Is an Operating Agreement Required in Hawaii?

No – Hawaii doesn’t require operating agreements, but they’re highly recommended and are generally executed when the LLC is formed.

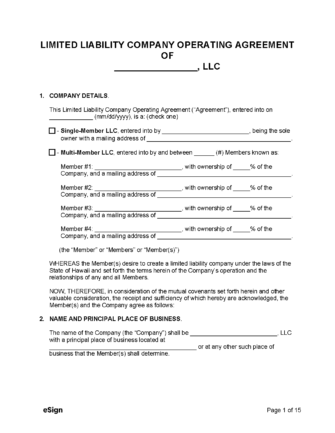

Types (2)

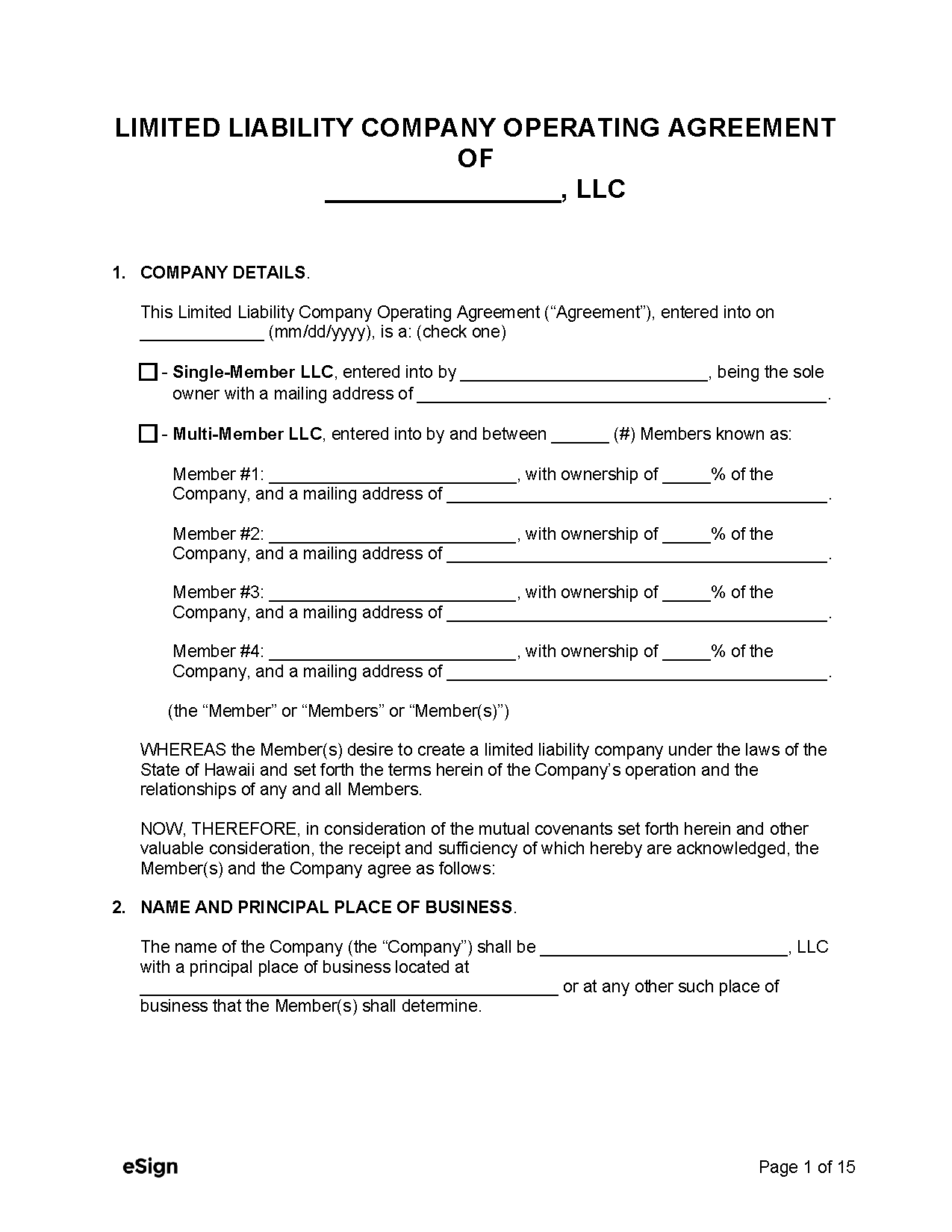

Single-Member LLC Operating Agreement – Allows an LLC with a single owner to define its operating procedures. Single-Member LLC Operating Agreement – Allows an LLC with a single owner to define its operating procedures.

|

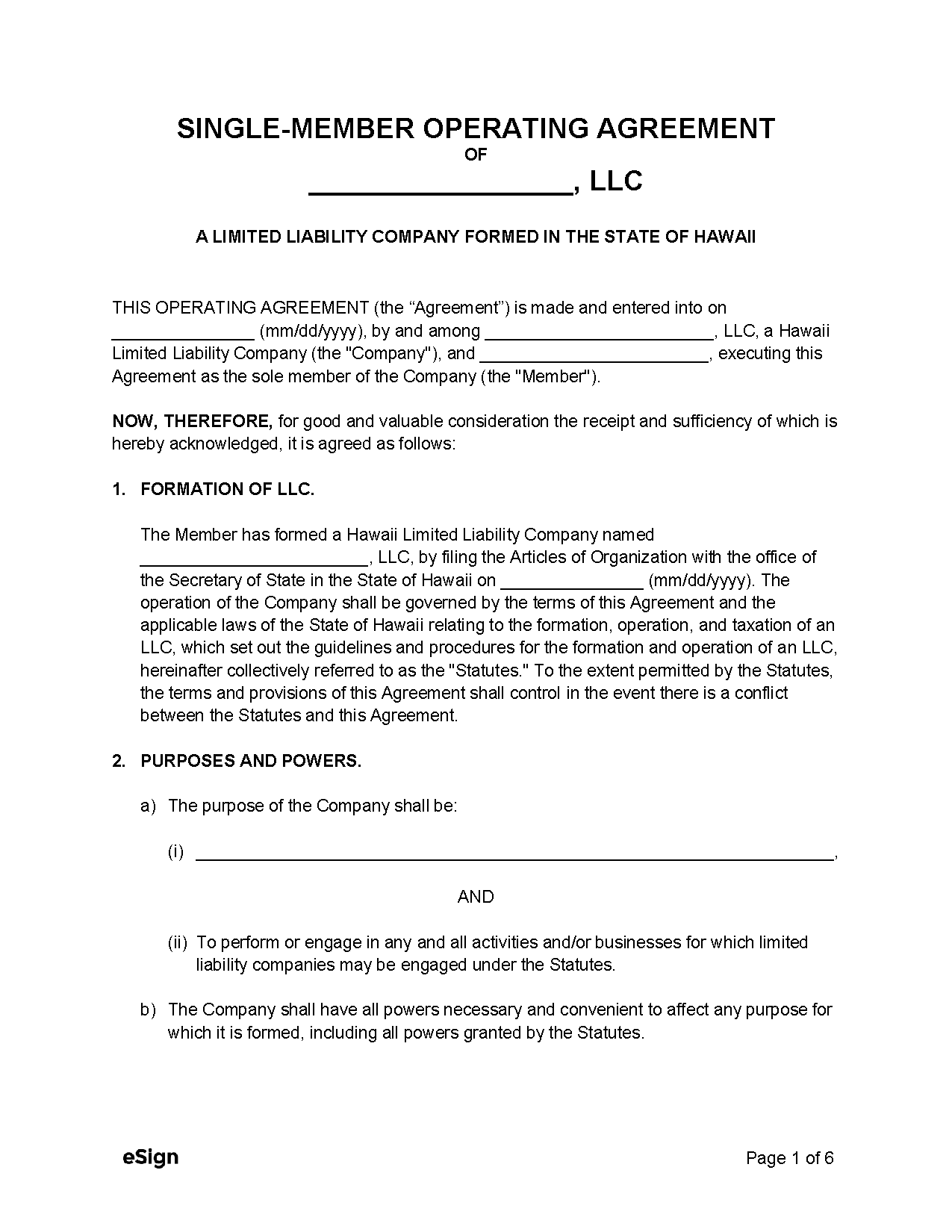

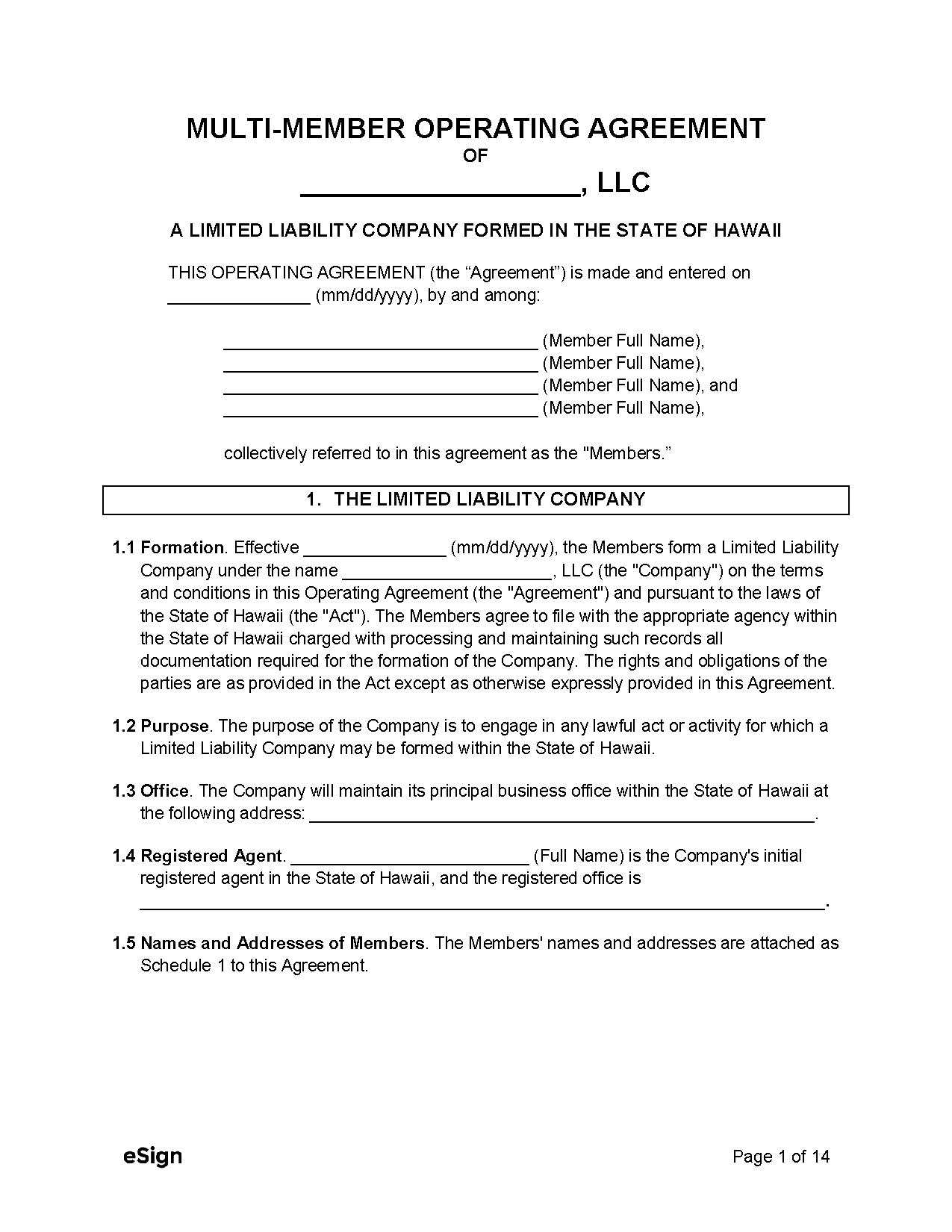

Multi-Member LLC Operating Agreement – Binds multiple members to a set of operating policies for their LLC. Multi-Member LLC Operating Agreement – Binds multiple members to a set of operating policies for their LLC.

|