This form is not required by the state of Massachusetts; however, completing an operating agreement is highly advisable as it protects each member from any company debts, liabilities, and obligations.

Contents |

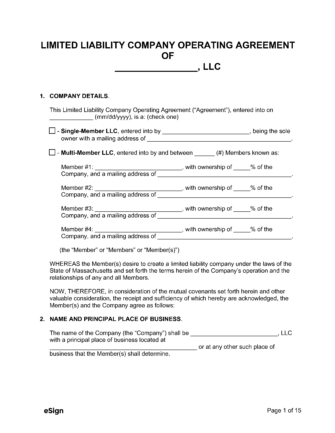

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 156C

- Definitions: Chapter 156C, Section 2

- Formation: Chapter 156C, Section 12

- Naming of LLCs: Chapter 156C, Section 3

How to File (6 Steps)

- Step 1 – Reserve the Entity Name

- Step 2 – Select a Registered Agent

- Step 3 – File a Certificate of Organization

- Step 4 – Create an Operating Agreement

- Step 5 – Obtain an EIN

- Step 6 – File Annual Reports

Step 1 – Reserve the Entity’s Name

The name of each LLC must be unique, and cannot be the same as, nor too similar to the name of any other corporation or LLC in the commonwealth unless explicit consent is given. The Secretary of the Commonwealth of Massachusetts Business Entity Search may be used to verify the availability of names.

As stated in Chapter 156C, Section 3, “Limited Liability Company,” “Limited Company,” or the abbreviation “L.L.C.,” “L.C.,” “LLC,” or “LC,” must be included in the chosen entity name.

When the name has been chosen, it may be reserved by delivering the following to the Secretary of the Commonwealth:

-

- Complete the Application of Reservation of Nam

- Write a $30 check payable to the Secretary of the Commonwealth.

- Mail or deliver both items to: One Ashburton Place, Room 1717, Boston, Massachusetts 02108-1512

Step 2 – Select a Registered Agent

In Massachusetts, every LLC must appoint a registered agent to receive service of process and other legal documents on behalf of the company. The registered agent may be an individual who resides in the state, a domestic or foreign corporation, or LLC that is legally allowed to do business and has a mailing address in Massachusetts

Step 3 – File a Certificate of Organization

Filing a Certificate of Organization with the Secretary of the Commonwealth legitimizes the limited liability company in the eyes of the state.

Method 1 – Online

Go to the Corporation Online Filing System, fill out the form, and click the Click here to submit this information button when complete. Foreign companies cannot use this method.

- Cost: $520

Method 2 – Mail

Domestic Companies

To file by mail, fill out the LLC Certificate of Organization form, print and sign the document, and send it to:

- Secretary of the Commonwealth, One Ashburton Place, Room 1717, Boston, Massachusetts 02108-1512.

- Cost: $500

Foreign Companies

Fill out and print the Foreign Limited Liability Company Application for Registration form. It must be signed and sworn to by a general partner of the company. The completed form may be delivered in the following manners:

- Delivered in-person or mailed to: Secretary of the Commonwealth, One Ashburton Place, Boston, Massachusetts 02108-1512

- Delivered via the fax instructions on the Secretary of the Commonwealth website.

The cost to file the Foreign Limited Liability Application for Registration is $500; an additional $20 will be required if filed by fax.

Note on Foreign Applications

Foreign applications require a Certificate of Existence or a Certificate of Good Standing issued from the entity’s state of origin.

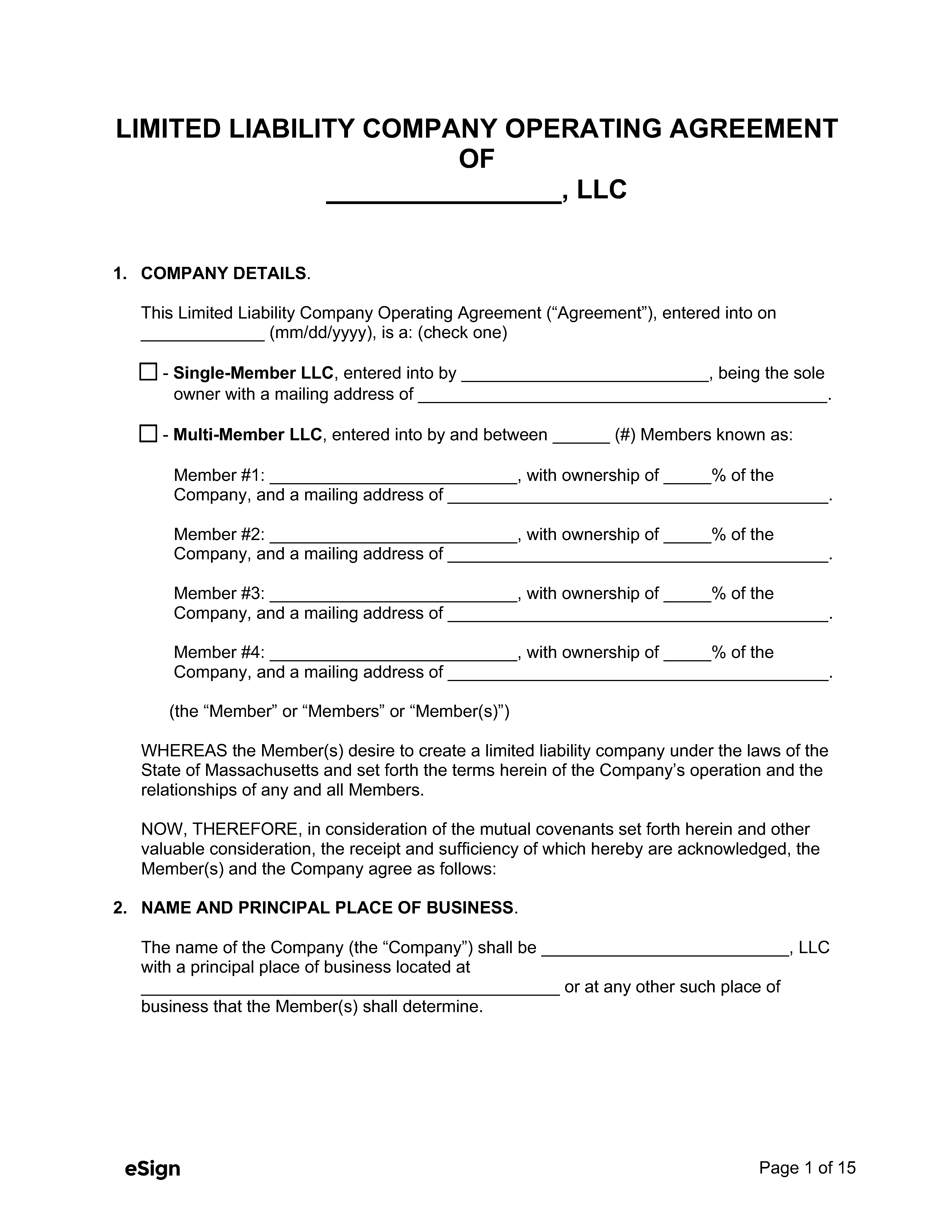

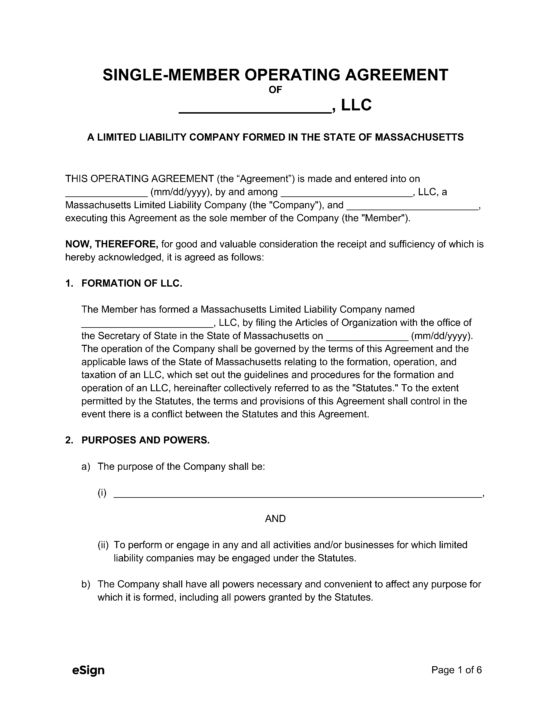

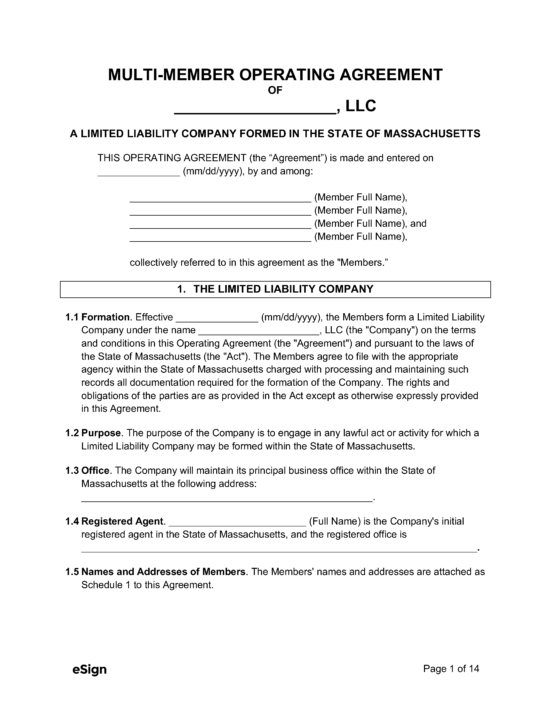

Step 4 – Create an Operating Agreement

Although not legally required in Massachusetts, executing an operating agreement will improve the company’s organization, how it will run, and clearly define its members’ obligations. The form gives company owners the ability to structure their business and inner management as they see fit.

Furthermore, in the event the company faces litigation or debt, the operating agreement serves to limit its owner’s liability.

Step 5 – Obtain an EIN

An EIN (Employer Identification Number) is required in nearly every case for tax reporting purposes. The exception is a single-member LLC that doesn’t wish to be taxed as a corporation and has no employees.

An EIN may be obtained by applying through the Internal Revenue Service (IRS) website and selecting the Apply Online Now button. A paper Application for EIN (Form SS-4) may be used if applying by mail.

Step 6 – File Annual Reports

Every LLC, domestic and foreign, must file an annual report containing all information required to be included in the Certificate of Organization. The report must be filed on or before the date the original certificate was filed.

The filing fee is $500, and the report can be filed online or by mail (Domestic|Foreign).

ResourcesFiling Options: Online (Domestic Only) or by Mail Costs:

Forms:

Links:

|