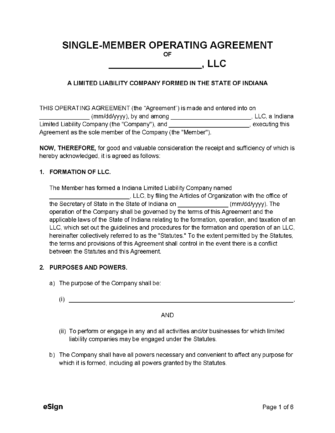

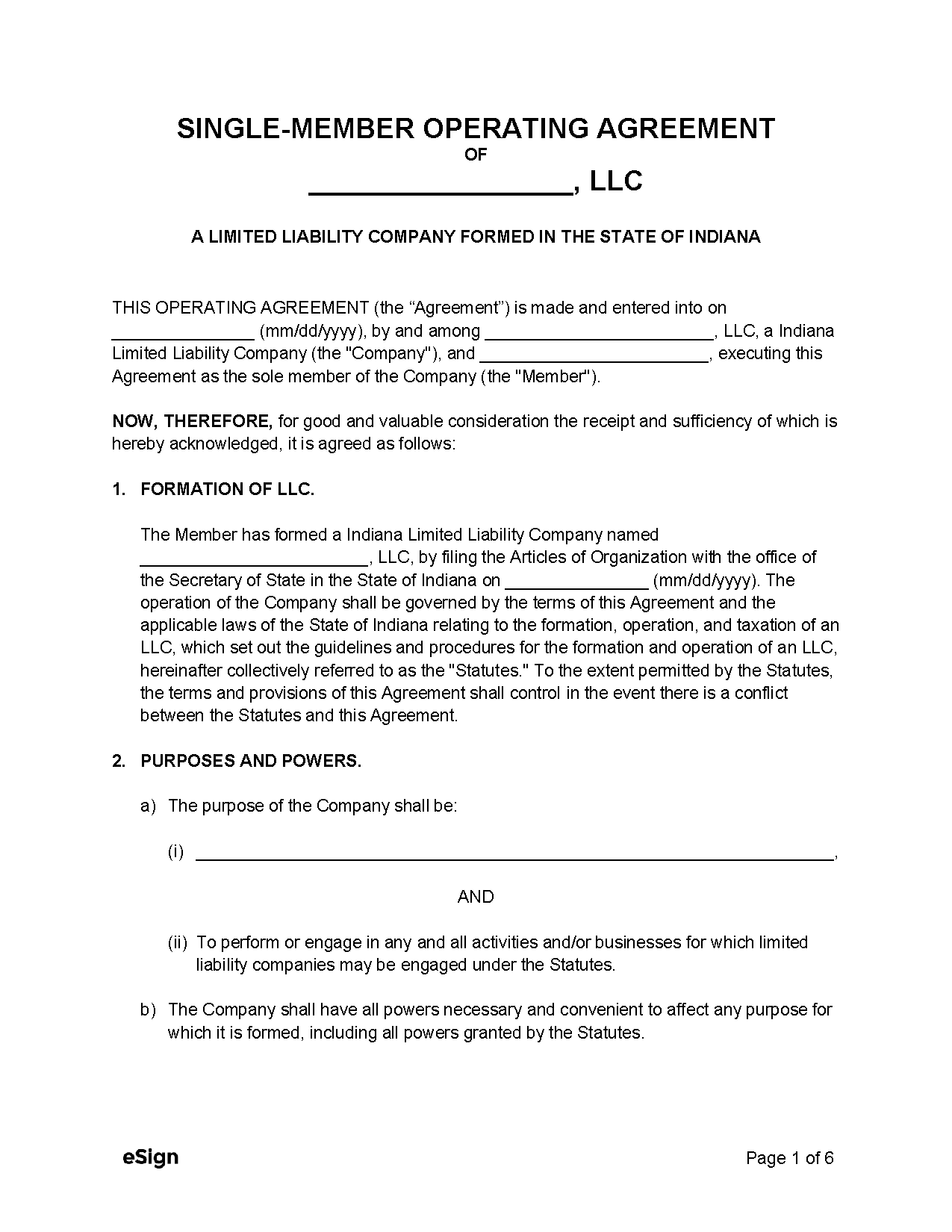

Indiana Single-Member LLC Operating Agreement

Last updated October 27th, 2025

An Indiana single-member LLC operating agreement relays the provisions that govern how a limited liability company operates internally. It provides a framework for handling profits and losses, business decisions, company property, and legal matters. The agreement also emphasizes that the owner is not personally liable for claims brought against the company.