Nebraska law does not require that an operating agreement be executed; however, in the absence of this document, state law will dictate the operating rules of the LLC. Furthermore, the agreement aids in the protection of members from company debts and potential lawsuits.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 21 (Sections 21-101 to 21-197 and 21-501 to 21-542)

- Definitions: § 21-102

- Formation: § 21-117

- Naming of LLCs: § 21-108

How to File (7 Steps)

- Step 1 – Choose Entity Name

- Step 2 – Select a Registered Agent

- Step 3 – File a Certificate of Organization

- Step 4 – Create an Operating Agreement

- Step 5 – Publication Requirements

- Step 6 – Obtain an EIN

- Step 7 – File Biennial Reports

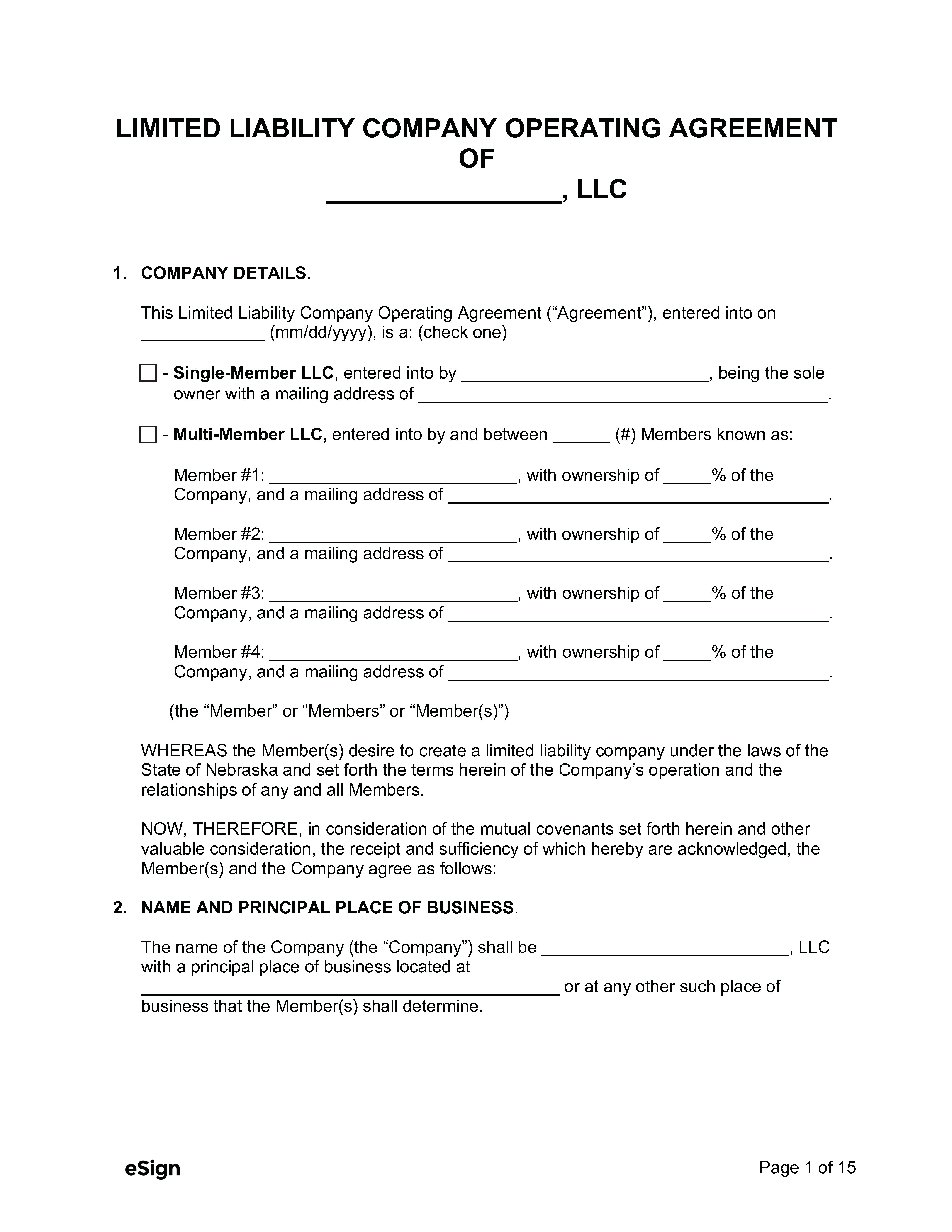

Step 1 – Choose Entity’s Name

Every LLC must have an original name that is different from any other business entity on file with the Secretary of State. Name availability may be checked online with the Corporate & Business Search. The online check may not be definitive proof that the name is available, therefore a written request must be sent to the Secretary of State via:

- E-mail: sos.corp@nebraska.gov

- Fax: (402) 471-3666

- Mail: P.O. Box 94608, Lincoln, NE 68509-4608

Once a suitable name has been selected, it may be reserved for up to 120 days by filing the Application for Reservation of Limited Liability Company Name. The form must be mailed to the below address with a $30 check made out to the “Secretary of State.”

Secretary of State

P.O. Box 94608

Lincoln, NE 68509

Step 2 – Select a Registered Agent

Every LLC in the state of Nebraska must select a registered agent to receive service of process and other official documents on behalf of the LLC. The designated agent may be an individual resident of Nebraska or an entity authorized to conduct business in the state. The registered agent must have a physical address in the state of Nebraska.

Step 3 – File a Certificate of Organization

The LLC must file with the Nebraska Secretary of State in order to be seen as legitimate in the eyes of state authorities. Domestic LLCs will file a Certificate of Organization; foreign LLCs must submit an Application for Certificate of Authority.

There is no state-provided Certificate of Organization form. Founding members will have to draft their own using the guidelines set out in § 21-117.

Method 1 – Online

Domestic Companies

To file online:

-

- Navigate to the Corporate Document eDelivery portal

- Click selecting entity type in the dropdown menu, select Domestic Limited Liability Company, and click continue.

- Enter the entity name, designated office, and effective date of filing.

- Click Choose File to upload your certificate.

- Click Continue, and follow the remaining instructions.

- The online filing fee is $100 and may be paid via credit card.

Foreign Companies

- Navigate to the Corporate Document eDelivery portal

- Click selecting entity type in the dropdown menu, select Foreign Limited Liability Company, and click continue.

- Enter the entity name, State/Jurisdiction of Organization, the principal office address, and effective date of filing.

- Click Choose File to upload your certificate; the first page of the PDF must be the Application for Certificate of Authority.

- Click Continue, and follow the remaining instructions.

- An original Certificate of Existence from the initial jurisdiction must be provided with the Certificate of Authority.

- The filing fee is $100 + an additional $10 for the Certificate of Existence and may be paid by credit card.

Method 2 – Mail or In-Person

The Certificate of Organization and Application for Certificate of Authority may be submitted by mail or in-person at the following address:

Secretary of State

P.O. Box 94608

Lincoln, NE 68509

Foreign LLCs must also provide an original Certificate of Existence and the Certificate of Authority.

For both foreign and domestic applications, a check or money order made out to “Secretary of State” may be used to pay the filing fee of $110.

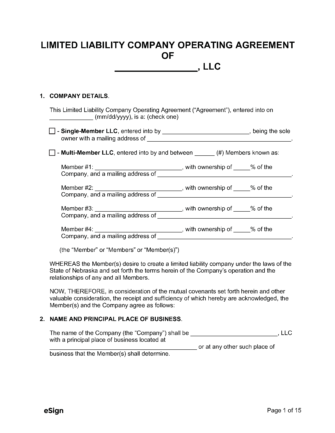

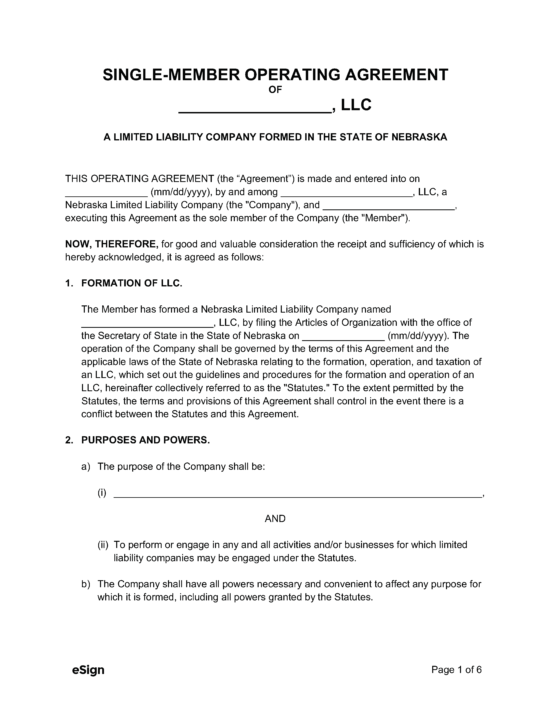

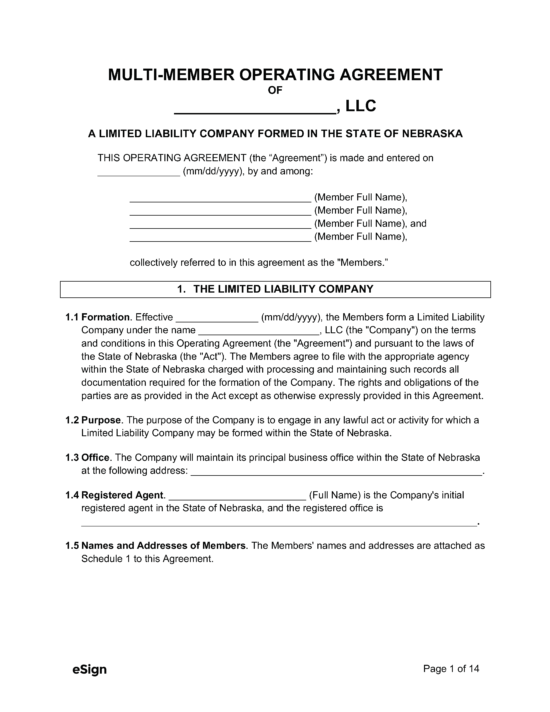

Step 4 – Create an Operating Agreement

Although not a legal requirement in the state of Nebraska, the creation of an operating agreement is highly recommended as it gives owners the power to govern the internal policies of the LLC. It also serves to protect members from litigation and company debts.

Step 5 – Publication Requirements

As stated in § 21-193, a notice of organization must be published in a legal newspaper of general circulation near the LLC’s designated office for three (3) consecutive weeks. Once completed, the newspaper will furnish the LLC with an affidavit of publication, and this must be filed with the Secretary of State.

Step 6 – Obtain an EIN

An Employer Identification Number (EIN) must be applied for by each multi-member LLC, as well as any single-member LLC that plans to hire workers or be taxed as a corporation instead of a sole proprietorship. This 9-digit IRS identifier can be obtained in either of the following ways:

- Online: Online Application

- By Mail: Form SS-4

Step 7 – File Biennial Reports

LLCs in Nebraska must file a report every two (2) years with the Secretary of State. These are due by April 1st of every odd-numbered year. The report may be filed online or by mail to: Nebraska Secretary of State, PO Box 94608, Lincoln, NE 68509-4608.

ResourcesFiling Options: Online, in-person, or by mail Costs:

Forms:

Links:

|