Though it is not legally required, company owners should draft an agreement so they may run their business as they see fit. If the operating agreement is not executed, state LLC law will govern how the company operates.

Contents |

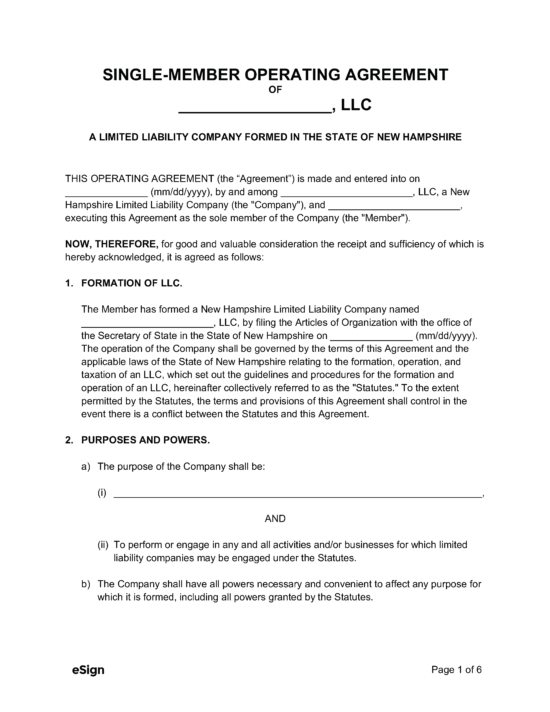

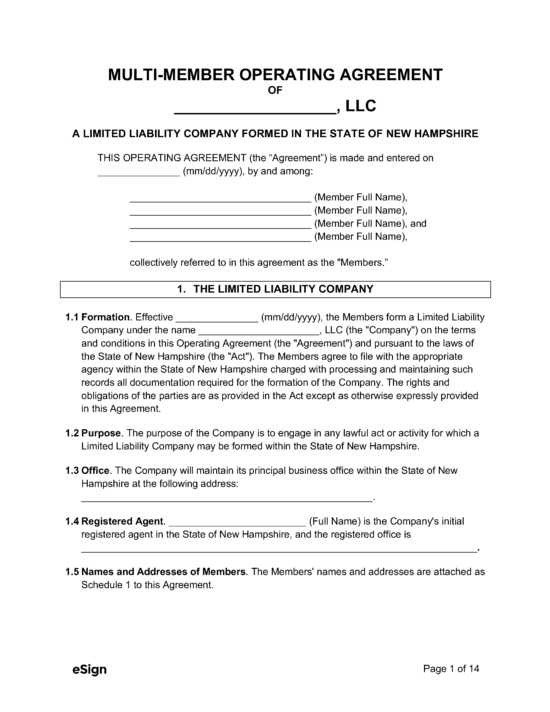

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 304-C

- Definitions: Section: 304-C:6-C18

- Formation: Section: 304-C:31

- Naming of LLCs: Section 304-C:32

How to File (6 Steps)

- Step 1 – Choose Entity Name

- Step 2 – Select a Registered Agent

- Step 3 – File a Certificate of Formation

- Step 4 – Create an Operating Agreement

- Step 5 – Obtain an EIN

- Step 6 – File Annual Report

Step 1 – Choose Entity Name

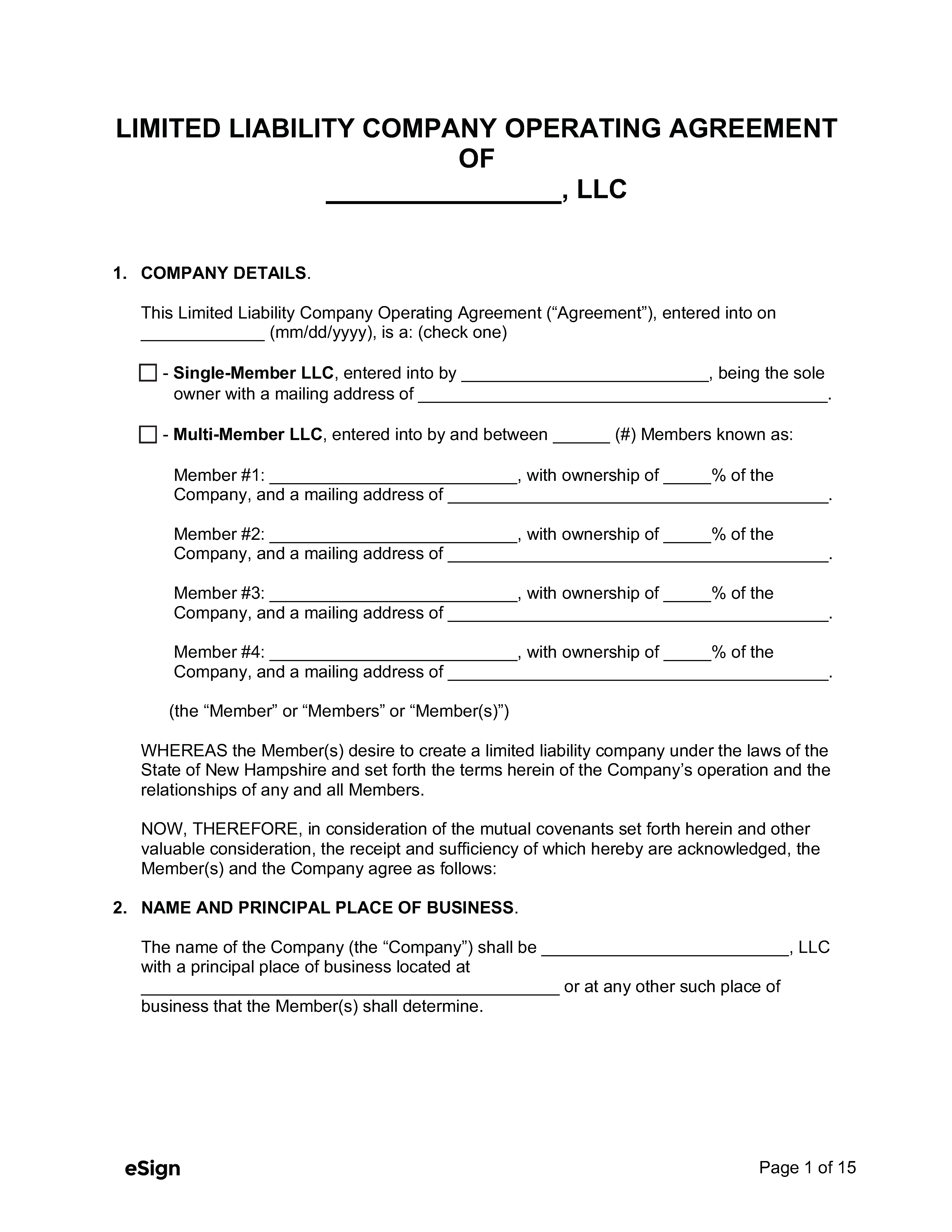

LLC names in New Hampshire must be unique and discernable from all other LLCs on file with the Secretary of State. Availability may be checked with the New Hampshire Department of State Business Search tool.

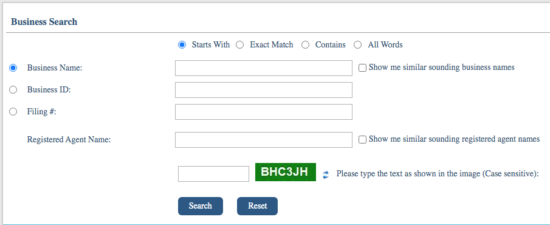

Once the desired name has been deemed unique, it may be reserved for a period of up to 120 days by filing an Application of Reservation of Name. This form may be filed online with the creation of a new NH QuickStart account.

The Application of Reservation of Name may also be filed by mailing the document to the address below with a $15 filing fee. The filing fee may be paid with a check made out to the State of New Hampshire.

Corporation Division,

NH Dept. of State,

107 N Main St, Rm 204,

Concord, NH 03301-4989

Step 2 – Select a Registered Agent

The state of New Hampshire requires that every LLC appoint an agent for service of process. The registered agent may be an individual resident of New Hampshire, or it may be a business entity that has the authorization to do business in the state. The selected agent is required to have a physical street address in New Hampshire.

Step 3 – File a Certificate of Formation

Once submitted and approved by the Secretary of State, the Certificate of Formation creates the Limited Liability Company in the eyes of the state.

Domestic LLCs are to file a Certificate of Formation while foreign LLCs file an Application for Foreign Limited Liability Company Registration.

Method 1 – Online

Both domestic and foreign entities may file online with the NH QuickStart portal.

- Go to the NH QuickStart Page and click Create A Free Account.

- Once the account has been created, on the NH QuickStart side menu, click Business Services.

- Select Create a Business Online.

- Follow the appropriate prompts and pay the filing fee (see below).

Method 2 – Mail

Domestic entities should complete the Form LLC-1 Certificate of Formation.

Foreign entities must complete the FLLC-1 Application for Foreign Limited Liability Company Registration.

Once completed and signed, it must be printed on 8.5″ x 11″ paper in black ink. The original document must be submitted to the address below accompanied by the filing fee.

Corporation Division,

NH Dept. of State,

107 N Main St, Rm 204,

Concord, NH 03301-4989

Note on Fees:

The fee for filing a registration document is $100 for both foreign and domestic entities. Any checks should be made payable to the State of New Hampshire. All forms filed online will have an additional $2 surcharge.

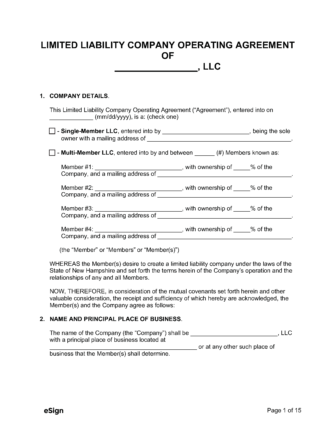

Step 4 – Create an Operating Agreement

New Hampshire has no law that states LLCs must execute an operating agreement; however, owners who choose to create an operating agreement will have more control over how the internal structure of their LLC is organized. The agreement also serves to protect members in the event that the company is sued or acquires debt. The document may be executed before, during, or after the Certificate of Formation is submitted to the Secretary of State.

Step 5 – Obtain an EIN

Every LLC must acquire an Employer Identification Number (EIN) from the Internal Revenue Service (IRS), with the exception being a single-member LLC with no employees that plans to file taxes as a sole-proprietorship.

The IRS provides an electronic application on their website and a paper application that may be submitted by mail to

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

Step 6 – File Annual Report

Every LLC authorized to do business in the state of New Hampshire must file an annual report to keep business information up to date with the Secretary of State.

The deadline for this report is April 1st of each calendar year and the filing must be submitted online via the NH QuickStart portal.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|