be obtained if the company has employees, multiple members, or if the LLC will apply for business licenses or request bank financing.

An EIN can be requested using any of the following methods:

- Online – Select Apply Online Now.

- Paper Application (Form SS-4) – Mail or fax the application to the applicable address below.

- Fax Address: (855) 641-6935

- Mailing Address: Internal Revenue Service, Attn: EIN International Operation, Cincinnati, OH 45999

ResourcesFiling Options: Online, Mail, Fax, & In Person Costs:

Forms:

Links:

|