An operating agreement also prevents the company from being mistaken as another entity type. Unlike an LLC, the owners of a partnership or sole proprietorship are personally liable for the entity’s debts and obligations.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title XXXVI, Chapter 605

- Definitions: § 605.0102

- Formation: § 605.0201

- Naming of LLCs: § 605.0112

How to File (6 Steps)

- Step 1 – Choose an Entity Name

- Step 2 – Designate a Registered Agent

- Step 3 – File the Articles of Organization

- Step 4 – Create an LLC Operating Agreement

- Step 5 – Apply for an EIN

- Step 6 – File Annual Report

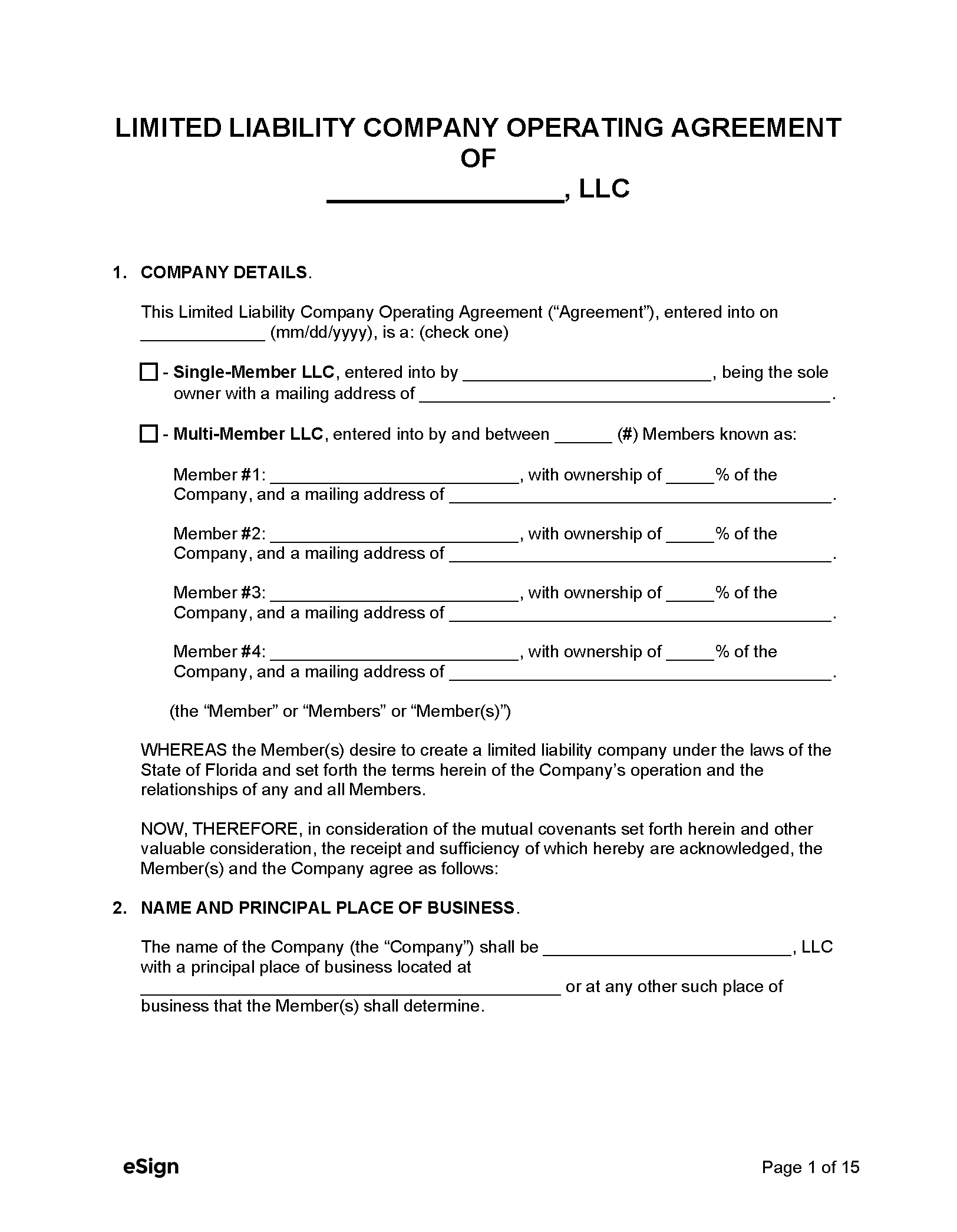

Step 1 – Choose an Entity Name

Before attempting to form an LLC in Florida, the person creating the business should check the availability of the entity’s name. Search the Division of Corporations’ records to see if another business has already taken the proposed name.

The name of an LLC must comply with Florida statute § 605.0112. According to this law, the company name must contain one (1) of the following words or abbreviations: “limited liability company,” “LLC,” or “L.L.C.”

Fictitious Name Registration:

If an LLC intends to conduct business using a name other than the one recorded with the Division of Corporations, a fictitious name will be required. For example, an LLC with the legal name of “John Smith Industrial Painters” may wish to operate under a different name for branding purposes. So, the LLC could register the fictitious name of “Painting Done Quick.”

- Register a fictitious name online, or use the paper application to register through the mail.

- Pay the $50 registration fee.

- Review the fictitious name registration guide to obtain comprehensive filing instructions.

Step 2 – Designate a Registered Agent

Each LLC is required to designate a registered agent, which is an individual or legal entity that accepts mail and service of process (court-issued paperwork) on behalf of the LLC. In Florida, a registered agent must meet the following requirements:

- Be available during normal business hours;

- Have a physical address in Florida (P.O. boxes are not permitted); and

- Have an active business registration/filing status in Florida (if an entity).

Step 3 – File the Articles of Organization

In order for an LLC to transact business legally in Florida, it will need to register with the Division of Corporations and pay a $125 fee. Registration documents can be submitted online (domestic entities only), through the mail, and in person.

File a Domestic (US-based) LLC:

- Online

- Access the Division of Corporations’ E-Filing service (select the checkbox to accept the terms of service, then click Start New Filing).

- Supply the requisite personal and business information.

- Pay the $125 filing fee (payable with a credit card, debit card, or Sunbiz E-File account).

- By Mail or In Person

- Complete the Articles of Organization.

- Print the Articles of Organization and sign it by hand.

- Attach a $125 check made out to the “Florida Department of State.”

- Deliver the Articles of Organization and filing fee to the appropriate address below.

- Mailing Address – New Filing Section, Division of Corporations, P.O. Box 6327, Tallahassee, FL 32314.

- Street Address – New Filing Section, Division of Corporations, The Centre of Tallahassee, 2415 N. Monroe Street, Suite 810, Tallahassee, FL 32303.

Register a Foreign LLC:

- By Mail or In Person

- Obtain a Certificate of Existence from the official office with custody of the foreign LLC’s records in the jurisdiction where the entity is organized. The certificate must be dated within ninety (90) days of registration in Florida.

- Fill out the Application by Foreign LLC for Authorization to Transact Business in Florida.

- Print the application and sign it by hand.

- Attach a $125 check payable to the “Florida Department of State.”

- Send all items to the appropriate address below:

- Mailing Address – Registration Section, Division of Corporations, P.O. Box 6327, Tallahassee, FL 32314.

- Street Address – Registration Section, Division of Corporations, The Centre of Tallahassee, 2415 N. Monroe Street, Suite 810, Tallahassee, FL 32303.

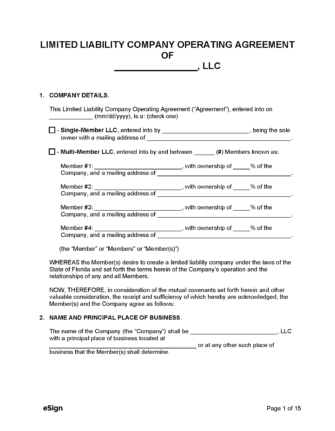

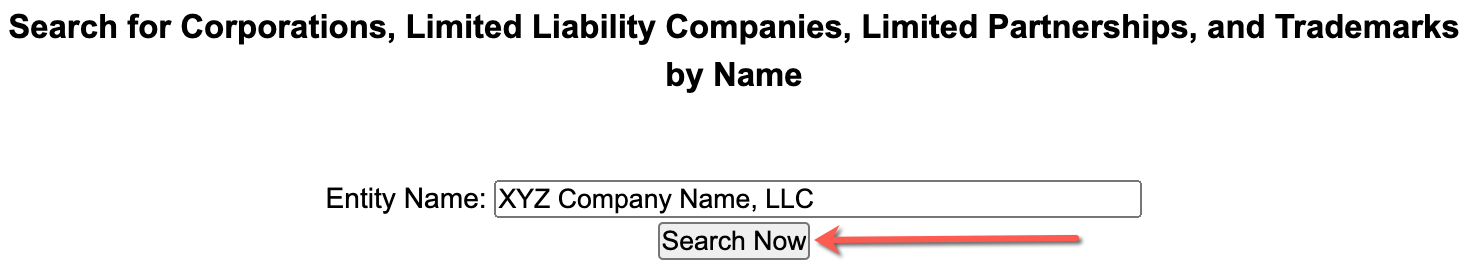

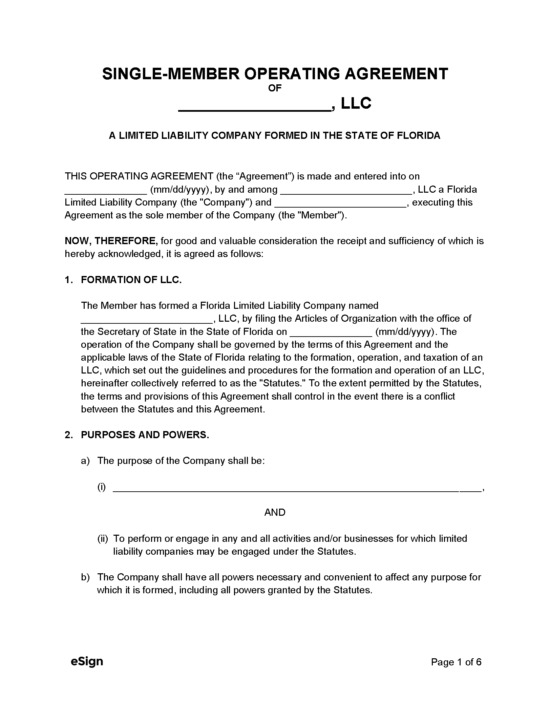

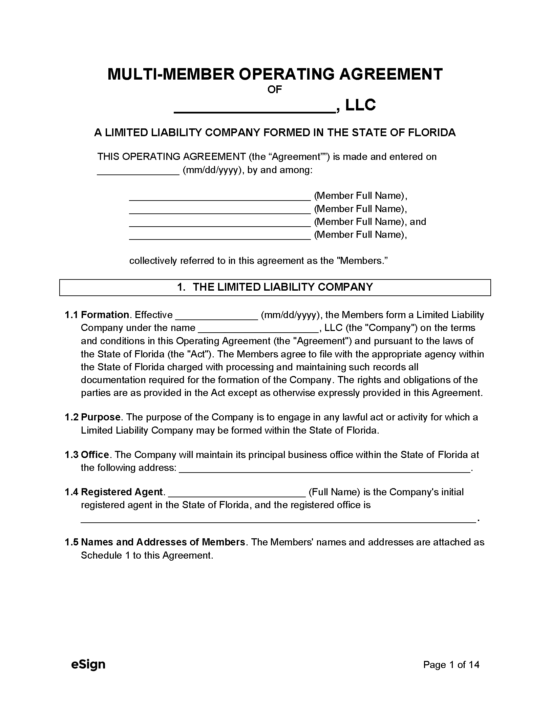

Step 4 – Create an LLC Operating Agreement

As with most other states, Florida LLCs do not have to create an operating agreement, although drafting one is highly recommended. An operating agreement allows the entity to establish its membership structure and define the rules and regulations of the company.

Step 5 – Apply for an EIN

A nine-digit number known as an EIN, or Employer Identification Number, is given to business entities by the IRS for tax identification and reporting purposes. While an EIN isn’t required for all LLCs, it will be needed if the company wants to hire employees, obtain a loan, or apply for business licenses.

An EIN can be applied for online (select Apply Online Now) or through the mail by filing Form SS-4.

Step 6 – File an Annual Report

LLCs will need to file an annual report to maintain an active status with the Division of Corporations. The first annual report is due between January 1st and May 1st on the year following the year of formation/registration. Reports must be filed online and will require a $138.75 filing fee.

Resources

Filing Options: Online, Mail, & In-Person

Costs:

- Domestic filing fee: $125

- Foreign filing fee: $125

- Fictitious name registration: $50

- Annual report: $138.75

Forms:

- Articles of Organization for Florida Limited Liability Company (Online) (PDF)

- Application by Foreign LLC for Authorization to Transact Business in Florida (PDF)

Links:

- File online: Sunbiz E-Filing Service

- Entity search: Division of Corporation Name Search

- Obtain a business license: