Content |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 18 (Corporations) § 18-2000 through § 18-2060

- Definitions: §18-2001

- Formation: §18-2002

- Naming of LLCs: §18-2008

How to File (5 Steps)

- Step 1 – Choose an Entity Name

- Step 2 – File LLC Forms with Secretary of State

- Step 3 – Execute an Operating Agreement

- Step 4 – Obtain an EIN from the IRS

- Step 5 – Annual Certificate

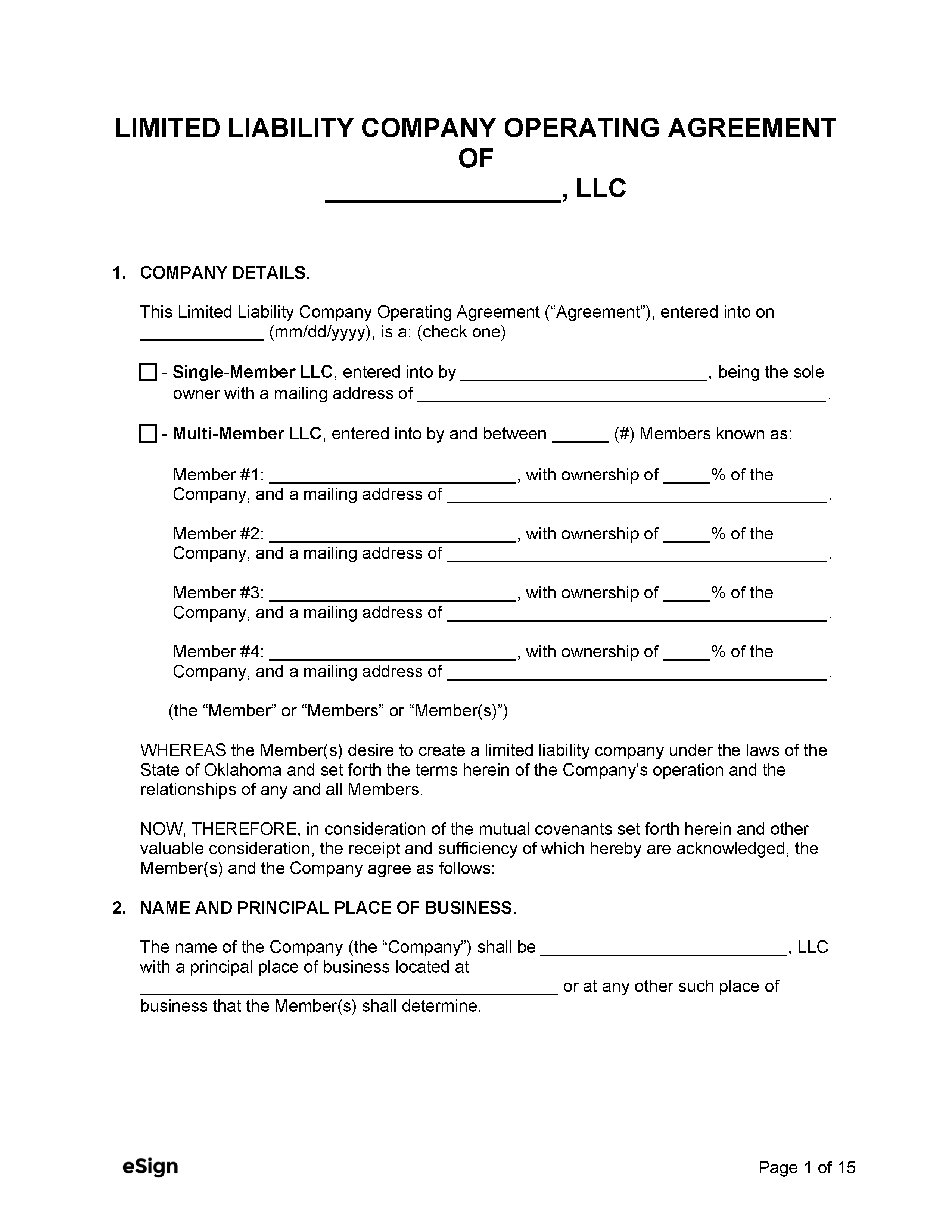

Step 1 – Choose an Entity Name

Oklahoma law specifies that the chosen name cannot be confused with an entity name that is already registered. Therefore, new LLCs will need to find a name that is unique and easily distinguishable from existing business names. The name must include one (1) of the following designations:

- Limited Liability Company

- Limited Company

- LLC

- LC

- L.L.C.

- L.C.

The word “limited” can be abbreviated as “LTD.” and “Company” can be abbreviated as “CO.”

To verify if an entity name is unique, search for any similar names on the Business Entities Search. If a significantly similar name is found, other names must be searched for until a unique one is discovered.

Before an LLC’s formation, a unique name can be reserved for a one hundred twenty (120) day period. To reserve the entity name, file a completed Application for Reservation of Name (Form 0034) with the Secretary of State (address below) and pay the $10 filing fee (check or money order payable to “Ohio Secretary of State”). Entity names can also be filed online.

Secretary of State

421 N.W. 13th, Suite 210

Oklahoma City, Oklahoma 73103

Step 2 – File LLC Forms with Secretary of State

The legal founding of an LLC occurs when the Articles of Registration are filed with the Secretary of State. Filing can be completed online, by mail, or in person.

Foreign LLCs (companies that are already registered in another state) are required to file an Application for Registration and a Certificate of Good Standing, Certificate of Existence, or Certificate of Fact issued by their state of origin and dated within the last sixty (60) days before filing.

File Online

- Navigate to the Entity Filing webpage.

- Click on the appropriate link Domestic Limited Liability Company for a new company or Foreign Limited Liability Company for a company based in another state.

- The user will be required to enter their personal name and email address in the indicated fields before clicking Continue.

- On the next page, click Start New beneath “Start a New Work ID” to create an online profile.

- Fill in the fields to create the required forms:

- Domestic LLC: Articles of Organization

- Foreign LLC: Application for Registration and Certificate of Existence (or equivalent document)

- Pay the filing fee (credit card required):

- Domestic LLC filing fee: $100

- Foreign LLC filing fee: $300

File By Mail / In Person

- Complete the required form(s):

- Domestic LLC: Articles of Organization

- Foreign LLC: Application for Registration and Certificate of Existence (or equivalent document)

- Mail or hand-deliver the form(s) to the below address and pay the required fee. If the forms are sent by mail, include the payment by check or money order payable to “Oklahoma Secretary of State.”

- Domestic LLC filing fee: $100

- Foreign LLC filing fee: $300

- Additional same-day filing fee for hand delivery: $25

Secretary of State

421 N.W. 13th, Suite 210

Oklahoma City, Oklahoma 73103

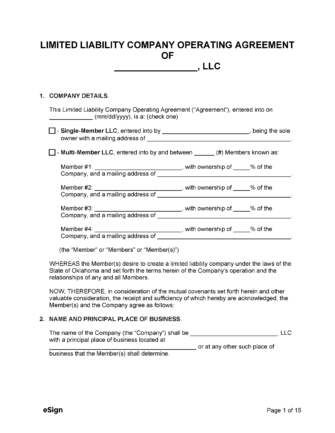

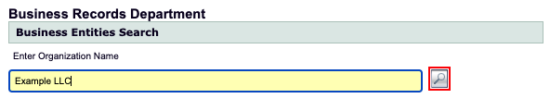

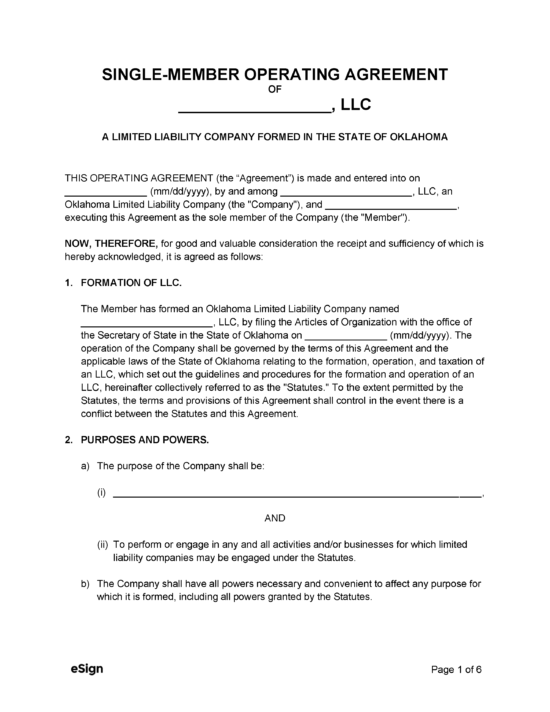

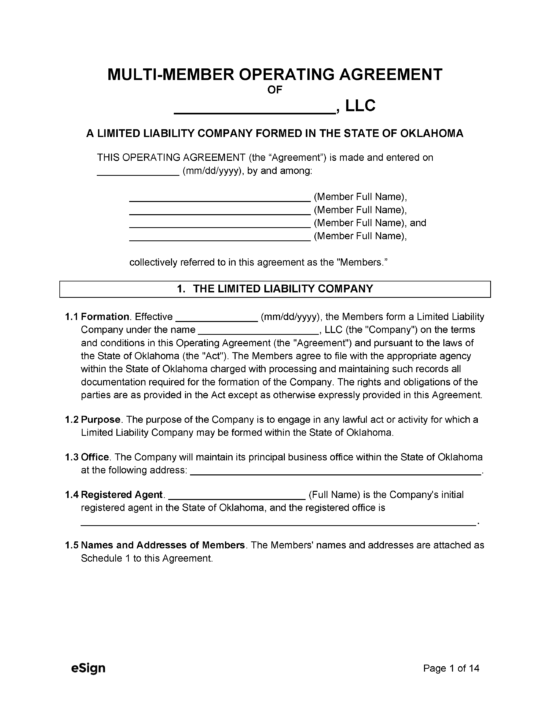

Step 3 – Execute an Operating Agreement

An LLC Operating Agreement establishes the division of ownership, rules, and regulations of a company. Although the document isn’t legally required and doesn’t need to be filed with the state, creating a binding agreement is an essential step in creating an LLC. If an agreement isn’t executed, the LLC will be governed by Oklahoma law and the members may be exposed to personal liability.

Step 4 – Obtain an EIN from the IRS

If an LLC has two (2) or more members, they will be required to apply for an employment ID number (EIN) from the IRS. The EIN is a number that identifies a business for federal taxation. Single-member LLCs will also need an EIN if they plan on having employees or being taxed as a corporation.

An EIN can be applied for online or by filing the Application for EIN (Form SS-4) by mail at the address below. There is no filing fee when applying for an EIN.

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Step 5 – Annual Certificate

Every year on the anniversary date of the LLC’s formation, an Annual Certificate must be filed with the Secretary of State. The certificate can also be filed online. The filing fee is $25.

ResourcesFiling Options: Online / By Mail Costs:

Forms:

Links:

|