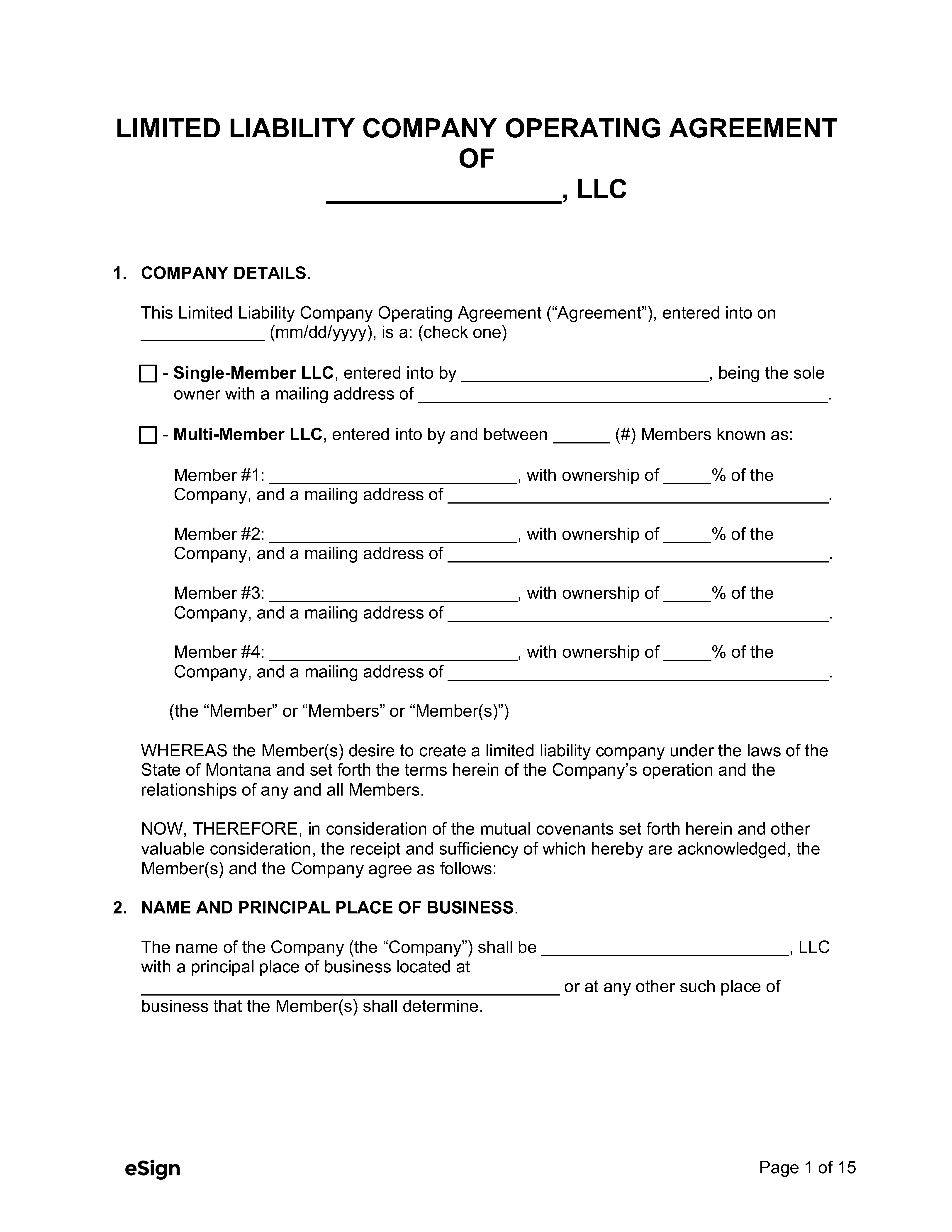

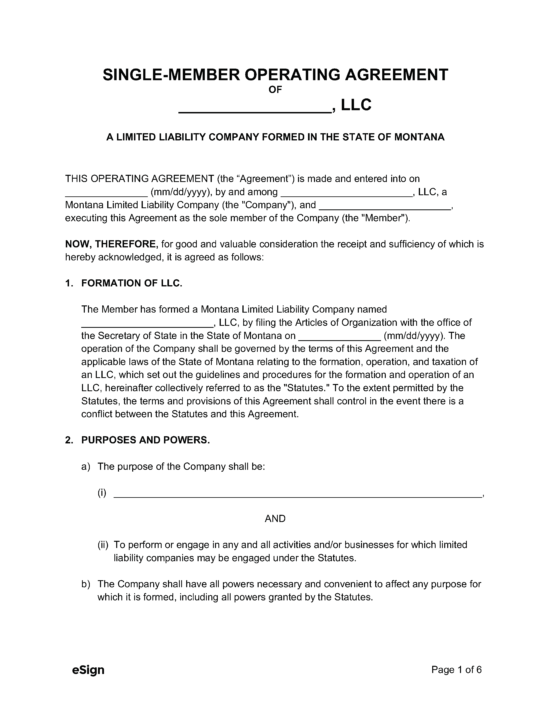

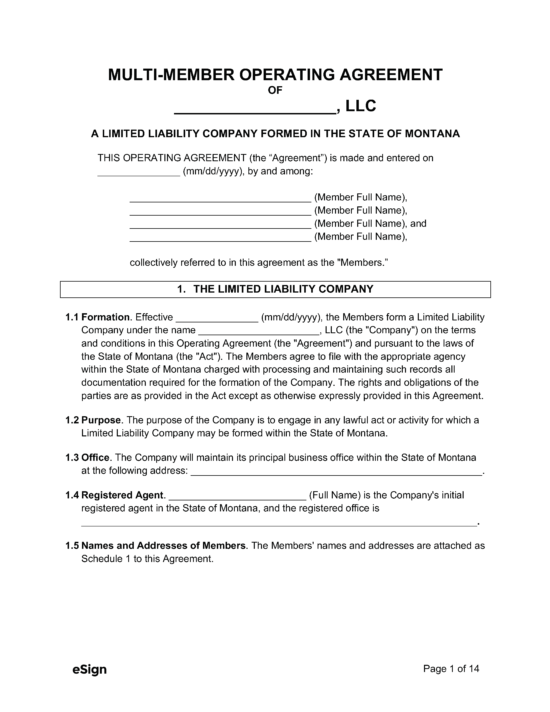

Is an Operating Agreement Required?

No – Montana LLCs can legally operate without an agreement. Nevertheless, it is recommended to draft one because it allows the members to structure and organize their company as they see fit.

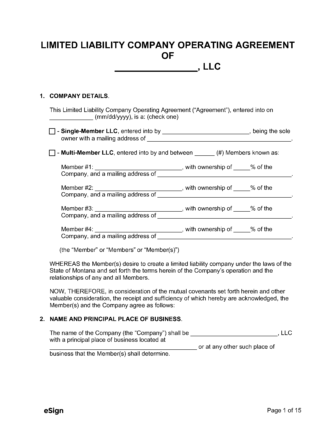

Types (2)

Single-Member LLC Operating Agreement – LLCs with one owner may use this form. Single-Member LLC Operating Agreement – LLCs with one owner may use this form.

|

Multi-Member LLC Operating Agreement – LLCs with more than one owner should use this document. Multi-Member LLC Operating Agreement – LLCs with more than one owner should use this document.

|